An Ape-Friendly Guide to DeFi Yield Derivatives

Generating passive income using DeFi is one of the most attractive things for a newcomer. The interest rates of these protocols are often promoted to be in the range of hundred to thousands % APY, putting the bank interest rates to shame –– but that’s somewhat misleading as returns are calculated on an annual basis,…

By: Eugenio Croitoru • Loading...

DeFi

Generating passive income using DeFi is one of the most attractive things for a newcomer. The interest rates of these protocols are often promoted to be in the range of hundred to thousands % APY, putting the bank interest rates to shame –– but that’s somewhat misleading as returns are calculated on an annual basis, when the reality is, they often evaporate in a matter of weeks. That’s where swaps come in, a huge market in TradFi but an entirely new segment in DeFi.

What are Swaps?

In the most basic terms, swaps are just derivatives that allow traders to exchange cash flow of one asset with another. There are various kinds of swaps with the most common being interest rate swaps. Swaps usually consist of fixed and variable rate components and are traded over the counter.

If all that sounded like jargon to and made no sense at all, don’t worry! Let’s break it down with an example involving apes and bananas.

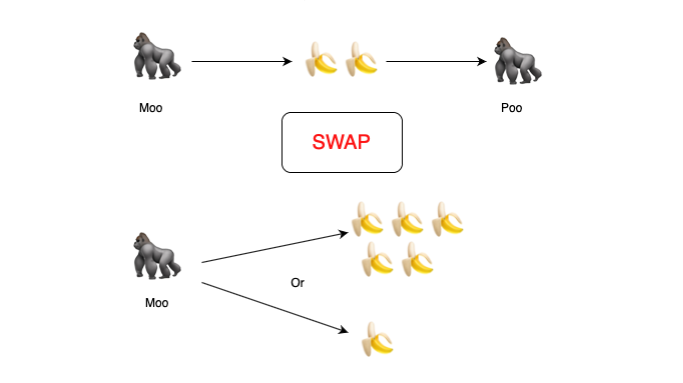

Here we have two gorillas Moo and Poo. Moo has a farm whose yield is fixed at 2 bananas per month and Poo has a farm that gives him a variable yield of either 5 bananas or 1 banana.

At the end of every month, they both have to give a minimum of two bananas to the chief gorilla to get money. Now, Poo is very risk-averse and waiting to see what yield he gets every month is very nerve-racking for him. On the other hand, Moo is an OG ape and couldn’t care less about a stable income. It’s all or nothing for him.

So they both talk and decide to come up with a scheme. Moo will give two bananas to the risk-averse Poo at the end of every month while Moo gets to keep the variable yield of bananas from Poo’s farm. This way, Poo can provide two bananas to the chief at the end of each month to receive a stable income and Moo gets to take more risk and profit if he’s able to get more than two bananas from his farm each month. This is a dumbed-down version and in the real world scenario of interest swaps, the banana would be replaced by fixed and variable interest and the chief gorilla would be the bank to whom the money has to be returned. Needless to say, there’s a lot more complexity involved.

Why Should You Care?

Well, swaps are one of the most fundamental derivatives in traditional finance with the market size for swaps is a staggering $524 trillion. The swap market is usually dominated by firms and financial institutions and rarely involves any individuals participating. There was no way until very recently to use interest rate swaps on DeFi.

However, that changes now with DeFi protocols Pendle Finance, APWine and Element Finance which bring a new yield primitive which is a completely untapped market so far and provides an easy way for yield farmers to take profits on their future yields.

How do Yield Derivatives Work?

