Reserve Protocol’s Permissionless Stablecoin Design Hub

SponsoredDeFi Users Can Launch 1:1 Backed Inflation-Proof Currencies On Reserve protocol

By: Squiffs • Loading...

Tutorials

Reserve protocol is a permissionless platform that allows DeFi users to launch and govern a variety of custom 1-to-1 asset-backed stablecoins, flatcoins, or index tokens. Through the Reserve platform, participants can deploy their own stable and resilient currencies known as RTokens that can be completely decentralized and verifiable on-chain.

RTokens are largely used by DeFi platforms, Fintech dApps, and o n-chain treasuries. However, Reserve sees the use-case for custom and safe stablecoins having the ability to expand beyond DeFi and Fintech and into other fields such as rewards programs, video games, or governments.

Stablecoin growth and adoption has piqued interest from some of the largest governments in the world, such as the United States and China in the form of CBDCs. Reserve’s goal is to increase the adoption and access to verifiably stable and safe currencies.

How Does the Reserve Protocol Work?

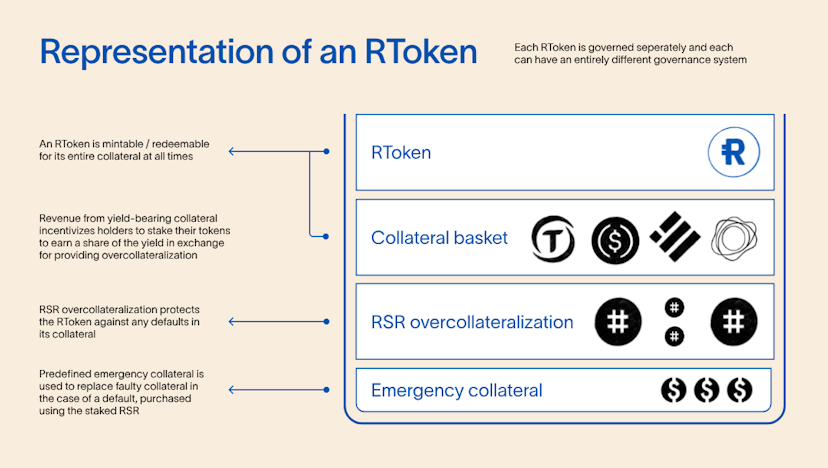

When using Reserve, an entity mints their own permissionless stablecoin for use within their products, a partner product, or for transactions. As Reserve is a decentralized platform with no middlemen, RTokens have no official issuer, and asset-backing reserves are verifiably locked on-chain at all times.

When issuing new RTokens, users deposit a basket of existing ERC20s that are defined to act as collateral. These collateral tokens are held 1:1 by the protocol and can be redeemed for by RToken holders at anytime with no swap liquidity required. RTokens are supported by the value of their collateral, and exit-able permissionlessly onchain without reliance on the rest of the market. It’s important to caveat, however, that collateral tokens themselves may sometimes require additional exit steps and their own liquidity concerns.

In order to encourage the safety of all users in the ecosystem, RTokens utilize the Reserve Rights $RSR governance token. Through ownership of RSR, holders can stake onto particular RTokens which allows them to participate in governance, and earn a share of generated revenue in exchange for providing overcollateralization. This overcollateralization acts as extra insurance on top of the original 1-to-1 backing’s each RToken is minted with.

