Bitcoin and Ether Hold Up Amid Market Selloff

Crypto Market Maker GSR Scales Back Operations

By: Owen Fernau • Loading...

Markets

So much for a calm summer market — 28 of the top 100 digital assets dropped 5% or more today on news that a major market maker is paring down operations.

The two largest digital assets, Bitcoin and Ether, proved relatively resilient, down less than 1% on the day.

The carnage was more pronounced in altcoins — Ripple (XRP), which is used for cross-border payments and is the fourth-largest digital asset, lost over $1B in market capitalization after dropping nearly 4%.

APE, which is central to the Bored Apes ecosystem, and LUNC, the token of the failed Luna ecosystem, crashed over 10%.

Meanwhile, MATIC, GMX and APTOS fell over 7%.

Muted Market

The selloff comes after crypto volatility has been flirting with all-time lows — an Aug. 7 report from analytics firm Glassnode noted that “Bitcoin markets are experiencing an incredibly quiet patch, with several measures of volatility collapsing towards all-time lows.”

The price action may serve as a wake-up call for investors after reaching what Glassnode called a “stage of extreme apathy and exhaustion,” in an Aug. 14 report.

GSR Downsizes

The price action was colored by the news that GSR, a market maker and investment firm which has been operating in crypto for ten years, had five high-level employees leave the company.

Some market watchers were quick to pin the day’s selloff on GSR paring back operations, but a dashboard from the controversial analytics platform Arkham Intelligence suggests otherwise — the firm’s total holdings increased by 16.9% to $75.35M in the past week.

RUNE Rallies

As always — some tokens are bucking the trend.

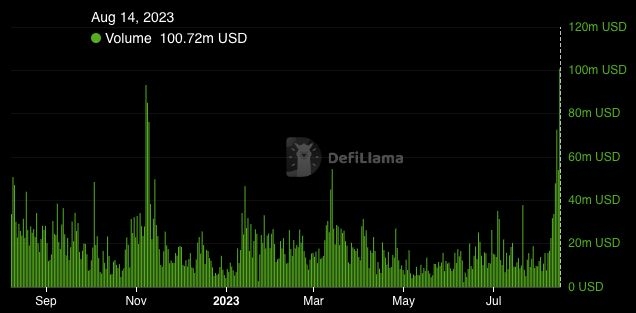

RUNE, the token of THORChain, a cross-chain swap protocol branching into lending and yield-producing vaults, posted a 3.8% gain on a day when the protocol processed a record $100M in volume. RUNE has surged 54% on the week.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.