DEX Aggregators; The Search Engines of DeFi Trading

One of the most important new tools to master in DeFi is trading on decentralized exchanges (DEXs) on Ethereum. For those trading tokens powered by Ethereum (ERC20 tokens), it’s important we can find the best trading rates across a growing list of liquidity sources in DeFi. It’s very similar to searching for the best flight…

By: The Defiant Team • Loading...

Explainers

One of the most important new tools to master in DeFi is trading on decentralized exchanges (DEXs) on Ethereum. For those trading tokens powered by Ethereum (ERC20 tokens), it’s important we can find the best trading rates across a growing list of liquidity sources in DeFi. It’s very similar to searching for the best flight rate. Do you check each airline website one-by-one or do you rely on aggregators or search engines like Expedia or Google Flights to guide you to the best deals?

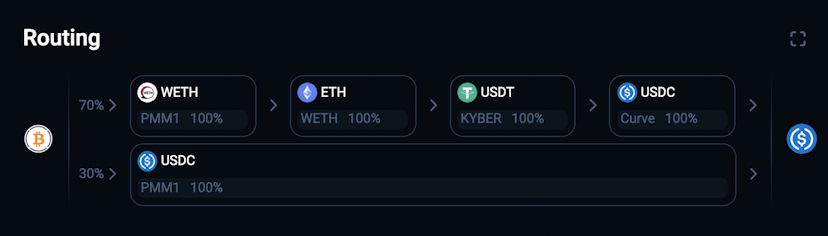

While many of us have used popular AMMs like Uniswap, Balancer, Curve, and more, DEX aggregators may be more convenient as they route liquidity from all of these liquidity sources, and others. DEX aggregator aim to provide a better rate with less slippage, regardless of whether it comes from Uniswap or Kyber, Balancer or Sushiswap.

Think of a DEX aggregator as the search engine for your DeFi trading. DEX aggregators can also split up your trade across different liquidity sources to improve the price. It’s not just a matter of knowing where to trade in DeFi anymore. Due to the algorithmic order routing, you’d likely never be able to find better rates searching on your own. You’d be competing against continuously refined algorithms to optimize trade routes, rates, slippage, and against the backdrop of major liquidity fluctuations in real time.

If you’re interested to try a DEX aggregator, a few of them, no particular order, are:

- 1inch Exchange (with the highest trade volume)

- ParaSwap

- Matcha by 0x

- Dex.ag

In the future, you’ll likely see DEX aggregators built into every DeFi wallet and product, as the API for DEX aggregators becomes the common engine amongst different DeFi applications. A few examples already of this are MetaMask implementing a swap which uses the 0x API that also powers the Matcha.xyz DEX aggregator. Zapper Exchange is also powered by the same API as Matcha.xyz. If one uses Matcha to trade and uses Zapper to track their DeFi portfolio, they might as well use Zapper Exchange since it’s just Matcha reincarnated.

Note: Subscribe now and join over 100K subscribers and keep up to date with the latest Crypto, DeFi, and NFT content.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.