$830M Burned: A Month Into EIP-1559

It’s been a month, almost to the day, since Ethereum’s EIP-1559 upgrade went live, and the milestone was met with the first-ever deflationary day for ETH, where more of the cryptocurrency was burned than issued. The upgrade promised more predictable gas fees, an improved user experience and the potential for a lower ETH inflation rate.…

By: yyctrader • Loading...

Research & Opinion

It’s been a month, almost to the day, since Ethereum’s EIP-1559 upgrade went live, and the milestone was met with the first-ever deflationary day for ETH, where more of the cryptocurrency was burned than issued.

The upgrade promised more predictable gas fees, an improved user experience and the potential for a lower ETH inflation rate. Here, we take stock of the first 30 days of the “ultra-sound money” regime.

ETH has enjoyed a stellar month, trading 35% higher at $3920 Monday afternoon New York time.

Subscribe for free to get daily DeFi news and interviews delivered to your inbox:

Let’s dive into the numbers.

Adoption

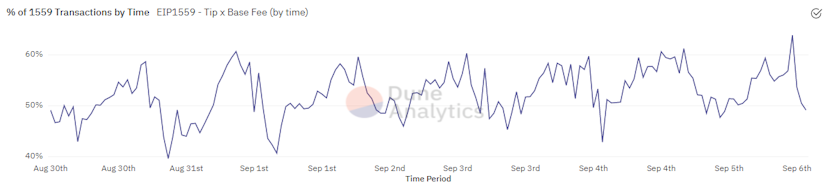

Metamask, the most popular Ethereum browser wallet, was quick to add support for EIP-1559 transactions. However, hardware wallets such as those made by Ledger and Trezor are yet to enable EIP1559. Consequently, security-conscious DeFi users continue to utilize the old gas estimation system and only half of the transactions on the Ethereum network currently take advantage of EIP-1559, according to a Dune Analytics dashboard.

Nearly A Billion Dollars In ETH Burned

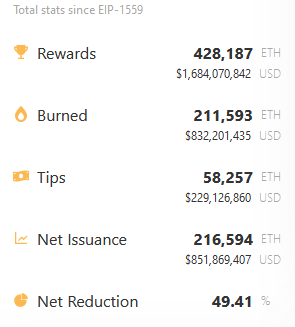

Over 211K ETH, or about $830M, has been burned in the last four weeks, and net daily ETH emissions have been cut in half, according to Watch The Burn.

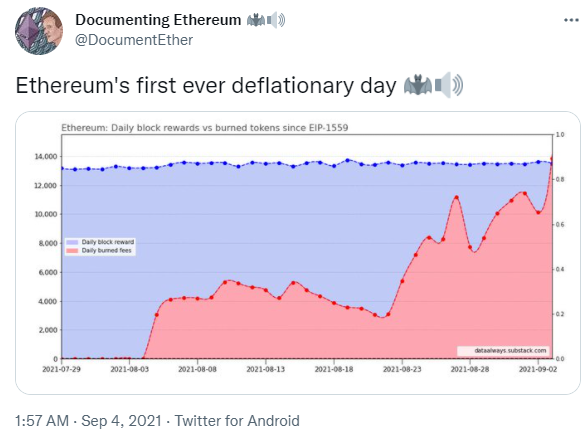

Ethereum had its first-ever deflationary day on Sept. 3, when a series of NFT drops caused gas fees to remain elevated through most of the day.

Gas Fees

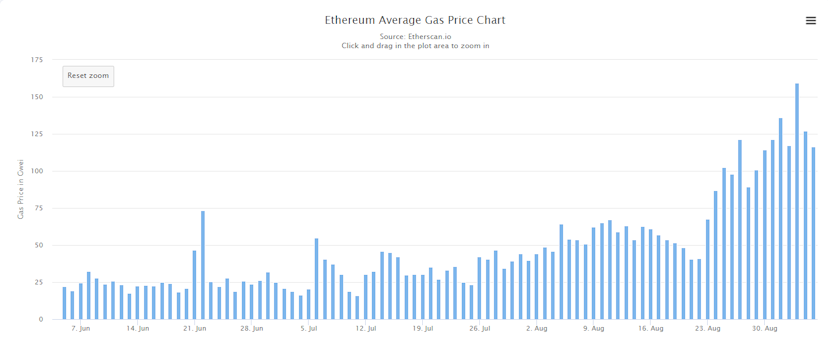

While some Ethereum users may have hoped that EIP-1559 would result in lower transaction fees, we’ve observed the opposite, as gas prices in August were consistently higher than the prior two months.

The NFT boom and continued expansion of blockchain gaming have been the biggest contributors to increased network activity, as NFT marketplace OpenSea and the popular play-to-earn game Axie Infinity are consistently among the biggest gas guzzlers, according to Nansen.

With new NFT projects taking crypto by storm each week — this time around it’s Loot, in case you’re wondering– activity on Ethereum should remain high for the time being, and therefore, so should the amount of ETH being burned.

But crypto is no stranger to boom and bust cycles, so don’t count on this wave to roll indefinitely.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.