Loading...

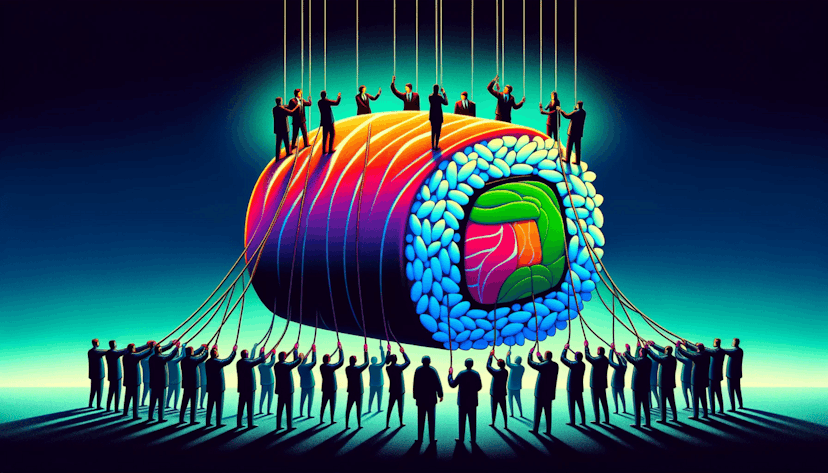

🍣 Sushi's Treasury Is At Stake Amid Bitter Infighting

Together with

GM Defiers!

Sushi’s long-running governance woes appear to be coming to a head, with a controversial proposal from its recently installed Operations Team seeking to move treasury assets under the control of a centralized entity. The team said it wants to safeguard the assets against an ongoing governance attack, but many in Sushi’s community believe the project is facing a centralization attack instead.

MakerDAO moving to support Ethena’s USDe token as collateral is ruffling feathers across web3, with Aave lowering its maximum loan-to-collateral ratio for Maker’s DAI stablecoin. MakerDAO’s co-founder also defended the protocol onboarding USDe as critics characterize Maker’s governance process as increasingly centralized.

Plus, Solana suffered high rates of transaction failures amid spam from bots, and a U.S. court ruled that Terraform Labs and its founder are liable for $40 billion worth of investor losses.

✍️ In today’s newsletter:

- Sushi drama escalates amid proposed treasury takeover

- Aave reduces LTV ratio for DAI

- MakerDAO co-founder criticizes decentralized governance

- Solana txs fail due to spam

- Do Kwon and Terraform Labs liable for civil fraud

🙏Sponsored

- DeGate Offers a CEX-Like Experience On-Chain

- DexToro Offers a CEX-Like Experience To Trade Crypto & Forex On-Chain Fully Decentralized With Self-Custody

📈 Markets in the last 24 hrs:

| Ticker | Value | 24h |

|---|

| Ticker | Value | 24h |

|---|---|---|

| Bitcoin | $65,774 | -5.75 % |

| Ethereum | $3,296 | -6.05 % |

| Gold | 1st Future$2,261 1.10 | % |

| S&P 500 | 5205.81 | -0.72 % |

| Arch Web | 32.76 | -6.49 % |

| Learn more about Arch Indices ,[object Object] | % |

🎬 WATCH

Check out our guide to earning memecoins using Farcaster and Drakula. Also, watch our podcast with TN Lee, the founder of Pendle, to learn about the innovative yield tokenization protocol.

THANKING OUR NEWSLETTER SPONSORS

| NEWSLETTER CONTINUES BELOW |

NEAR is the chain abstraction stack, empowering builders to create apps that scale to billions of users and across all blockchains.

Don’t miss Solana’s largest community conference - Solana Crossroads. Join 3,000+ attendees May 10-11. Speakers include Anatoly Yakovenko, Raoul Pal, Ansem, and more. Get your tickets before they’re sold out!

DeFi Saver is an all-in-one management dashboard for decentralized finance protocols, with more powerful interfaces, trading features and automation options for Aave, Compound, Curve, Spark, Morpho Blue & more.

DexToro is a decentralized derivatives exchange powered entirely by audited Ethereum smart contracts. Trade Crypto and Forex with up to 50x leverage with full custody of your assets. NO KYC.

