Traders Bet Arbitrum Will Have the Second-Biggest Layer 2 Token

Some Are Using OP As a Reference

By: Aleksandar Gilbert • Loading...

DeFi

Traders are betting Arbitrum tokens will trade above $1 when they hit users’ wallets on Thursday.

Derivatives for ARB tokens, to be issued on March 24, are trading from just above $1 to as high as $9.

These markets offer an indication as to how the leading Ethereum scaling protocol will be valued in liquid, public markets. These early bets would make Arbitrum the second-largest Layer 2 token, with a market capitalization of more than $1B, according to CoinGecko. Parent company Offchain Labs’ equity was valued at $1.2B in its Series B funding round.

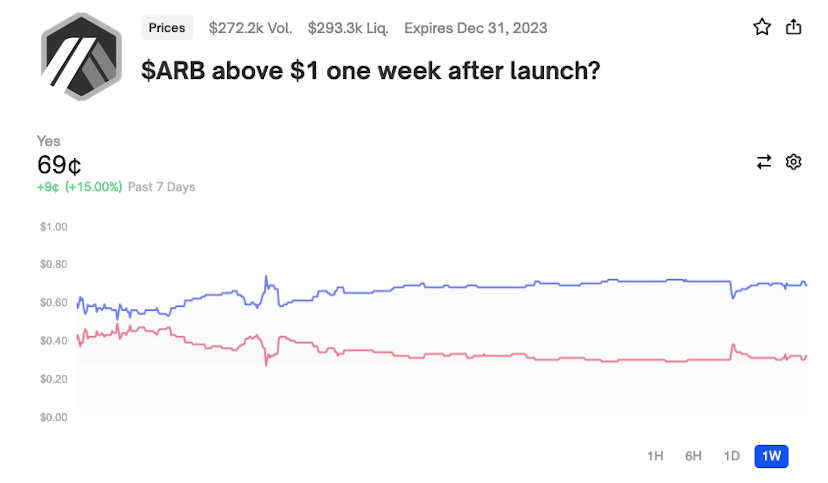

A pair of ARB IOU markets that have processed almost $3.5M in trades Monday value ARB at more than $8.50. Betting website Polymarket Whales put the odds the token will trade above $1 at about 70% Monday evening New York time.

Traders that are longing and shorting ARB on a new futures contract listed on the BitMex exchange believe the tokens will trade just above a dollar after the airdrop. The contract has processed $240,000 of trading volume in the last 24 hours.

Token Airdrop

More than 600,000 Arbitrum users are eligible for the 1.1B ARB tokens that will be distributed in Thursday’s airdrop. Arbitrum’s founding team, its investors, and ecosystem DAOs will split another 4.5B tokens. ARB’s value will therefore determine whether the airdrop mints a new group of millionaires.

Arbitrum To Airdrop Long-Awaited ARB Token On March 23

Layer 2 Network To Decentralize And Add Support For Layer 3 Blockchains

Layer 2 blockchains, or rollups, are central to Ethereum’s plans to scale and accommodate billions of users. Several billion-dollar startups have jumped into the arena, but Arbitrum has emerged as the clear leader, with a 55% market share and a transaction count that topped Ethereum’s on two consecutive days last month.

Optimism Comparison

Analysts who have shared their back-of-the-napkin math on social media have used Optimism’s OP token as a measuring stick. Optimism is the second-largest rollup on Ethereum, with $2B in user deposits to Arbitrum’s $3.9B, per L2BEAT. The OP token was trading at $2.50 Monday evening New York time and is up almost 80% in the past 12 months.

Using an “extremely basic framework of how to *possibly* value $ARB against $OP,” pseudonymous Messari analyst Trade Joe’s Crypto valued ARB at $1.84 on March 16, given its 10B supply and Arbitrum’s lead in user deposits. The value jumped to $3.76 when comparing Arbitrum and Optimism in terms of ETH bridged to the respective blockchains.

Arbitrum parent company Offchain Labs announced the airdrop on March 16. When ARB launches, Arbitrum’s founding team will cede control of the blockchain to token holders and take a step toward decentralization.

Token Distribution

Of the total supply of 10B ARB tokens, 42% will go to a DAO-controlled foundation. The Arbitrum DAO itself will be run collectively by token holders. Current and future employees of Offchain Labs, Arbitrum’s parent company, will receive about a quarter of the tokens. Investors will receive 17.5%.

Users who met certain criteria as of Feb. 6 will be airdropped 11.5%, and DAOs – almost all of them within the Arbitrum ecosystem — will receive 1.1%.

Arbitrum users prior to Feb. 6 earn points for using the platform. Using the blockchain over a longer period of time, conducting more transactions, conducting higher value transactions and depositing ever-greater liquidity into the ecosystem are all rewarded with higher point totals.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.