Yearn Finance Ecosystem Breakdown –– Pushing the Boundaries of Human Coordination

Yearn Finance surprised the DeFi world late last year when the project announced a flurry of mergers with Cream, Pickle, SushiSwap, Akropolis, and Cover in the span of a week. While the Cover merger ended, the remaining teams continue to collaborate at top speeds enabled by the shared goal of capital efficiency, belief in Yearn’s…

By: Owen Fernau • Loading...

DeFi

Yearn Finance surprised the DeFi world late last year when the project announced a flurry of mergers with Cream, Pickle, SushiSwap, Akropolis, and Cover in the span of a week. While the Cover merger ended, the remaining teams continue to collaborate at top speeds enabled by the shared goal of capital efficiency, belief in Yearn’s deeply meritocratic values, and the low-friction integrations enabled by interoperable smart contracts.

Andre Cronje developed Yearn last year initially as a way to invest his family’s savings. The platform allocates stablecoins to lending protocols that are generating the most yield. Cronje introduced the concept of vaults, into which any Ethereum user could deposit in order to take advantage of the vault’s specific yield generating strategy. Last July, he released YFI, a token which had no pre-sale, no offering, and could only be earned in the initial distribution by using the Yearn platform.

YFI’s market cap would reach $1B less than a month after its distribution and Yearn has $3.40B in total value locked (TVL) according to DeFi Pulse, placing it first among yield aggregators, and eighth among all DeFi protocols.

YFI’s fair launch and Cronje’s “test in production” ethos have become models to follow in the space, while the project has attracted 30 full-time contributors, yielding one of the most successful financial decentralized organizations, or DAOs, to date.

Demonstrating similar values to the community-driven YFI launch, no tokens, fiat, or equity were exchanged and no paperwork was filed for the mergers. They “were as simple as saying that we want to do it and then we do it,” said the anonymous Tracheopteryx, a member of the Yearn core team in an interview with Yearn ecosystem members . With bureaucratic hurdles cleared, the teams are “able to work together at the speed of trust. Which is about as fast as you can go in the world.”

While the mergers were well publicized, the nature of the integrations were less so, so we dug into how the teams work together, on both a technical and social level.

Cream

Cream acts as the core leverage provider for Yearn. While any lending platform allows for leverage, or borrowing assets in exchange for collateral, an integration with Cream allows Yearn to borrow at “zero-collateral,” according to a launch post in which Cream introduced the Iron Bank, the protocol-to-protocol lending product.

Instead of collateral, The Iron Bank uses a credit system in order to originate loans. As Yearn has been whitelisted, they can borrow from Cream’s Iron Bank without posting collateral. Because of this synergy, Yearn’s strategies are more capital efficient, and the extra yields can be passed on to vault depositors.

Cream is also known as the long-tail lender in DeFi, meaning that the project accepts tokens which lenders like Compound and Aave do not. While Compound has 10 active money markets in its protocol, Cream has 70 available. Some of those tokens represent deposits in Yearns vaults, like yCRV and yETH, increasing the utility for users depositing to Yearn, and in turn increasing the yield-aggregator’s total value locked.

“As Cream tackles the long-tail of assets, the Iron Bank isn’t meant to do that,” Cream project lead Leo Cheng told The Defiant. “The Iron Bank is meant to handle blue chip assets with deep liquidity.”

Cheng referred to the Yearn ecosystem as a product of “the stars aligning.” COVID accelerated the trend toward remote work while DeFi’s explosion pushed the ecosystem to emerge. “What I find most refreshing is, I’m now working with some of the smartest people around the world, smartest, most driven, and innovative people,” Cheng said.

Overall, Cheng sees the Yearn ecosystem as a meritocracy. “It doesn’t matter what part of the world you live in or what language you speak so much as the ability, and the desire to learn quickly, do the work, pitch in, do stuff, make an impact, and then you’re welcome.”

To those outside of crypto, this idea may be strange, but the Yearn ecosystem exemplifies what may be the future of work, where people choose tasks themselves more so than receiving orders from a boss.

Pickle

Pickle’s primary function in the Yearn ecosystem is in the latter protocol’s “Backscratcher” vault, which Yearn said is one of its competitive advantages in its Q1 report. The vault uses Curve’s governance staking contract, which requires locking CRV for a predetermined amount of time, in exchange for overall protocol fees and a boost on any liquidity positions in the automated market maker the user has. Curve’s staked governance token is called veCRV.

Users can deposit CRV into Yearn and get yveCRV in exchange. This boosts the rewards of all Yearn vaults which earn CRV rewards. According to Yearn, the protocol’s share of the locked CRV is so large, the APY of the Backscratcher vault is 10.43% as opposed to the 6.72% which comes from locking in Curve directly.

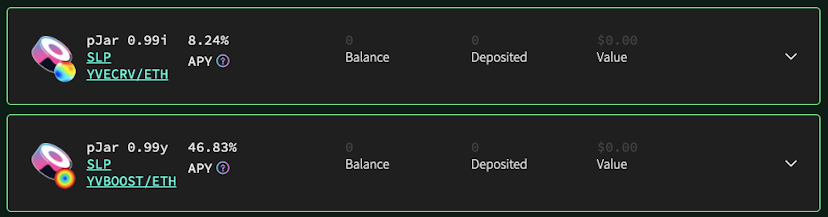

Yearn’s partner exchange, Sushiswap, provides a yveCRV/ETH pair so that users can trade their yveCRV for ETH and “get their principle back” according to Yearn.