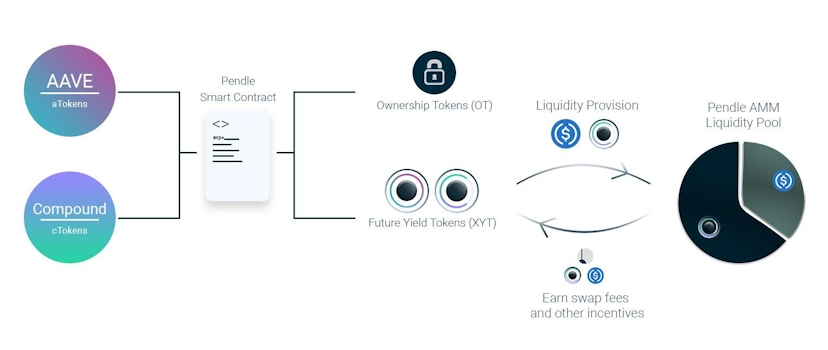

All these protocols introduce yield derivatives and enable the trading of tokenized yield on Ethereum. As described above, a swap consists of a fixed and a variable component. The fixed and variable component is modelled by using ownership tokens (OT) and fixed yield tokens (XYT). The OT tokens represent the ownership of the underlying asset and the XYT tokens represent the future yield that can be earned on that asset.

Functioning of yield tokens pooling and swapping

For example, suppose you go to Aave and deposit your 10 ETH there to earn an interest-bearing aETH. Once you’ve got the aETH token you can use these platforms to split the aETH into OT and XYT which represents the underlying asset and the yield token respectively. This XYT can now be sold using a futures contract to earn upfront money.

Time-Decaying AMM

Pendle’s unique AMM design allows users to do more than just sell the yield tokens for money. Current AMM’s like Uniswap’s constant product AMM which depend on the formula x*y = k works great for normal assets. For time decaying assets, that would mean guaranteed and significant through impermanent loss (IL).

Impermanent loss is quite common and it happens when the value of your deposited assets changes compared to when you deposited them. In liquidity pools, the yield is usually higher when it’s new and the interest provided tends to decrease with time as more people provide liquidity. For tokens which represent this yield, this implies a severe deprecation in their value as the yield goes down.

The time-reliant nature of the yield tokens ensures a heavy penalty for people providing liquidity. Pendle changes that with the introduction of a novel AMM which shifts its equilibrium point to account for time-decay. It is specifically designed to support these tokens to reduce IL caused by reliance on time.

Pendle’s AMM shifting the equilibrium to account for time-decay

This unique AMM design allows Pendle users to liquidity pool the XYT token in Pendle’s AMM to add one more step to your yield farming. If you want to learn more about how Pendle’s AMM works, their documentation has a more detailed explanation.

Another added benefit of this is that using Pendle, even traders who don’t own the underlying asset can get exposure to the future yield of an asset by purchasing XYT tokens from Pendle’s AMM. Pendle’s first of its kind AMM allows a range of time-dependent derivative products to be traded so it’s definitely worth watching how it will evolve in the future.

Protocol Comparison

The main idea behind all three protocols is similar but they all take a slightly different approach to user flow. APWine’s native token $APW already has value accrual mechanics built into it so one could argue for better that it has better tokenomics for its holders. Pendle’s native token on the other hand is currently a utility token but eventually will have governance functions added to it. They also plan to add value accrual mechanisms to the token to benefit the holders and LPs. Element.fi on the other hand doesn’t have a public or private sale so there won’t be a token. They also take an interesting approach by using non-fungible tokens to represent the principal asset.

Right now, it’s too early to say which platform is going to be the clear winner because there’s not enough to separate them. Eventually, as the ecosystem matures, we should see each of them pivoting in their own direction and it’ll be interesting to see what they grow into.

DeFi Composability

DeFi is all about creating new products using composable and programmable money legos. Sometimes this interoperability leads to inventions like Alchemix which leaves a lot of TradFi people scratching their heads.

DeFi is composable money Lego’s

Yield derivatives add another block to these money legos. It shouldn’t take long for them to create a completely new market and hopefully, after reading this article, you’ll be well-positioned to take advantage of it when it happens.

If you like a beginner-friendly introduction to topics like this article, then consider following me on Twitter where I share insights about new and upcoming projects. Until next time ?

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.