Layer 1 Tokens Crumble After SEC Calls Them Securities

DeFi Tokens Dive While Bitcoin Dominance Soars

By: Samuel Haig • Loading...

Markets

Crypto markets nosedived over the weekend, with Ethereum down 4% and Bitcoin dropping 2.5% since Saturday.

The bearish price action follows the U.S. Securities and Exchange Commission filing lawsuits against leading centralized exchanges Binance and Coinbase last week for allegedly violating U.S. securities laws.

In its complaint against Coinbase, the SEC claimed that the digital assets SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO all comprise securities.

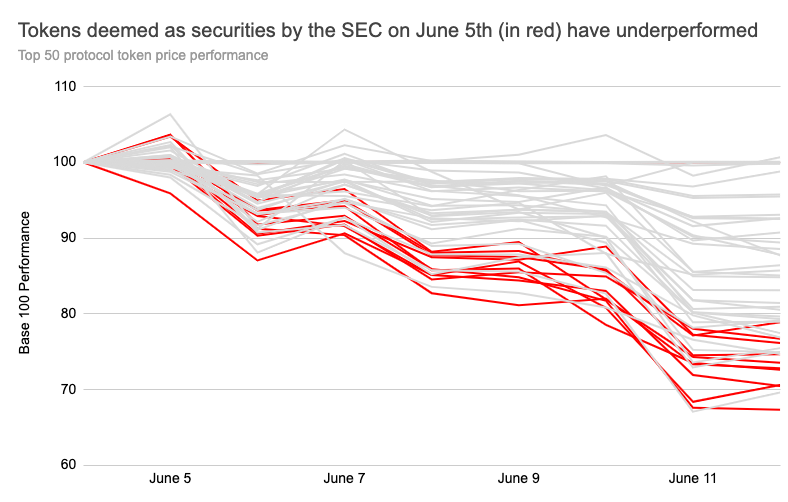

The mentioned tokens declined by an average of almost 27% since the SEC's lawsuit, while the top 50 tokens by market cap dropped by an average of 15% in that time, according to data compiled by web3 index provider Arch Finance.

Solana, Polygon, and Cardano have since published statements rejecting the SEC’s securities classification for their native tokens.

While the markets quickly recovered after an initial pullback last week, the weekend’s downturn indicates that markets may not so easily shrug off the regulatory battles facing the leading crypto exchanges.

Top DeFi assets also suffered, with LINK, LDO, AAVE, and CRV erasing between 15% and 22% of their value over the past week.

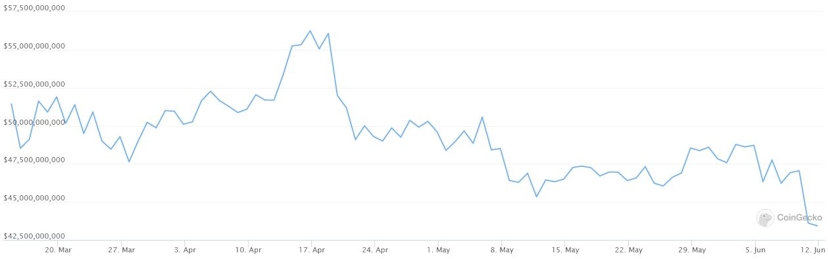

Just two of the top 50 DeFi protocols by TVL posted growth for the week, with OlympusDAO up 0.3% and Linea up 18.5%.

Bitcoin Dominance Hits 24-Month High

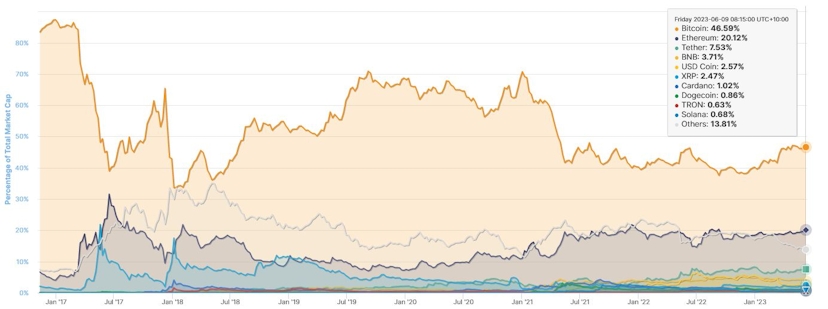

With many tokens suffering sizable losses while Bitcoin remained relatively unscathed, BTC’s market dominance has climbed to its highest level in two years.

On June 10, Bitcoin dominance tagged 47.5%, a level not seen since May 2021, according to CoinMarketCap.

ETH dominance hovered around 20% for the past two years, surging above 21% as the markets peaked in late 2021 and hitting a low of 14% a year ago during the depths of the 2022 bear market.

On-Chain Ethereum Activity Evaporates

Ethereum’s on-chain activity sharply slowed as markets dropped, with its weekly burn rate falling to just 2,683 ETH, according to Ultra Sound Money.

For comparison, the network destroyed five times as much Ether during the previous week, with Ethereum burning 54,923 ETH over the past month.

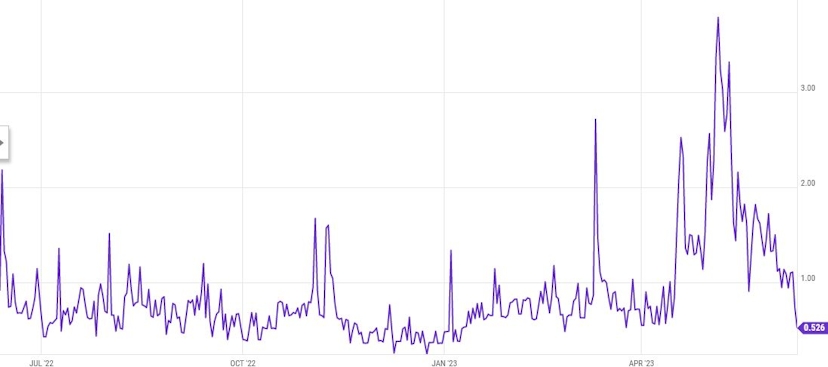

According to Ycharts, the fees associated with simple token transfers is down to $0.52 after hitting a yearly high of $3.78 a month ago.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.