SBF's Industry Standards Would Be Onerous for DeFi

DeFi Startups Don't Have the Resources to Meet Proposed Norms

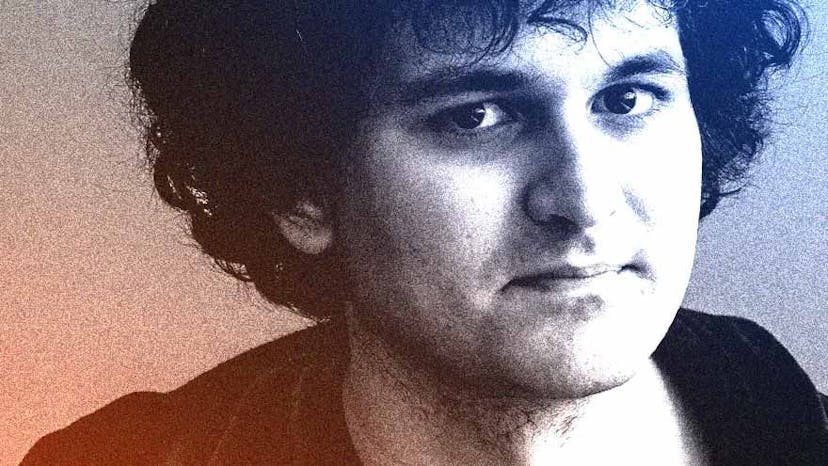

By: Sameep Singhania • Loading...

Research & Opinion

Sam Bankman-Fried’s proposal to set crypto industry standards undermines DeFi’s entrepreneurial spirit and presents an existential threat to the space’s leading DeFi teams and platforms.

On October 19, Sam Bankman-Fried, the CEO of crypto exchange juggernaut FTX, delivered one of the most provocative and controversial documents to hit the industry: a detailed blueprint for regulatory oversight and industry standards in the digital asset space.

180-degree Turn

In less than 4,000 words, the degen-gone-lobbier managed to perform a 180-degree turn from his unbridled DeFi days to a polished suit-and-tie executive heading a fully compliant centralized exchange (CEX).

In addition to advocating for on-chain censorship and stifling regulations, Bankman-Fried pulled the proverbial rug out from underneath leading DeFi platforms and algorithmic stablecoin issuers alike, while positioning his own FTX Exchange to collect all of the lost alpha in the aftermath.

DeFi is More Than Contracts and Validators

How? Bankman-Fried proposes codifying individuals and organizations acting as frontend providers and even website hosts under the umbrella of traditional financial brokerages. He also suggests they be subject to all relevant regulatory policies, including stringent KYC (Know Your Client) obligations.

This is quite a stance for a guy who, just two years ago, was aggressively farming and draining liquidity pools from prominent DeFi protocols. But while time does fly in crypto, we can’t allow our guiding principles to waver in the face of changing tides.

Pursuit of Principles

To be sure, Bankman-Fried did acknowledge a couple of DeFi’s key components. He praised the DeFi community for “maintaining free, decentralized validators and smart contracts” and said they are absolutely crucial for DeFi.

Unfortunately, that appears to be the only element of DeFi Bankman-Fried can still support. It makes for a less-than-satisfying concession for those who remain in this space to pursue our principles — not power.

SBF Replies to 'Constructive Feedback' on His Regulatory Proposals

FTX Honcho Roiled DeFi With Proposed 'Industry Norms'

Here’s the challenge with registering and operating at the level of a top-tier financial institution: it’s expensive, tedious, and resource-intensive.

A small startup team can hardly handle the legal costs, let alone manage the time and energy required of its top decision-makers. Only the largest financial institutions can serve as broker-dealers and the like, as it is they who can allocate the necessary resources to legal departments and highly specialized professionals. It is not feasible for smaller firms to handle the regulatory requirements.

For those of us who remember DeFi’s promise, our No. 1 responsibility is to stay true to our values: uncompromising decentralization, censorship resistance, and self-sovereignty.

So, in the event individuals and small teams cannot provide frontends, run websites, or conduct essential product marketing, what’s left?

Well, as Bankman-Fried proposed, they the people may contribute code and smart contracts and run validators as a form of free speech.

Translation: individuals can build the legos and make sure they run smoothly. As for assembling the legos, determining their use cases, building ecosystems, and connecting with communities —that’s for the big chiefs upstairs.

DeFi in Name Only

To me, this is the last thing crypto should do. For those of us who remember DeFi’s promise, our No. 1 responsibility is to stay true to our values: uncompromising decentralization, censorship resistance, and self-sovereignty.

SBF’s vision for the future seems strangely ignorant — if not outright dismissive — of cryptocurrency’s founding principles. He supports tokenized equities and sanctioned on-chain addresses and blocklists while rejecting USD stablecoins backed by on-chain reserves.

Censorship Resistance

Should the FTX CEO persuade regulators to embrace his ideas, DeFi will be stripped of its intrinsic decentralization and censorship resistance and rendered a skeleton of pseudo-permissionless smart contracts and validators.

By targeting frontend providers and other unlicensed DIY-ers — you know, the ones that built Maker, Aave, UniSwap, Synthetix, and the other blue-chip platforms that erected a $40 billion DeFi arena from ground zero — such a regulatory model would crush DeFi’s original entrepreneurial spirit. DeFi legos would inevitably fall under the authority of high and mighty industry players, namely, CEXs such as FTX. Or worse yet, they could be corralled by larger financial institutions like Blackrock or JPMorgan.

Gone will be the days of free-thinkers congregating on communal chat forums to pursue the mission of returning power to the individual. Gone will be the days of genuine self-ownership in the digital realm. Gone will be the days of a self-directed, ever-evolving free market for assets and protocols. And certainly, gone will be the days of a thriving ecosystem of (truly) decentralized financial applications.

As DeFi tools are integrated, then assimilated, then acquired and consumed by the legacy financial system we designed them to replace, DeFi will exist in name only — as a suite of digital native financial tools to optimize process efficiency in traditional finance and cross-border use cases. And eventually, to serve as the baseline infrastructure for finance in Central Bank Digital Currency (CBDC) systems.

The Bottom Line: Decentralization Comes First or Never

We have to preserve DeFi as an engine of innovation and ingenuity at the heart of cryptocurrency. Like it or not, that doesn’t just mean ensuring that a strong consensus remains intact, attracting a decentralized body of validators, and securing trustless bridges between ecosystems. Those are all critical infrastructure components, and each deserves attention in its own right.

But if anything has become undeniably apparent since October 19, it is that our infrastructure is only as robust as the principles that guide and direct its evolution.

As project leads, we must affirm why we are building what we are building with our teams, frequently connect with our communities to understand their individual needs, and stay committed to protecting the former and serving the latter. Otherwise, all is lost, and we are merely building the next iteration of an inequitable and exploitative financial system — albeit a highly efficient one.

Sameep Singhania is the co-founder of QuickSwap.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.