Chasing Yield on Ethereum Doesn't Pay Off. Here's How Arch Solves It

SponsoredChoosing a single protocol exposes participants to fluctuating APYs, while constantly switching requires a lot of effort. Get one token to do it all.

By: Arch Finance • Loading...

Tutorials(https://www.arch.finance/best-of-web3)

In the crypto landscape, staking and lending protocols have become popular for earning passive income and preserving long-term savings.

Staking ETH offers an APY reward in the form of new ETH tokens, and stakers contribute to network integrity by verifying transactions.

Around 16% of all ETH tokens (roughly 19.2mn ETH or $35.5bn) are currently staked on the Ethereum network, with a historical APY of about 5%.

Lending ETH in DeFi platforms is another strategy for earning passive income and contributing to the lending protocol and ecosystem.

The Limitations of a Traditional Strategy

Participants in Ethereum's passive income strategies have three options:

- Betting on a single protocol

- Constantly switching to the highest APY protocol

- Diversifying among protocols for long-term returns

Choosing a single protocol exposes participants to fluctuating APYs and risks of relying solely on one asset, jeopardizing long-term savings.

Constantly switching protocols based on APYs requires active market participation and careful evaluation of transaction costs, making it impractical for most participants.

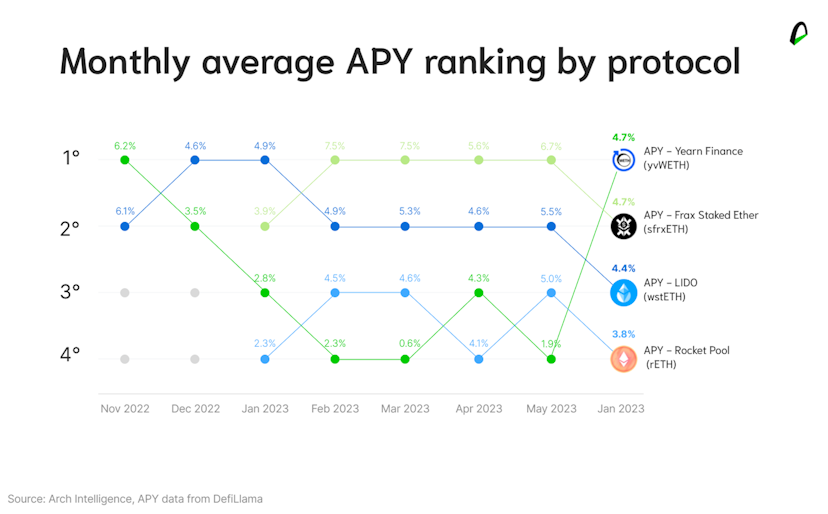

The ranking of top APY protocols has changed three times in the last eight months, adding complexity to the challenge and impacting returns for participants who fail to transition promptly.

Diversification Is the Way, but Sometimes it's Prohibitively Expensive

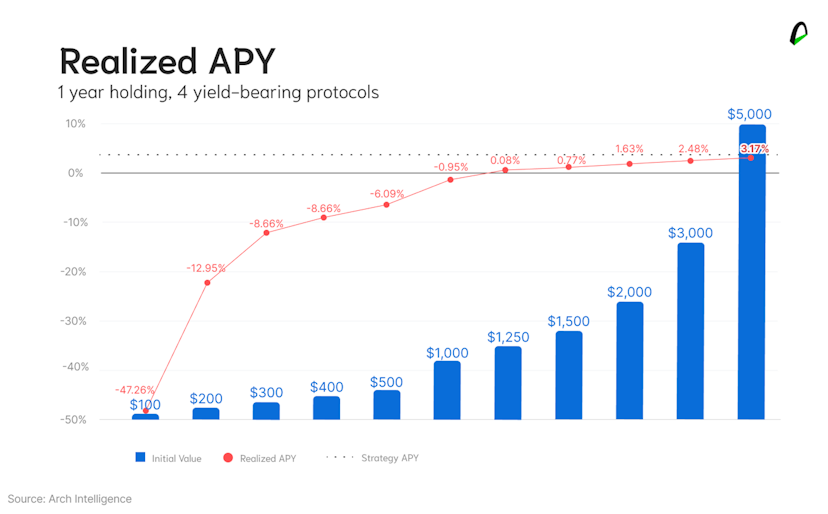

For instance, if an investor can invest in four Ethereum staking protocols, each with a 4.2% APY, transaction costs of approximately $10 per transaction must be considered. To break even with these fees, a participant must invest at least $2,000 for a year.

Investments below this threshold or for a shorter duration would result in a loss due to gas fees exceeding earned rewards.

For example, if an investor invests $3,000 a year, they would only recover 35% of the stated APY (1.47% vs. 4.20%) due to substantial costs associated with entering and exiting the strategy.

Gas fees involved in entering and exiting protocols can eat into potential gains and impact the profitability of the investment.

