ETH Burns and a Price Surge After EIP-1559 Executes

The Ethereum market is on fire, at least proverbially speaking. Over the first eight hours since EIP-1559 was implemented, thus changing the transaction fee mechanism of Ethereum, 2,458 ETH, or $6.9M at ETH’s current price of around $2.8K, had been burned. The proposal, which went into effect with the London hard fork at 8:34 am…

By: Dan Kahan • Loading...

DeFi

The Ethereum market is on fire, at least proverbially speaking.

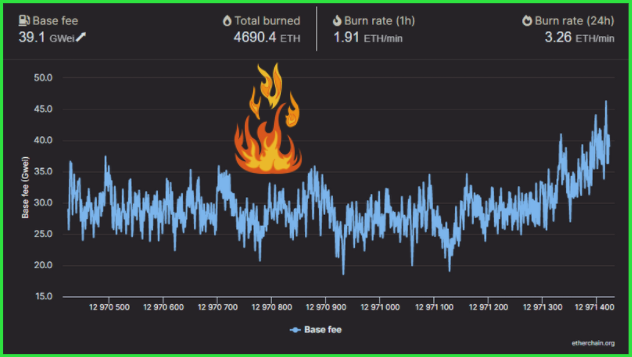

Over the first eight hours since EIP-1559 was implemented, thus changing the transaction fee mechanism of Ethereum, 2,458 ETH, or $6.9M at ETH’s current price of around $2.8K, had been burned.

The proposal, which went into effect with the London hard fork at 8:34 am EST on Aug. 5, was a long-awaited change for making Ethereum’s gas fees more predictable. It does this by implementing a base gas fee that gets permanently burned during each transaction.

Now ETH is being burned at a rate of 3.42 ETH per minute.

DeFi is a big contributor to ETH’s burn: Uniswap protocol founder Hayden Adams tweeted that within the first two hours of EIP-1559’s launch, Uniswap burned 80 ETH and at this rate would burn 350K ETH, or around $1B per year.

Burn Data from Etherchain.org

If ETH burned is greater than ETH issued, then that means Ethereum’s cryptocurrency becomes a deflationary asset, reducing the total supply of ETH outstanding and putting pressure on the price to increase –– it’s why you’ve seen the “ultrasound money” meme all over Twitter.

Still, in the first few hours after the momentous London hard fork came into effect, ETH was only truly deflationary for a roughly 40-minute period starting at 5:00 pm EST, during which time average gas prices spiked as high as 514 gwei, according to a Dune Analytics dashboard. During this brief time, Ethereum emission rates decreased due to gas fees being burnt faster than rewards could be mined.

Still Bullish?

Leading up to EIP-1559’s implementation, investors were extremely bullish on Ethereum’s long-term prospects. As founder of the popular Week in Ethereum News Evan Van Ness told The Defiant, “1559 is the most bullish fundamental change for $ETH since mainnet launched 6 years ago.”

But questions remain about short-term influences on the market, namely whether this will be a classic “sell the news” scenario.

“People are placing their bets,” said a crypto investor who uses the handle @Crypto_Texan on Twitter. “If it turns out that less ETH is going to be burned than expected, then it’s a sell the news event. If it turns out that more ETH is going to be burned than expected, then I could definitely see a price run up.”

Thus far, the market for ETH has continued on its bullish run.

Ethereum prices started that day at $2.7K. The price took a brief dip to $2.5K right after the EIP-1559 launch. But that proved to be short-lived, as ETH quickly rallied back to daily highs above $2.8K — the highest it’s been since June 7. “We did not see the typical buy the rumor, sell the fact reaction with this update,” Kevin Murcko, the CEO of CoinMetro, a crypto exchange based in Estonia, told The Defiant. “The fact that the gains were maintained with little in the way of a sell off tells me that the market is looking for higher highs in the short term.”

“The first thing we noticed is that the users have faith in the upgrade as the price of the ETH token went up, signifying the widespread faith in this upgrade after going live.” said Matthijs de Vries, CTO and co-founder of AllianceBlock. “This is the first time Ethereum has introduced a deflationary concept to the otherwise inflationary model, and so far, it looks promising.”

It still may be a while before we can grasp the long-term impact of EIP-1559, but for now — burn, baby, burn.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.