DeGate Offers a CEX-Like Experience On-Chain

SponsoredTrade easy, sleep easy, with the perks of your favorite CEX and DEX in one platform

By: Squiffs • Loading...

Tutorials

With plenty of platforms available in the modern market, traders spend a lot of time searching for the most efficient trading hub. DeGate has designed its DEX with both DEX and CEX native traders in mind, allowing users to trade efficiently.

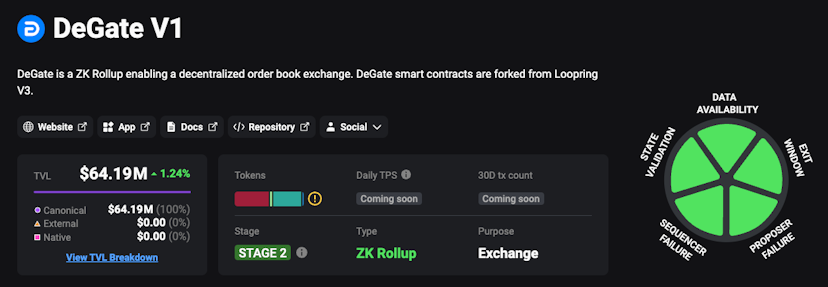

Built with Zero-Knowledge Rollups (ZK Rollups) on Ethereum, trustlessness and security remain a priority while also offering quick transaction speeds and a unique grid trading system. This focus on security has been recognized by DeFi analytics platform L2 Beat which has marked DeGate as one of the only Layer 2 protocols they cover to reach their “Stage 2”.

To achieve Stage 2 status on L2 beat, protocol rollups must be fully managed by smart contracts, with a decentralized fraud-proof system. Users must also have ample time to react to unwanted upgrades that may be in the pipeline. Essentially,Stage 2 refers to a mature decentralized protocol that is considered safe for new users.

Source: L2 Beat

CEXs vs DEXs

CEXs carry an array of features for improving trading performance, while DEXs can preserve a user’s privacy and security. After the collapse of FTX in 2022, traders and market makers alike are taking the latter into account more than ever.

Top centralized exchanges offer excellent UI/UX, deep liquidity, quick transaction speeds, and low fees. The slick user interfaces and efficient bid fills are great for attracting new users who may be less wary of the security risks involved.

DEXs do not require personal information or KYC, and all funds and active trades are recorded on-chain, which makes traders' funds and positions more resilient to hacks and exploits. In return, DEXs often have lower liquidity, are more restrictive on the trading pairs offered, and have generally slower transaction speeds.

DeGate DEX

DeGate’s order book DEX is designed to provide users with a blend of both centralized and decentralized exchange experiences. Taking inspiration from Loopring Protocol, DeGate is built using ZK Rollups, with features including orderbook limit orders, grid trading, and permissionless listings.

DeGate’s goal is to offer a trustless and permissionless experience for its users through its dApp. There is no backdoor, and it allows for what is known as “Exodus Mode, where users can withdraw their assets back into their Ethereum wallet through the smart contract. For instance, if a user withdrawal request faces prolonged delays due to operational issues, users can opt to initiate Exodus Mode after a designated waiting period. This allows the user to retrieve assets in their DeGate account on the contract layer, reinforcing the principle of self-custody of funds.

Trade and Earn Yield With DeGate

Users can begin by visiting the web app, connecting their wallet of choice, and depositing the desired amount of funds. The app has functions such as limit orders, DCA, and grid trading.

