Learn About Matcha And Cross-Chain Swaps

SponsoredDEX Aggregator Matcha Adds Cross-Chain Functionality

By: 0x • Loading...

Explainers

Founded in 2020, Matcha is a DEX Aggregator built by 0x. Through a DEX aggregator like Matcha, users are able to automatically source efficient liquidity to back their swaps and minimize price impact.

What is Matcha?

Aggregation allows for transactions to occur in a more efficient manner. As new networks expand the DeFi ecosystem, the available liquidity sources for users to choose from increase as well. With this, Matcha has expanded into the multi-chain world by adding cross-chain swaps to its platform.

Matcha’s differentiating focus is on price and trade execution. Their product aggregates 100+ liquidity sources from 9 different chains to offer the most favorable swap to the user.

Currently offering zero fee transactions on both regular swaps and cross-chain swaps, the aggregator has MEV protection integrated with its Smart Routing feature to protect against sandwich attacks on smaller cap coins, which can be targeted on high volume routes. All of which have allowed Matcha to have very low revert rates. Matcha also offers gasless swaps and Limit Orders.

What Are Cross-Chain Swaps?

Interoperability between the growing list of Ethereum Virtual Machine (EVM) compatible chains and scaling solutions is a focus for many development teams right now. Powered by Socket.Tech, apps such as Matcha have begun integrating the cross-chain swap feature.

