Markets Pull Back As Memecoin Mania Cools

PEPE Crashes 50% From Friday Peak

By: Samuel Haig • Loading...

Markets

Crypto markets are off to a shaky start this week.

Sellers defended the $2,000 price level for Ether and confirmed resistance at $30,000 for Bitcoin, leading both assets to trade lower by around 7.5%.

The total value locked in DeFi protocols dipped by 5% to $47.2B, according to DeFi Llama. The sector’s market capitalization is also down 7% at $46.4B, according to CoinGecko.

Memecoin Mania

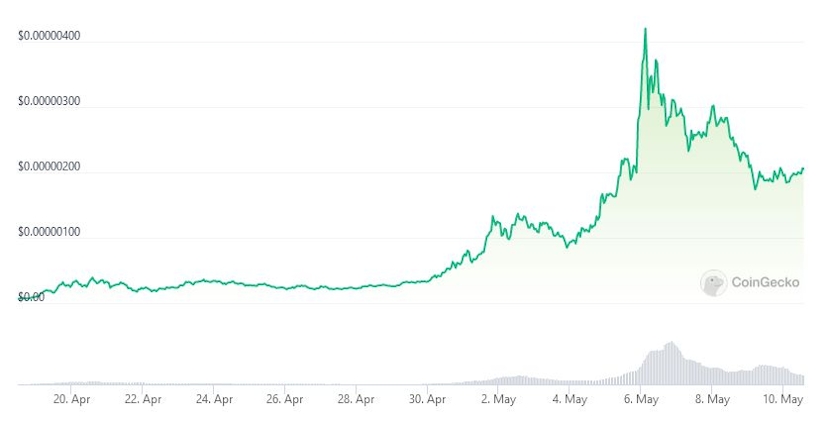

The latest wave of memecoin madness appears subsiding for the moment, with PEPE shedding nearly $1B in value since Saturday. It now has a market capitalization of $864M after hitting $1.82B when Binance listed the token.

Other memecoins are tumbling too, with TURBO crashing 62%, AIDOGE falling 53%, and FLOKI down 34% since the weekend began. Coingecko estimates memecoins are now worth $17.8B.

64,000 ETH Burned

Volumes on decentralized exchanges are high as traders trawl to find the next obscure token promising eye-watering gains.

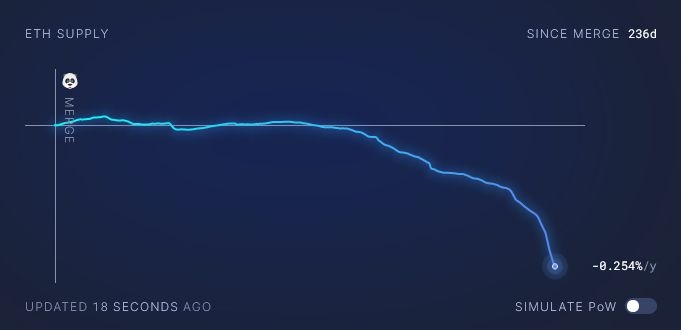

A 13% increase in Ethereum’s weekly on-chain activity drove a spike in the network’s burn rate, with 64,000 Ether worth $118M permanently removed from supply over the past week, according to Ultra Sound Money.

The figure equates to one-third of the ETH burned since The Merge was activated eight months ago.

Bitcoin is also suffering from high levels of congestion amid the recent rising popularity of BRC-20 tokens and NFTs. Average transaction fees spiked 10x since the start of May to tag a local high of $31 yesterday, according to Ycharts. Bitcoin fees have since pulled back to roughly $20.

Arbitrum Nova Activity Soars

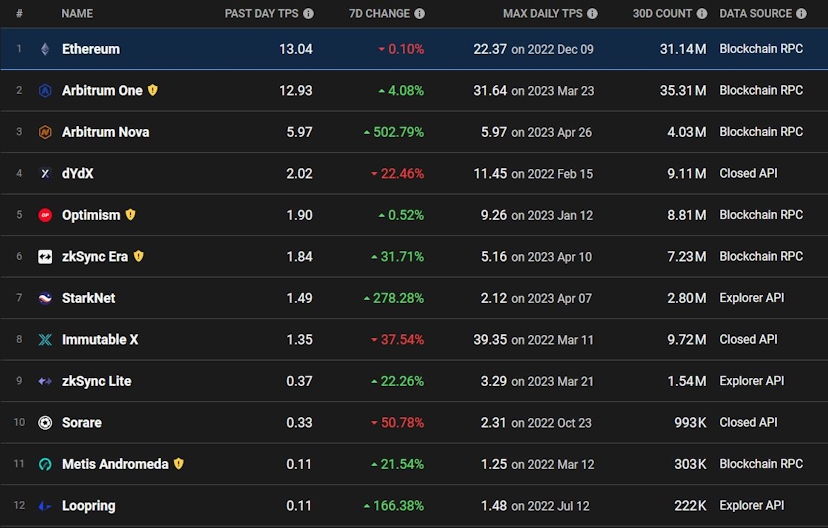

Arbitrum Nova’s daily transaction count surged more than 500% this past week, according to L2Beat. However, the network is processing a record 6 transactions per second (TPS), suggesting Nova’s adoption is only starting to take off.

Nova launched last August, becoming the second chain in the Arbitrum ecosystem. Nova specializes in hosting web3 gaming and social applications. The increase in activity coincides with a nearly 60% decline in the TVL of Arbswap, the second-largest DEX on the network.

StarkNet and Loopring are also enjoying a resurgence in on-chain activity, up 278% and 166%, respectively. StarkNet processed 1.5 TPS, down from a record high of 2.1 TPS last month, while Loopring executed just 0.1 TPS on average throughout the day, down from its high of 1.48 TPS last July.

For comparison, Ethereum and Arbitrum each processed 13 TPS yesterday. Arbitrum is currently beating mainnet by 30-day volume, with the networks processing 35.3M and 31.1M transactions, respectively.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.