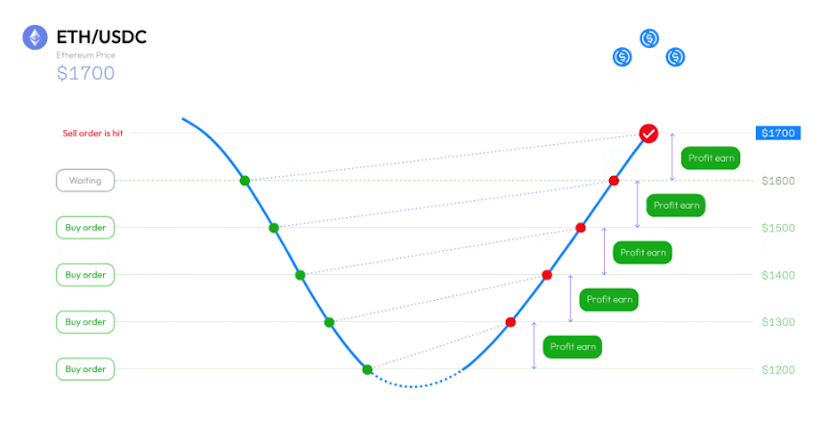

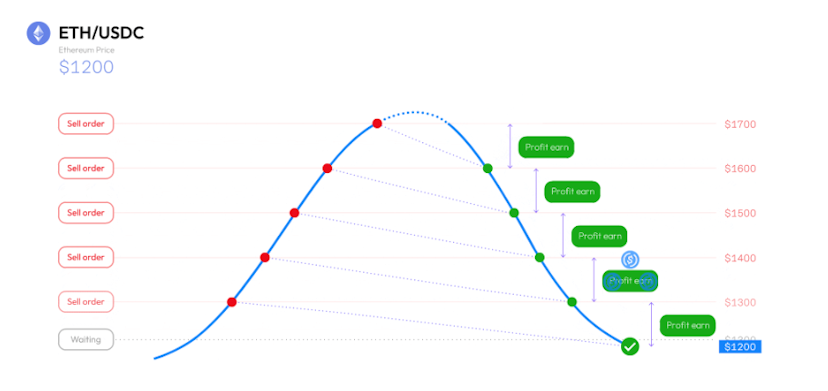

Grid trading and batch spot trading are two of the platform's more unique features, which are also designed to save the user on network fees. Grid trading is a popular automated trading strategy that is commonly found on centralized exchanges.

In a grid trading setup, the user enables a series of buys and sells within a specific price range. For every buy executed, a sell order is instantly placed at a take profit level, and vice versa when shorting. Automated execution is possible on a CEX as users do not have full custody of their funds, while wallet signatures act as a layer of friction in decentralized exchanges.

DeGate bypasses the need for repetitive wallet interactions in grid trading by bundling the order executions into the signature for the first order. This allows users to automate actions in a sovereign environment instead of giving up the rights to their private keys like they would on a centralized exchange.

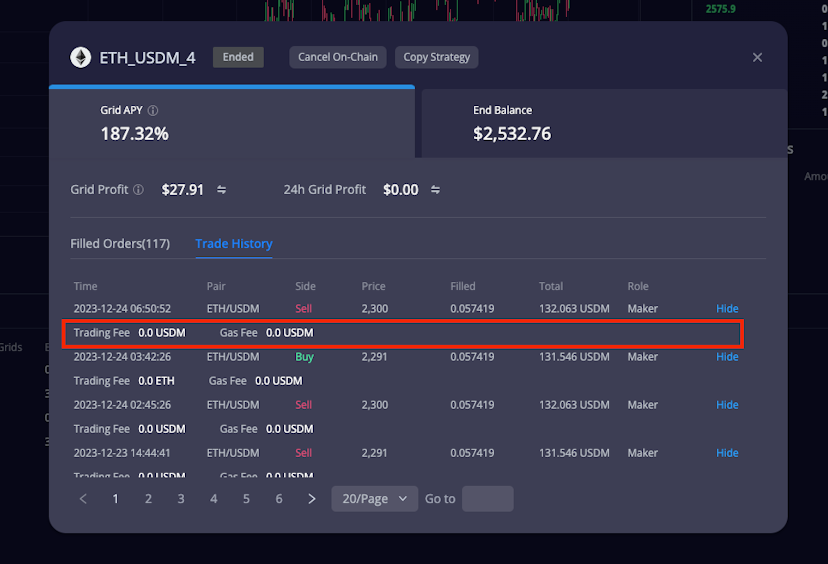

In addition to order bundles, DeGate maximizes cost-efficiency for its makers, allowing them to trade for free. The platform recognizes the importance of maker orders, thus zero gas fees and zero trading fees for all maker orders.

This yield efficiency gets taken one step further with the inclusion of $USDM yield on top of user grid trading. Through the integration of Mountain Protocol’s yield-bearing stablecoin $USDM, traders earn 5% APY for holding and utilizing the stablecoin in trading strategies on DeGate. This bonus yield can act as a small boost for profitable trades or a form of hedge for trades that are closed in a loss.

DeGate offers traders a versatile web app on which to trade. The platform will allow users to utilize a growing list of previously CEX-exclusive features with the peace of mind of knowing their assets and positions are verifiable on-chain.

Between its grid trading, batch spot trade feature, and bonus yield opportunities, the protocol looks to offer both a unique and cost-effective solution for crypto traders looking for a decentralized solution.

DeGate’s web app is now live in its Mainnet phase for anyone to use. For additional information on the development of DeGate, visit their Medium or website, where the team offers monthly updates, Q and As, and more.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.