The trading pair also allows yveCRV vault depositors to earn SUSHI rewards and also trading fees by providing liquidity in the pool.

Backtracking –– users can deposit CRV into Yearn’s veCRV vault to get CRV rewards, then deposit the yveCRV redemption token, along with ETH, into the yveCRV/ETH pair in Sushiswap, and earn SUSHI rewards. If it sounds complicated, it’s because it is.

But hang tight because there’s more.

Pickle comes in by providing a “jar,” Pickle’s equivalent of a vault, that automates reinvesting the SUSHI rewards to get more liquidity providing tokens while also adding Pickle rewards on top.

As Larry the Cucumber, how Pickle’s founder is known, said on the call, “it’s a mouthful.”

Pickle also launched two Yearn affiliate jars on May 14. The jars essentially “wrap” a Yearn vault up in a Pickle jar, giving Yearn up to a 50% profit share from the TVL which is contributed through Pickle’s jar.

The Pickle team took advantage of its white-label status with Yearn in order to create the jar, but Yearn does have an open TypeForm for any product which integrates Yearn’s vaults.

Yearn’s partnerships show the protocol is emerging as what Vance Spencer has called “financial middleware.” Yearn may become more invisible to the end user as products continue to integrate with the protocol.

Larry the Cucumber said that it’s been interesting working alongside the Yearn team, as the protocol is “the father of yield farming.”

Despite Pickle and Yearn both functioning as yield aggregators, Larry said the teams have great synergies. Outside of the technical integrations, Pickle has benefited from code reviews from the Yearn team, for instance.

SushiSwap

SushiSwap, an automated market maker (AMM), is perhaps the most well known of Yearn’s official partners. The project has $3.44B in TVL compared with Yearn’s $3.40B at the time of writing.

Sushi and Yearn first announced their merger on Nov. 30, and like Yearn, Sushi has developed many products since, including Kashi, which offers “isolated lending markets,” a governance staking mechanism which gives Sushi stakers proportional rewards of the 0.05% taken on every swap on the network, and Miso, a launchpad for issuing new tokens.

Sushi’s primary role in the Yearn ecosystem is providing “custom AMM experiences” for the yield aggregator’s strategies. An example of this would be in the Backscratcher vault mentioned above, where Sushi can incentivize liquidity for a yToken (tokens which represent Yearn deposits), with SUSHI rewards boosted on top.

“Whenever they have a new vault, new product that we can enable and make more liquid, whenever they need something, we can provide help and assistance,” 0xMaxi, identified as Sushi’s “fearless leader,” on the project’s website, told The Defiant.

Akropolis

Akropolis and Yearn merged with Akropolis becoming the “front-of-house institutional service provider,” as the announcement post says.

“The primary objective, which is what we discussed with Andre when we first talked about it, was for us to focus on two aspects… biz dev and product strategy,” Ana Andria, Akropolis founder, told The Defiant.

“The best way to think about us, at this stage, would be, we are very comfortable speaking with institutions and would love to extend that skillset and capacity and relationships to the Yearn ecosystem participants and our team is definitely not as heavy on the backend as all the other teams,” she said.

As DeFi expands, Andria and her team are working on how to sell institutions on Yearn products. She’s toying with calling Akropolis’ offerings “alternative high yield cash management solutions,” language which she admits is dry, but may be necessary to unlock the billions in capital under institutional control.

The founder doesn’t think everything needs to be changed to get institutions onboard. “I don’t even think it’s about being buttoned down, because who doesn’t like anime girls, only people that lie to themselves, so to me it’s more about communicating complex concepts as simply as possible using the language and metaphor that the audience is already familiar with and can relate,” she said.

The Bleeding Edge

In all, Yearn represents the bleeding edge of human coordination. The project denies categorization as a company, and states that “Yearn does not have an official voice.” Tracheopteryx of Yearn core emphasized the point, saying “I can’t speak for Yearn, it’s not that type of a thing.”

An impassioned 0xMaki described the burgeoning shift in the nature of work, saying “it might seem impossible to grasp that ‘oh if I put some time in, someone’s going to give me money,’ that’s not how a usual company works! I should be sending a resume, I should be having someone telling me what to do!” He continued: “It’s not about that. It’s all about initiative, it’s all about taking ownership.”

The fast moving DAO has a culture where Tracheopteryx says “I can be my full self, I can be as expressive and creative as I want to be and you don’t get hung up by the trappings and the boundaries of older infrastructures. That friction is just not there.”

The project not only has an innovative culture, it has a Treasury with a net worth of $202M with which to finance the protocol’s continued expansion.

In investigating the most futuristic financial ventures in the world, Yearn Finance appears to be more “organism,” as Tracheopteryx calls it, than organization. For those wondering what the future of digital work looks like, it may look something like Yearn, an emergent process, which appears to only be gaining steam.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.