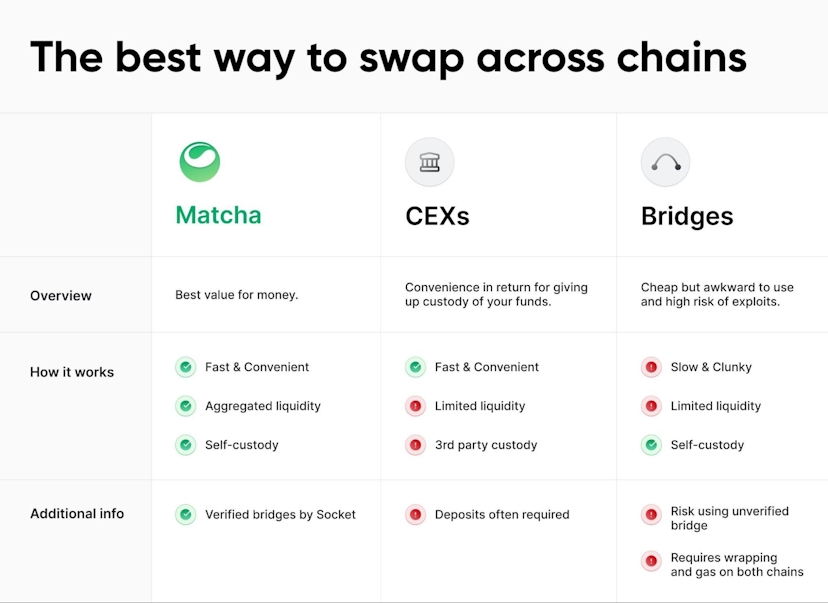

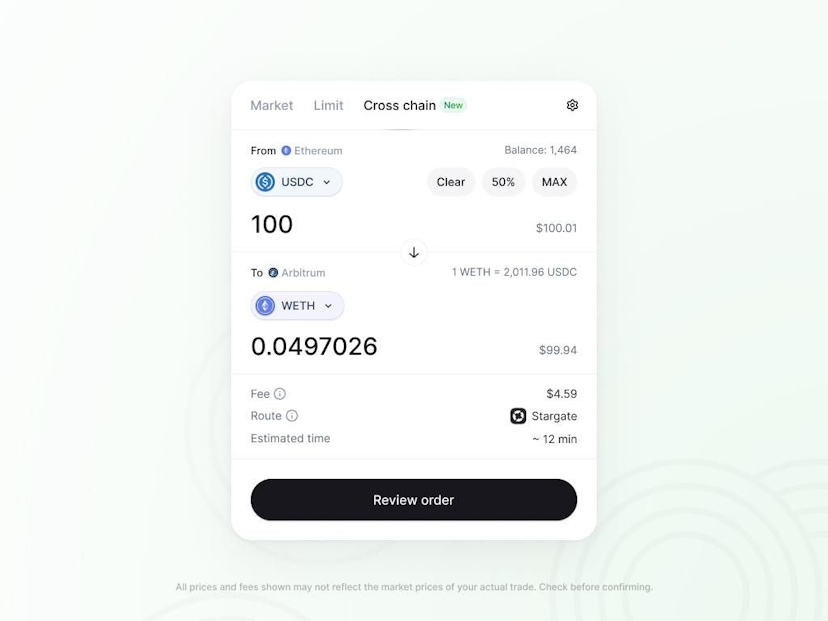

Through cross-chain swaps, users can swap one asset on a particular chain for an entirely new asset on a separate chain with one transaction. Prior to this, users were forced to individually bridge and swap each asset individually, which can result in unnecessary gas fees, limited swap liquidity, and a slower experience. This feature can be particularly useful when swapping between chains with different native gas tokens.

When performing a cross-chain swap on Matcha, the app will seek the best option for each specific transaction, operating through Socket API routes such as Stargate Finance. Cross-chain swaps on Matcha are available on 7 chains: Ethereum, Optimism, Polygon, Arbitrum, Avalanche, Base and BNB Chain.

Who Uses Cross-Chain Swaps?

Whether trading large volumes or just speculating with spare crypto, users need an efficient path across blockchains. Cross-chain on Matcha can be an effective tool for traders of all levels, with everything users need in one place.

In the modern multi-chain economy, most DeFi traders have crypto on multiple networks. Swapping across chains allows for quick and efficient maneuvering for multi-chain management. Cross-chain swapping can optimize user experience for functions such as cost flexibility, yield optimization, and exploring new dApps.

Multi-Chain Economy

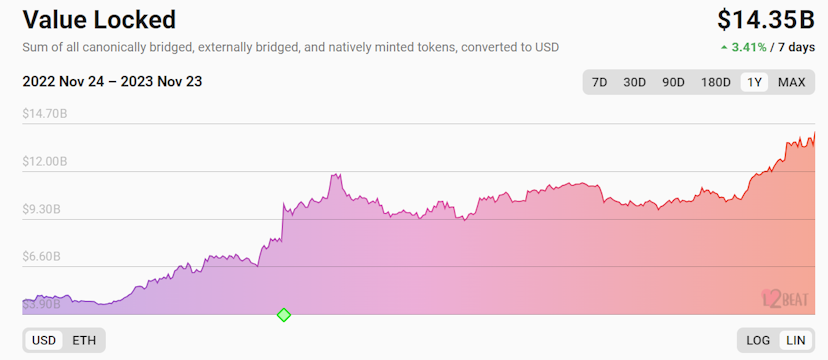

An increasing number of scaling solutions have been built on top of Ethereum over the last few years. Each respective EVM-compatible chain is looking to scale itself by cultivating its own native DeFi ecosystem. This rapid expansion has resulted in total L2 TVL currently being at all-time highs of $14.35B.

Total Layer 2 TVL. Source: L2BEAT

For airdrop farmers, yield hunters, and general DeFi participants there are countless opportunities in the current market, and maneuvering from chain to chain can be a clunky experience. The traditional route of swapping individual assets and bridging them can lead to an increased number of transactions, longer wait times, unnecessary fees, and counterparty risk.

Cross-chain swaps combine these tasks, which reduces friction for the user. Streamlining point A to point B with cross-chain swaps and liquidity aggregation creates a better overall experience for DeFi users.

The Future of Matcha

Products like Matcha that enhance swap accuracy help DeFi participants avoid unnecessary losses, and make the Web3 space more approachable for both non crypto-natives and existing users alike. Through its short lifespan the DeFi and crypto markets have proven that they can be inefficient, and aggregator products are meant to provide an enhanced UI and UX that can help users navigate avoidable losses.

As the L2 craze continues to grow, the interoperability of EVM chains and the ability to move nimbly from chain to chain are increasingly important. Cross-chain swaps and omnichain infrastructure dApps lay the groundwork for an expansive and diverse DeFi ecosystem. Through these products, users can explore every opportunity that crosses their path within Web3.

The development of cross-chain functionality could lead to an expansive omni-chain ecosystem. As each respective chain grows, chain agnostic protocols and NFTs could become a mainstay for DeFi users of all levels. While the multi-chain ecosystem is in its infancy compared to Ethereum, integration into dApps such as Matcha prove promising for this next step in DeFi.

Try it out for yourself at matcha.xyz and let us know your thoughts!

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.