Loading...

👨🌾Earn Boosted Staking Rewards With ETHx By Stader

DeFi Alpha

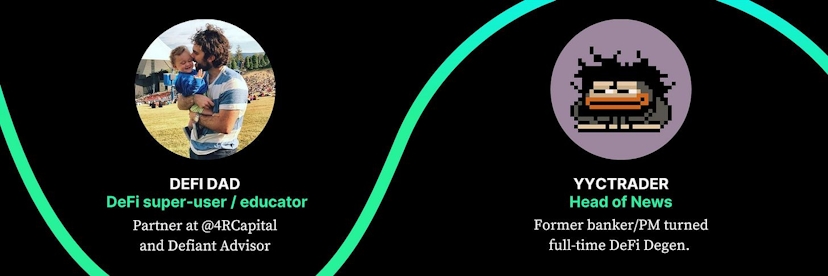

DeFi Alpha is a weekly newsletter published for our premium subscribers contributed by Defiant Advisor and DeFi investor at 4RC, DeFi Dad, and our Degen in Chief yyctrader.

It aims to educate traders, investors, and newcomers about investment opportunities in decentralized finance, as well as provide primers and guides about its emerging platforms. It is meant to be highly actionable and shareable.

Any information covered in DeFi Alpha should not form the basis for making investment decisions nor be construed as a recommendation or advice to engage in investment transactions. Any mention of a token or protocol should not be considered a recommendation or endorsement.

THANKING OUR NEWSLETTER SPONSORS

| Newsletter continues below |

Yield Alpha

Each week we will provide options to earn yield on ETH, WBTC, stablecoins, and other major tokens.

- ETH: Up to 38.28% APY looping ETH 4.3X on Metronome

THANKING OUR NEWSLETTER SPONSORS

| Newsletter continues below |

SPONSORED POST

Steer Protocol is a game-changing platform that unlocks unprecedented yield opportunities for liquidity providers through its Smart Pools. Smart Pools, provide passive yield through dynamic automation of LP management on over 5 AMMs, such as Uniswap and SushiSwap V3 with support across 10 different blockchains networks.

The core objective of Steer Protocol is to equip LPs with an easy-to-use and user-friendly platform driven by sophisticated algorithms for both the novice and the trader. Regardless of prevailing market conditions, Steer Protocol empowers users to maximize their liquidity to the fullest extent by their Liquidity Engine which provides the most flexible LP solution on the market.

Alpha: Polygon, Arbitrum, and Optimism pools are seeing over 100% APRs for select pairs!

Since its launch just a month ago, Steer Protocol has garnered tremendous appreciation from LPs due to its Smart Pools and industry-leading APRs. Recently supported by Angle’s Merkl Protocol, this integration not only offers substantial fees but also enhances rewards for LPs, creating an even more attractive venue for LPs. Any LP reward programs on Merkl will now be accrued to Steer Protocol LPs!

Embark on your journey with Steer Protocol today and seize the opportunity to become an LP, earning not only high fees but also boosted rewards. Discover a world of unrivaled possibilities and maximize your yield potential with Steer Protocol.