How Arch Solves the Diversification/Gas Fees Problems with the Arch Ethereum Diversified Yield Token ($AEDY)

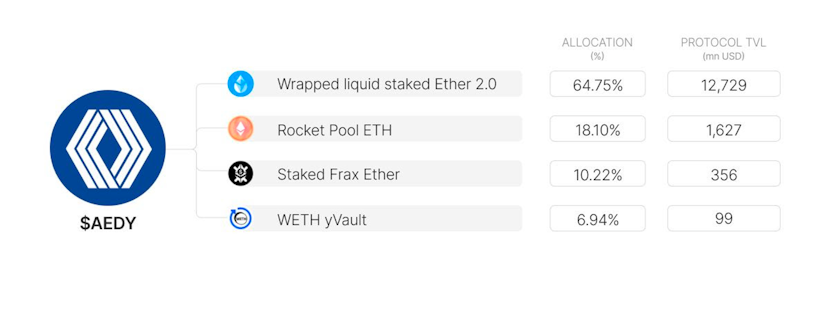

Arch Ethereum Diversified Yield (AEDY) token addresses the challenges mentioned by offering diversified exposure to yield-bearing protocols on Ethereum, minimizing APY volatility and protocol-specific risks.

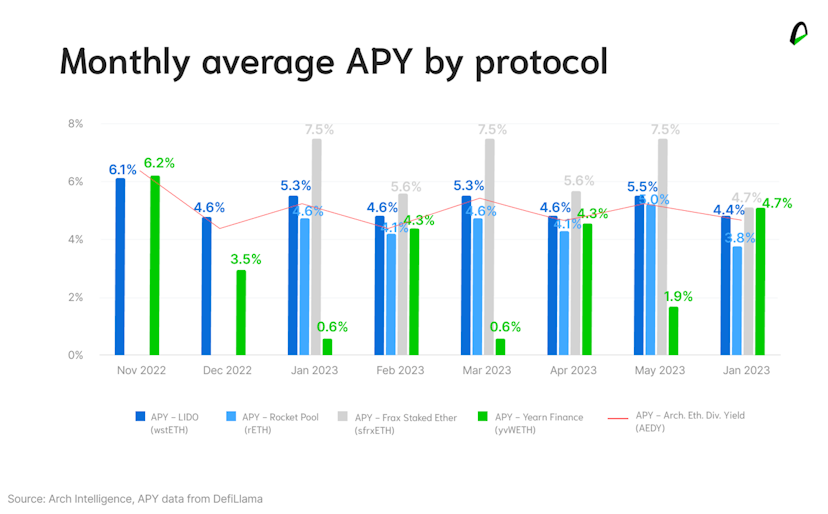

While strategies have given APYs ranging from 0.6% to 7.5% in the past months, ADDY had a smooth 4.72% average APY (already net of fees).

AEDY simplifies the investor's journey and allows for rebalances when new strategies become relevant. It’s available on the Polygon Network, reducing gas costs significantly.

AEDY follows a methodology that seeks diversification through battle-tested protocols and undergoes periodic rebalancing.

New protocols and strategies can be added if they meet specific requirements. The weights assigned to each strategy in AEDY are determined based on their square root TVL proportion, ensuring a balanced representation.

One important aspect of this token is that it doesn’t incur any form of leverage, which protects participants from having their returns seized in the eventuality of rate spikes in the borrowed assets of a leveraged strategy.

AEDY is designed for individuals aiming to maximize the potential of their long-term Ethereum holdings through diversification, low transaction fees, and compounding.

Hassle-Free Yield Generation with Arch Finance's Truly On-Chain Approach

At Arch, we prioritize the complete collateralization of our products, ensuring that every component is fully supported by its underlying assets.

Your assets are entirely collateralized; all constituents are blocked in our smart contracts, providing comprehensive protection you can see publicly on-chain.

Furthermore, we adhere to strong and transparent methodologies, establishing a robust framework for our offerings.

It's a truly on-chain experience that's gas efficient and always up-to-date.

The Web3 Asset Manager

We are driven by our passion for the market and dedication to staying ahead of the curve.

That's why we developed the Arch Token Classification Standard (ATCS), which plays a crucial role in index construction. This standard provides a comprehensive view of project sectors and token types, enabling investors to make informed decisions.

Using this sound methodology, we offer yield-bearing assets, index tokens, and portfolios to cater to different investment preferences and risk tolerances.

Whether seeking passive income, diversification, or a balanced strategy, we provide a tailored option that helps you maximize returns while maintaining a diversified portfolio.

The information provided in this content is for informational purposes only and should not be construed as financial advice. Arch Finance does not provide personalized investment recommendations or financial planning services. Investing in cryptocurrencies and decentralized finance (DeFi) assets carries inherent risks, and individuals should conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Please note that Arch Finance's services may not be available to customers based in the United States due to regulatory restrictions. This content is not intended for use by any individual or entity in the United States or any jurisdiction where such use would be contrary to applicable laws or regulations.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.

![Chasing Yield on Ethereum Doesn't Pay Off. Here's How Arch Solves It [Sponsored]](/_next/image?url=https%3A%2F%2Fcdn.sanity.io%2Fimages%2F6oftkxoa%2Fproduction%2Fa05071133850099de7e5c467cd300d062b57fa59-1920x1080.png&w=828&q=75)