Equilibrium Creating Version of Curve on Polkadot

Equilibrium, an interoperable money market, announced on a Feb. 9 Medium post plans to create a version of Curve Finance’s automated market maker on the project’s chain within the Polkadot ecosystem. Equilibrium will be able to facilitate trading for homogeneous assets on Polkadot, whether they are DOT-based or different tokenized versions of the same asset,…

By: Camila Russo • Loading...

DeFi

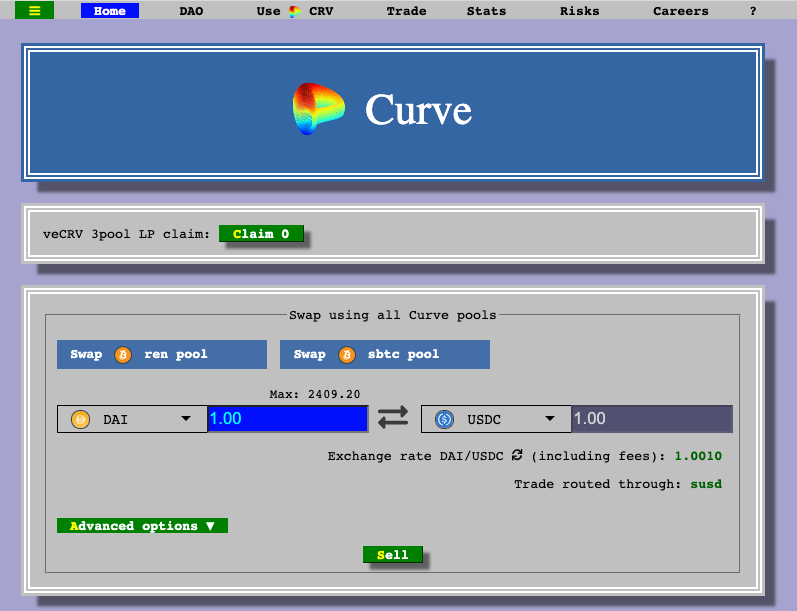

Equilibrium, an interoperable money market, announced on a Feb. 9 Medium post plans to create a version of Curve Finance’s automated market maker on the project’s chain within the Polkadot ecosystem.

Equilibrium will be able to facilitate trading for homogeneous assets on Polkadot, whether they are DOT-based or different tokenized versions of the same asset, like Bitcoin’s WBTC and renBTC.

The move is a sign that competition to become the settlement layer for open finance is increasing, as the number of DeFi offerings on new blockchains ramp up.

“This is a collaboration in which Curve will supervise business logic implementation and fully support the development process for getting its AMM integrated with Equilibrium,” Equilibrium wrote in the post. “The finished result will see Curve’s AMM implemented as a lightweight exchange module on Rust and running on Equilibrium’s Polkadot parachain.”

Interoperable Future

Equilibrium is aiming to become the interoperable home of DeFi, where users can lend, bail out (providing liquidity to cover potential borrower losses), borrow and trade crypto assets, and bringing Curve’s algorithm to the parachain represents a step in that direction

Equilibrium said in its launch post that the ported AMM’s “initial liquidity on Polkadot will be limited.” But the project notes that “Curve’s market-making algorithms can accurately minimize slippage in the trading of similar assets.”

Value Accrual

As high gas costs have become a daily discussion among Ethereum and DeFi enthusiasts, some are pointing towards layer-2 technologies like rollups as key to reducing the cost of transactions.

Interoperability adds potentially another solution to the fee dilemma as users may be able to bridge their assets to other blockchains, with similar, or even copied, functionality. Indeed, Equilibrium intends to compete with DeFi incumbents.

If Equilibrium is successful with Curve,this would potentially free up space in the Ethereum blockchain. For now though, DeFi users would rather pay to use Ethereum DeFi, and by many times over.

The Curve porting project has a six-week development roadmap and has received support from the Web3 Foundation by way of its Open Grant Program.

[UPDATED: 2/12 @ 10:30AM EST to reflect that Equilibrium updated its announcement, after the original story was published, to characterize its relationship with Curve as a collaboration instead of a partnership]

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.