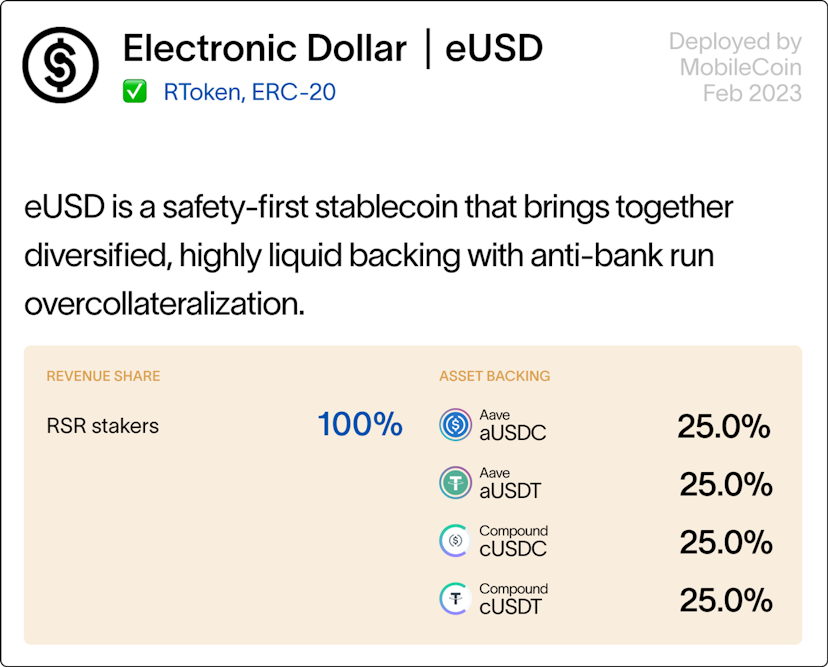

RTokens are being used across a variety of ecosystems. For example the Electronic Dollar (eUSD) is an RToken with a total market cap of 22m USD, being implemented in products such as Sentz and Ugly.Cash as a form of international payments and remittances.

Different Types of RTokens

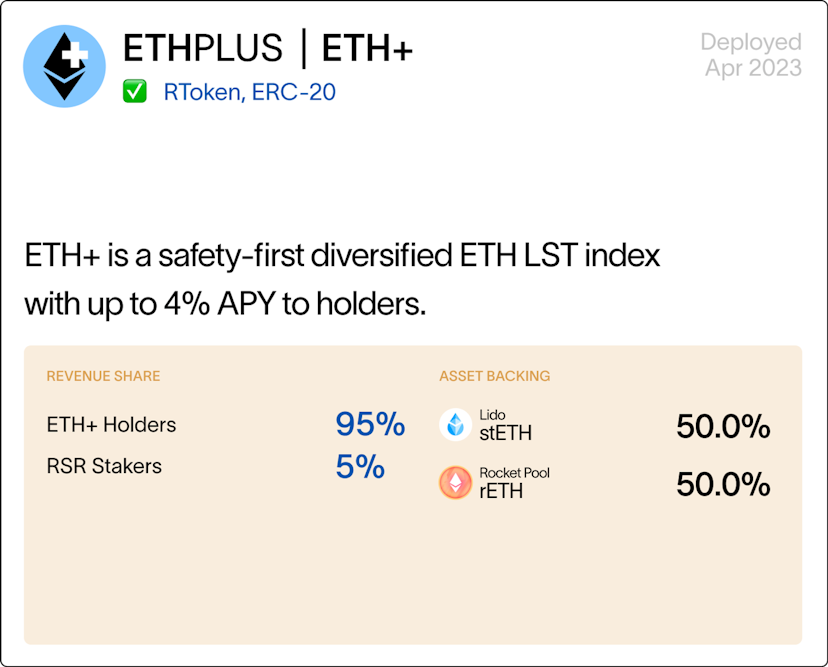

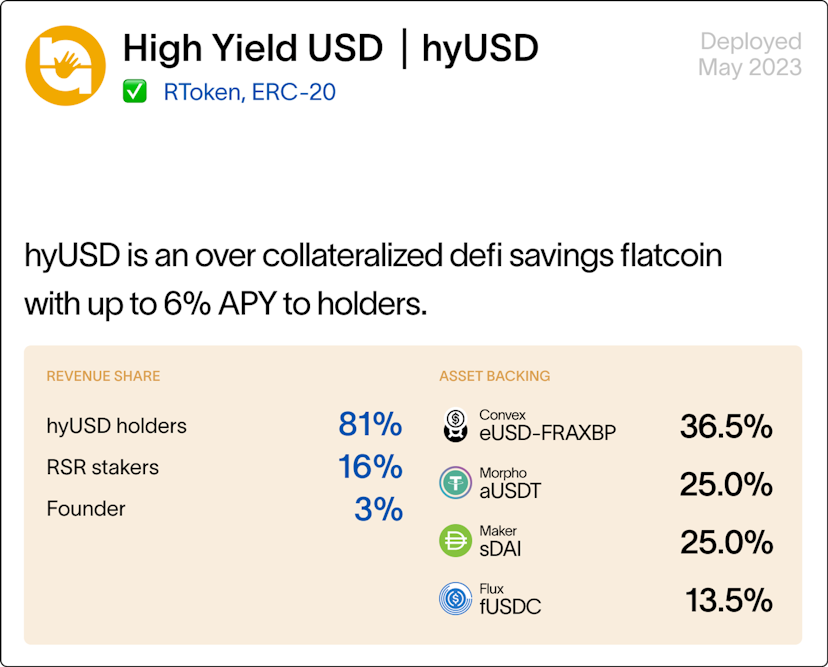

The RToken ecosystem allows for creative and diverse approaches towards stablecoins, flatcoins and index tokens. These can be designed differently in order to maximize yields, security, or any other personal preferences.

