1inch Fuels DeFi Airdrop Trend With Christmas Present

DEX aggregator 1inch surprised DeFi users with a holiday treat with the release of the 1INCH governance token on Christmas Eve. 1INCH features a total supply of 1.5B tokens, which unlocks every 6 months over the course of the next 4 years. Tokens were airdropped to all wallets that made at least one trade before…

By: Cooper Turley • Loading...

DeFi

DEX aggregator 1inch surprised DeFi users with a holiday treat with the release of the 1INCH governance token on Christmas Eve.

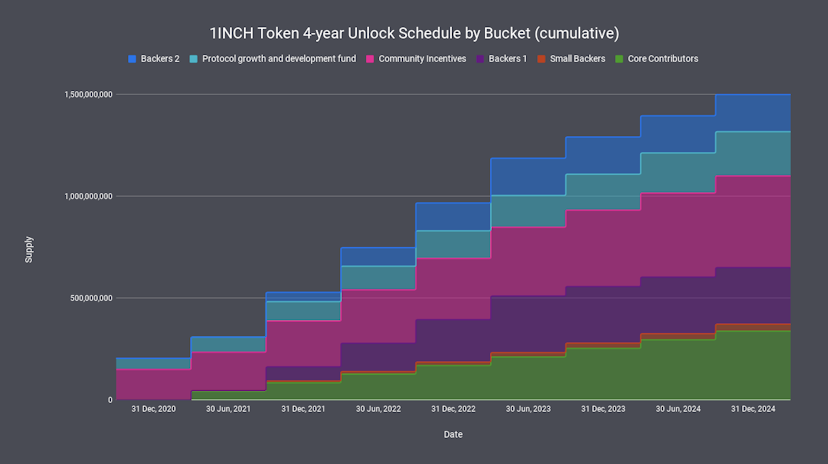

1INCH features a total supply of 1.5B tokens, which unlocks every 6 months over the course of the next 4 years. Tokens were airdropped to all wallets that made at least one trade before Sept. 15, at least 4 trades in total or at least $20 in total volume.

After spiking to ~$3 per token, or a $4.5B FDV, the price of 1INCH has since settled at around $1 at the time of writing, meaning airdrop participants received on average around $1,000 worth of tokens.

90% of Volume

1inch has routed over $8B of volume since starting as an ETHNY hackathon project, recently closing $12M in funding earlier this quarter. It accounts for nearly 90% of all DEX aggregator volume, according to this Dune Analytics query.

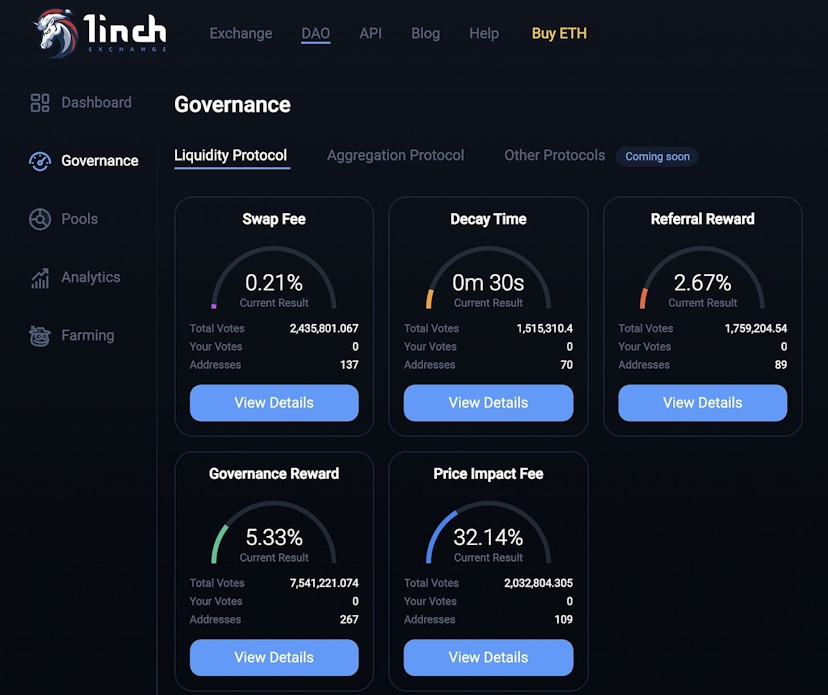

6% of the 1INCH supply was unlocked at inception, used to govern a 1inch DAO which covers key parameters such as Swap Fees and Governance Rewards.

Liquidity Mining

The well-received present was followed by a two-week liquidity mining program, allowing 1INCH holders to provide liquidity to key trading pairs (1INCH/ETH, 1INCH/DAI, etc.) to farm 0.5% of the total supply.

Still, DeFi’s notorious Lobster DAO pushed the 1inch team to justify key elements of the protocol, inquiring about how fees are collected and the core team’s role in profit sharing and distribution. A transcript of the Q&A can be found here.

1inch responded to criticism that it was keeping positive slippage for itself, by saying “token holders have full governance over the detailed distribution of Spread Surplus.”

Others May Follow

The release comes as the first DEX aggregator to release a governance token, a signal that others like Matcha and Paraswap may follow suit in the coming months. For DeFi users, it’ll be interesting to see how the DEX landscape unfolds in 2021, and if retail users are loyal to household names like Uniswap, or if they’d always prefer to find the best price using an aggregator like 1inch.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.