Layer 1s Better Watch Their Backs as L2s Surge in TVL

Smart contract platforms — Terra, Solana and Avalanche, to name a few — had a summer to remember. Terra’s LUNA rocketed 421% between June 1 and Sept. 30 and its fellow Layer 1s (L1s) Avalanche and Solana also delivered triple-digit returns. Now Layer 2s (L2s), which make Ethereum transactions more affordable and faster by executing them…

By: Owen Fernau • Loading...

DeFi

Smart contract platforms — Terra, Solana and Avalanche, to name a few — had a summer to remember. Terra’s LUNA rocketed 421% between June 1 and Sept. 30 and its fellow Layer 1s (L1s) Avalanche and Solana also delivered triple-digit returns.

Now Layer 2s (L2s), which make Ethereum transactions more affordable and faster by executing them off the Layer 1 mainnet, are showing signs of mounting a rally of their own. This may bring Ethereum back in the spotlight after Solana’s SOL, Terra’s LUNA and Avalanche’s AVAX hit all-time highs in September and October. ETH has yet to break its all-time high of $4,357, which it hit in May.

Both Ethereum L2s and these L1s tout their low fees and quick transaction speeds as advantages, placing the two groups in direct competition.

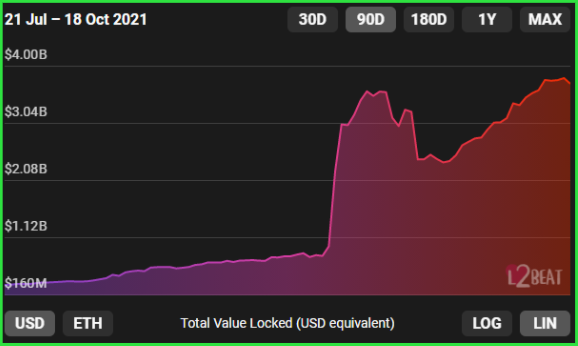

Total value locked across Ethereum L2s is at an all-time high of $3.80B as of Oct. 18, eclipsing last month’s previous all-time high of $3.59B. The previous high occurred at a time when ArbiNYAN, an upstart yield farm on Arbitrum, the leading L2 in terms of TVL, accounted for roughly one-third of the TVL across all L2 solutions.

Value on L2, According to l2beat.com

Preference for L2

Sushiswap, a decentralized exchange (DEX), is leading the charge on the L2 Arbitrum. As of Oct. 18, Sushi leads all DeFi apps, except dYdX, in value locked on L2s. TVL on Sushi’s Arbitrum deployment stands at $382.4M, a more than 87-fold jump from the paltry $4.3M achieved the day after the deployment on Sep. 1, according to DeFiLlama.

That jump in TVL contrasts with Sushi’s Ethereum L1 TVL, which has actually dropped 4% to $4.62B, over the same time frame, according to DeFiLlama.

This shows a clear divergence between the protocol’s L2 and L1 deployments. Users are choosing more efficient transactions despite the additional work of bridging to another blockchain.

L2 Growing

It’s not just Sushi — many OG DeFi protocols that originated on Ethereum are now seeing their L2 TVL growth rate outstrip that of L1.

Curve Finance, an automated market maker (AMM), comes in second among Ethereum-originating apps in terms of L2 TVL at $330.8M, according to DeFi Llama. And like Sushi, Curve’s L2 TVL is growing much faster than the protocol’s original L1 deployment. Since Curve deployed on Arbitrum on Sept. 13, its TVL has grown over 250 times larger to $327.8M from just $1.27M, according to DeFiLlama.

Curve’s Ethereum L1 deployment has grown a respectable 27.7% in that time, but that still doesn’t come close to the growth on its L2 deployment on Arbitrum.

Balancer, a DEX in the top open finance index by market cap, DeFi Pulse Index (DPI), is also driving L2 TVL up while its L1 has remained relatively listless.

Since its L2 deployment on Arbitrum on Aug. 31, Balancer has attracted over $100M in liquidity, while its L1 went up just 3.66% to $3.11B.

Balancer’s L2 value locked is still more than an order of magnitude away from its L1 deployments, but the momentum is certainly there.

Trading Volume Headed to L2 Too

It’s not just TVL that’s gaining steam — DeFi trading volume on L2s is also gaining relative to L1. Uniswap’s deployment of its V3 across L2s Optimism and Aribtrum has hit an all-time 24-hour high of $115M in volume, according to a tweet by the protocol’s founder Hayden Adams. The high comes at a point when 24-hour volume on Uniswap’s V3 on L1, while still dwarfing L2 volume at the billion-plus, has remained flat since before even Arbitrum’s L2 deployment.

Uniswap V3’s L1 volume has been relatively flat

More Good News? zkRollups

And there’s more good news on the horizon for L2 enthusiasts: Starkware, which uses zkRollups, an L2 technology built on cryptographic proofs, has announced that it will release StarkNet in November. Starkware has raised in aggregate $123M from the likes of Sequoia Capital and Paradigm, according to Crunchbase.

Starkware also produces StarkEx, the zkRollup-based L2 solution. dYdX has used StarkEx to become the leading DEX by more than $2.6B as of Oct. 18, according to CoinMarketCap.

Another well-known zkRollup L2 called zkSync released the first app to its testnet last week. ZkSync bills itself as the first zkRollup to be compatible with the Ethereum Virtual Machine (EVM). This means developers should be able to keep much of their same code when deploying to zkSync.

In all, ArbyNYAN first propped up L2 numbers as a flash-in-the-pan yield farm with TVL cratering over a thousand fold to $1.2M from an all-time high of $1.48B, after rewards for a single-sided ETH pool ended and the NYAN token tanked. But now OG DeFi projects are attracting value and volume on their L2 deployments. Plus there are more zkRollup-based L2 solutions on the way.

With Ethereum’s mainnet the base chain for L2 transaction data, this momentum appears to signal a bullish phase for a smart contract platform that’s largely been in the shadows the past couple months.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.