Some of the more notable examples that are used widely today include: eUSD, the overcollateralized stablecoin, ETH+, which is a diversified LST index token, and hyUSD, a DeFi savings flatcoin yielding 6% APY to its holders.

This allows for investors to explore a variety of DeFi opportunities, with the peace of mind of knowing their tokens are secure, overcollateralized, and verifiable on-chain.

Reserve’s Investment in Curve

With so many different potential avenues for RTokens to take, safe collaterals with sufficient on-chain liquidity is imperative for the success of RTokens. In order to help promote a secure and reliable liquidity source Reserve acquired a large governance position in the Curve and Aerodrome ecosystems in 2023.

Reserve acquired $20m worth of Curve and Aerodrome ecosystem governance tokens - CRV, CVX, SDT and Aero- to assist in boosting the liquidity provided to community created RTokens. Through this acquisition, Reserve is able to encourage a more liquid and sustainable RToken ecosystem.

Reserve selected these four particular assets in order to leverage each token's unique structures and governance models. Through this diversification, Reserve can meet different requirements such as voting power and locking lengths to maximize their impact in the Curve and Aerodrome ecosystems, and therefore have a larger influence on their native RToken ecosystem.

How to Use the Reserve protocol

Users can begin by visiting the Register token explorer homepage where they can browse through notable RTokens. After clicking on any of the existing RTokens, users can then view all of its details such as collateral exposure, revenue distributions and additional yield opportunities.

If looking to mint a specific token, users can simply click the “mint” button and from there they will be prompted with the amount desired to mint, and eligible collateral available in their wallet.

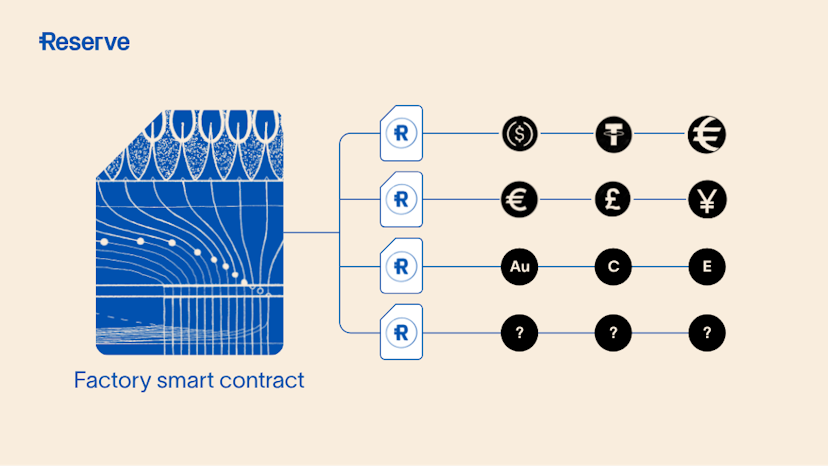

To create an entirely new RToken, Reserve protocol is available through a system of factory smart contracts that anyone can deploy, either directly or through an interface built on top of them. The first user interface is the Register token explorer homepage, and was released by ABC Labs.

When minting a new RToken, the deployer has full customizability of the token parameters such as trading delay(s), auction settings, backing buffer percentages and more, all of which can be explored in the official documents. It is strongly advised that all the parameters are thoroughly studied and understood before launching any RTokens, and all of the prudent information can be found within the Protocol Operations section.

The Future of Stablecoins and Reserve Protocol

As blockchain adoption progresses the use case for stablecoins only grows stronger. However the ideal path forward from a practical and regulatory standpoint remains unclear. Reserve protocol aims to abolish the uncertainty that can be associated with middlemen and fiat valuations under the idea that stable currency is a basic human right.

Following large increases in inflation across the globe, the Reserve stablecoin factory looks to provide a customizable hub for stablecoin deployment and usage. Through decentralized overcollateralization and permissionless access, RToken’s free and rapid deployment makes it so anyone can create or access long-lasting, inflation proof, stable currency.

In order to learn more about Reserve Protocol and their growing ecosystem, you can view detailed information in their Medium, join the Discord and access the $10M grant program to begin creating your own RToken today!

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.