Binance Outflows Slow After SEC Crackdown

Net outflows from Binance are at about $500M in the past 24hrs after spiking to over $1B on Monday.

By: Samuel Haig • Loading...

CeFi

Net outflows from Binance, which spiked after U.S. securities regulators filed charges against the world’s largest crypto exchange, are slowing.

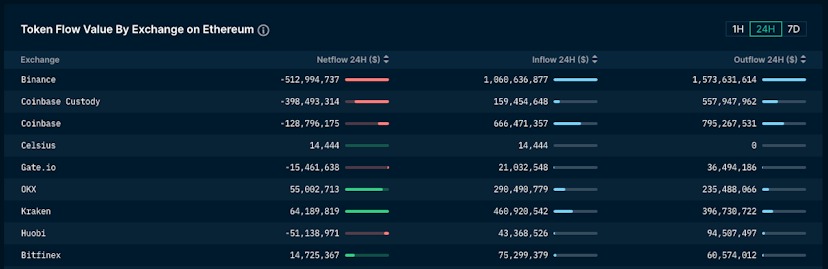

In the past 24 hours, Binance's net outflows retraced to $513M from $1.4B a day earlier, according to data analytics company Nansen. While Binance has had total outflows of $1.5B, withdrawals have been offset with inflows of $1B, the data show.

Binance users had pulled more than $3B worth of assets from the exchange in a single day after the U.S. Securities and Exchange Commission sued Binance for violating U.S. securities laws on Monday.

Outflows continued after the SEC filed to seek a temporary restraining order to freeze Binance US assets on Tuesday. The outflow was Binance’s largest since mid-December, when more than $2B left the platform amid concerns surrounding its solvency.

Markets Retrace Losses

While outflows slowed, crypto markets have also retraced Monday’s losses. Bitcoin is down 1% in the past 24 hours and Ether is down 1.5% after rallying Tuesday, according to CoinGecko.

Some analysts have suggested the regulatory threat posed by the SEC was priced in following Coinbase’s Wells Notice and reports that the U.S. Department of Justice was considering criminal charges against Binance in December.

“If Binance disappeared, long-term, that does not change the value or utility proposition for ETH,” Bishop said. “We should expect these growing pains to continue as the whole industry steps out of the shadows and blinks in the bright lights of mass adoption.”

SEC Goes After Coinbase

Coinbase is suffering the second-biggest outflows after Binance, with net withdrawals of nearly $526M, according to Nansen. The SEC also filed a lawsuit alleging securities violations against the exchange.

The move followed escalating tensions between Coinbase and the SEC, with Coinbase filing legal action demanding the agency apply its formal rulemaking process to delivering clear regulatory guidelines to the crypto industry last July. In March, Coinbase received a Wells Notice, which typically precedes a formal lawsuit from the SEC.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.