💰 Sushi Team Under Fire For Proposed Treasury Takeover

Sushi’s long-term governance saga is at a crossroads, with a proposal from its core Operations Team proposing to bring the project’s treasury assets under the control of a centralized entity amid a purported governance attack. However, community members say the move is the latest in a long string of actions intended to sideline decentralized governance and plunder assets from Sushi’s DAO.

💵 Aave Reduces MakerDAO's DAI Collateral After Proposal to Completely Eliminate It

Aave reduced the loan-to-value ratio of MakerDAO’s DAI stablecoin by 12% percentage points down to 63%. The move came in response to Maker onboarding for Ethena’s controversial yield-bearing stablecoin, USDe, as collateral, with some in Aave’s community wanting to abandon DAI entirely.

🗳️ MakerDAO Founder Says Having “Rando’s” Participate in Governance Makes DAOs Unpredictable

MakerDAO is also facing criticism from onlookers over the increasingly centralized governance process surrounding protocol changes, with Aave’s Marc Zeller stating that a lack of open discussion before governance measures take effect is making the protocol “hard to predict.” Rune Christensen, MakerDAO’s co-founder, hit backing, stating that handing governance responsibilities over to “randos” is just as detrimental as centralized decision making.

SPONSORED POST

DeFi Saver is switching from using DSProxies as smart wallets that hold users' positions in supported protocols, to using Safes, which are currently the most popular smart wallet and multi-sig wallet in the Ethereum ecosystem. With this change, users will enjoy the option to manage their positions created through DeFi Saver in most other frontends, such as the protocol default frontends through the Safe app. On top of this, the update reduces gas costs both during initial setup and with any later transactions and users can expect to see more interesting UX improvements rolled out in the future.

READ MORE: DeFi Saver integrates Safe to bring account abstraction to DeFi

🤖 “Bots Spam Better Than Humans” Leading To Transaction Failures On Solana

Failed transactions on Solana soared to record highs above 70% for two consecutive days amid surging spam from bots. Researchers argue the problem is a product of Solana’s inherent design, which prioritizes low transaction fees over robust and responsive fee markets.

🧑⚖️ Do Kwon And Terraform Labs Found Liable For $40 Billion Fraud

A U.S. court found Terraform Labs and its co-founder Do Kwon liable for $40 billion in civil fraud following a unanimous jury verdict. The collapse of the Terra network and its algorithmic stablecoin UST in May 2022 plummeted the crypto markets into the depths of the recent bear trend and triggered the contagion risk that culminated in billions worth of CeFi insolvencies during the proceeding months.

🌍 ELSEWHERE

- China’s Largest Funds Apply For Spot Bitcoin ETF In Hong Kong (Bitcoin Magazine)

- Chainalysis Hires Former IRS Criminal Investigations Chief Jim Lee (CoinDesk)

- Solana and Blast memecoin launch and trading platform pump.fun hits $5 million in revenue (The Block)

🔥 TRENDING

- The Bitcoin Halving Is 19 Days Away — How Did BTC Perform In Past Cycles?

- Ethena Labs ENA Launches at $1 Billion Market Cap Post Airdrop As “Sats Campaign” Kicks Off

- Ondo Finance To Deploy OUSG Assets In Blackrock’s BUIDL Fund

- DEGEN Launches Arbitrum Orbit-Based Layer 3 Chain

- LRTs Surge To Record Dominance Over Restaking Sector

- Memecoins Fuel Record Monthly DEX Trading Volumes

- Memecoin Frenzy Arrives On Base As Tokens' Market Cap Crosses $1 Billion

- Maker DAO To Reduce Borrowing Fees And Increase Spark Debt Ceiling

- DEGEN Rallies On Increasing Adoption By Base Ecosystem Projects

- Vitalik Buterin and Arthur Hayes Weigh In On Memecoin Frenzy

The Defiant Alpha

“an industry must-read”

Get even more! For actionable insights and community access, Join The Defiant Alpha to receive:

- The Defiant Daily | Mon to Fri

- Weekly Recap | Saturdays

- DeFi Alpha | Sundays

- Access to exclusive degen chats and events