Cover Protocol - Recent articles

Loading...

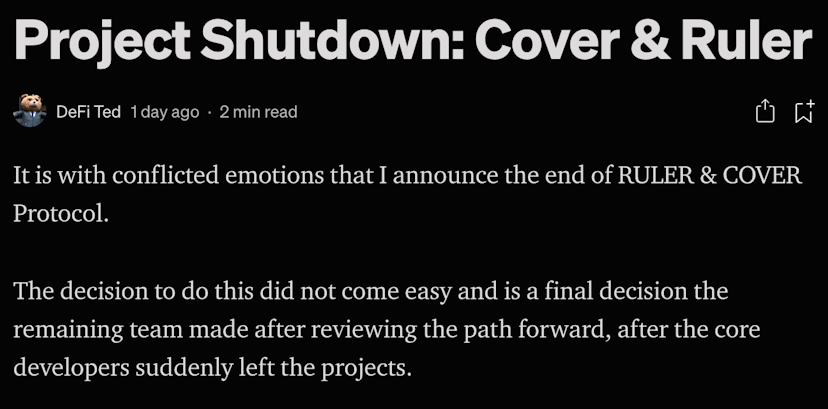

Two DeFi Projects Shut Down and Pledge to Return Users' Funds

Two DeFi projects tasked with helping traders in the space hedge risk announced they are shutting down on Saturday. Cover, an insurance protocol, and Ruler, a debt market without liquidations, lost their developer team and determined that they could not continue, according to a blog post authored by a cofounder of both projects who goes…

Loading...

Cover Protocol Token Dives After Yearn Breakup

Yearn Finance and Cover are splitting ways after announcing a merger back in November. The reasons behind the break-up haven’t been disclosed, but Yearn’s creator, Andre Cronje, has made one thing clear: it’s not amicable. Lost Trust Originally, Yearn—which specializes in lending aggregation, yield generation, and insurance—had partnered with peer-to-peer insurance lending protocol Cover with…

Loading...

Insurance Protocol Cover Exploited for $9.4M

DeFi’s rising insurance protocol Cover Finance was exploited for $9.4M worth of user funds after a group of hackers used a faulty smart contract to mint quadrillions of COVER tokens. Cover Finance allows users to buy smart contract protection on supported DeFi protocols by buying CLAIM tokens that can be redeemed in the event of…

Loading...

Yearn Merges With Cover to Make DeFi Safer

After a series of flash loan attacks where DeFi protocols lost $100M in damages, Yearn acquired Cover Protocol to provide decentralized insurance. The project pays out claims from exploits or certain attacks on smart contracts, using a the Snapshot voting tool to decide coverage. The claim will move to its Claim Validity Committee (CVC) to…