Permissionless Index Protocol Kuiper Goes Live Today

Kuiper, a permissionless protocol for creating indices has been released on Ethereum mainnet today in what the team behind it is calling a soft launch.

By: Brady Dale • Loading...

DeFi

Kuiper, a permissionless protocol for creating indices has been released on Ethereum mainnet today in what the team behind it is calling a soft launch.

An index tracks a number of financial assets, and often has an associated financial product like a fund or token, that allows investors to gain exposure to that basket of assets. ETFs are such financial assets in traditional finance, and have grown into a $9 trillion industry. There have been a flurry of tokenized index projects launching in DeFi, but Concourse Open co-founder Scott Lewis argues there is more to be done.

“There just is not a credibly neutral protocol for index tracking, and the ability to track an index is a major unlock for any financial system,” said Lewis, a member of the team that bootstrapped Kuiper, told The Defiant via Twitter DM. “We think that capability should exist as a public protocol.”

While the project has been audited three times by Code4rena (a project launched by Scott Lewis, one of Kuiper’s bootstrappers), it has not been tested in a live environment yet. In a draft blog post shared with The Defiant in advance, the team wrote that it’s not feasible to “understand the safety level of a protocol until it has handled real money and been tested by participants, some whitehat, some blackhat, who may be looking to break it.”

Balancing Assets

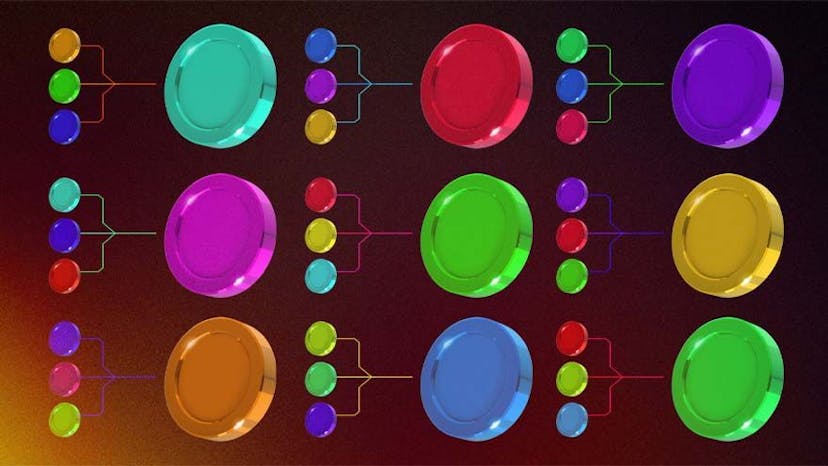

Indices usually have rules around balancing the relative value of constituent assets. So, for example, if one asset goes up significantly in value, it’s either traded for the other assets in the index or new investments in the index go specifically to the assets that need to be topped up, so the overall portfolio is back in balance (but worth more in total).

Indexes can get even more complicated in decentralized finance, because so many of the assets in the space do funky things, like collect fees, collect other tokens, rebase or grow on their own. All of these features can introduce smart contract risks.

“Kuiper allows the use of any standard ‘defi safe’ ERC-20 to be included in indices,” Lewis said, citing some more complex tokens like NFTX’s xPUNK, Compound’s cUSDC and Convex’s cvxCRV as likely tokens to be included. It will also support tokens that have been bridged from other chains. “Deflationary tokens and rebasing tokens and other exotic tokens are not supported,” he added.

Established Players

There’s some well established indices in the space, both centralized and on Ethereum. Among those, Balancer and Set protocols allow users to create tokenized indexes. Index Coop has made two different DeFi-focused indices. There’s a crypto index on the NASDAQ, TradeBlock offers several indices, Cryptex has its Total Crypto Market Cap token, Arch Finance has an Ethereum Web3 index token, among others.

This isn’t Lewis’s first venture into indices. He was a co-founder of the DeFi Pulse Index which collaborated with Index Coop to make DPI, the ERC-20 powered index of some of the largest DeFi protocol tokens. Lewis’s Concourse Open built data tracking website DeFi Pulse, among other DeFi projects.

Kuiper aims to stand out in a few ways, but they can be summed up in two words: permissionless and uncensorable.

Anyone can propose a set of assets for an index, someone else can put it together and generate a token that represents the assets in that index, while others can see that it remains balanced.

No Governance

Kuiper has no governance set up to upgrade the smart contracts. This could prove to be a problem down the line, the team acknowledges, but it also means the parameters will never suddenly drastically change. It also makes censorship of indices all but impossible.

It is set up with a few parameters that can be changed, but it allows no more than 20% in fees to be collected on its indices. That’s a hard cap that’s built in.

Kuiper was entirely bootstrapped with no outside venture investors involved. The team that bootstrapped Kuiper includes Lewis, of DeFi Pulse, Hyype and others; Will Price, an independent investor; Zak Cole and Nathan Blakely, both of Slingshot; Kevin Britz, of Coinbase; Aaron Beattie, of Whiteblock; and Nate Oden, of the Concourse Open Community. Once the protocol is live, “the organization will found itself,” Lewis said. The bootstrappers may or may not be part of it.

Contributors to the open organization are invited to express interest. “We are looking to add individuals for all positions you find in an elite open organization committed to making a protocol successful,” the post says.

The team also has neither announced a governance token nor ruled one out. “We have explicitly made a decision to not discuss this topic to avoid the possibility of information leakage, because information that does not exist can not be leaked,” the post explains.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.