Nexus Mutual Offers Cover on Centralized Exchanges

Cryptocurrency investors are now able to buy insurance on centralized exchange deposits via Nexus Mutual. Mutual members who have verified their identity with Nexus can purchase insurance claims on select centralized custodians including Celsius, BlockFi, Nexo, inLock, Ledn and Hodlnaut. NXM holders are also able to stake tokens on behalf of these custodians, essentially stating…

By: Cooper Turley • Loading...

DeFi

Cryptocurrency investors are now able to buy insurance on centralized exchange deposits via Nexus Mutual.

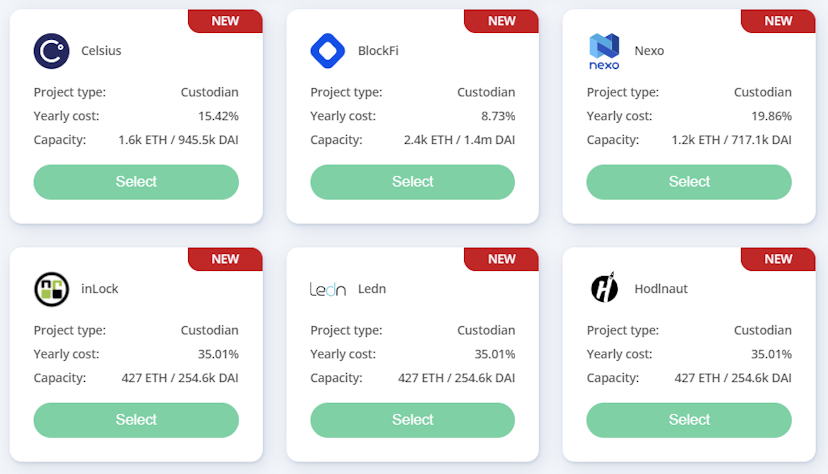

Mutual members who have verified their identity with Nexus can purchase insurance claims on select centralized custodians including Celsius, BlockFi, Nexo, inLock, Ledn and Hodlnaut.

NXM holders are also able to stake tokens on behalf of these custodians, essentially stating that they find them to be secure and that they vouch a vulnerability will not occur. 50% of each cover purchased is divided proportionally between the stakers of that contract.

Cover buyers have the right to submit a claim if they lose more than 10% of their funds after the custodian gets hacked, or if withdrawals from the custodian are halted for more than 90 days.

The clearest example of this would be the recent hack of KuCoin, where the exchange was subject to over $150M in lost funds which have since largely been recovered.

Nexus Mutual now has $57M in covers outstanding, backed by $96M in ETH in the capital pool according to Nexus Tracker. While these custodians hold multiples more funds than the amount of total cover available, the release marks a step in the right direction for DeFi playing a vital role in protecting users from custody risk.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.