Maker Foundation Transfers Funds to DAO in Decentralization Push

The Maker Foundation is sending 84K MKR tokens, worth $512M at the time of writing, to its DAO’s Treasury. The move is a major step towards further decentralizing the protocol. MKR holders will now decide via governance how the 84K tokens will be spent. Tokenholder governance will also oversee employees who were previously supported by…

By: Owen Fernau • Loading...

DeFiThe Maker Foundation is sending 84K MKR tokens, worth $512M at the time of writing, to its DAO’s Treasury. The move is a major step towards further decentralizing the protocol.

MKR holders will now decide via governance how the 84K tokens will be spent. Tokenholder governance will also oversee employees who were previously supported by the Maker Foundation.

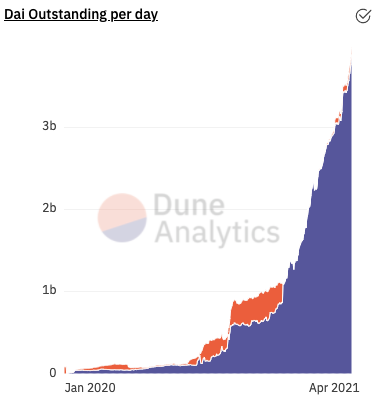

The Maker Foundation has supported MakerDAO since 2017 when the project went live on Ethereum’s mainnet and has seen the growth of DAI supply go from zero to the $4B mark, which the project passed yesterday as usecases for the stablecoin in DeFi continue to grow.

The market apparently responded well to the news, as MKR hit an all-time high of $6,292 yesterday, at one point the second biggest 24-hour gainer among the top 100 tokens in CoinGecko. It has since retraced some of those gains and is now trading at $5,306.

In Decentralized Hands

“Big big news for us in the Maker Community, everything has been done with one objective, decentralization,” Nadia Alvarez, who does Latin America-facing business development for Maker, said of the change. “The Foundation is getting dissolved, various core units are starting their business thanks to the support of the Maker Governance, and we are seeing how this has an incredibly positive impact on the community, making it stronger.”

In order to receive support from the DAO instead of the Maker Foundation, “core units,” the divisions of business which support the Maker protocol need to go through the “Core Unit Framework.” At least ten teams have created proposals to continue operations under MakerDAO’s supervision, including Alvarez’s Growth Core Unit, which will be starting to work for the DAO this month along with the Protocol Engineering Unit, said Sébastien Derivaux, who works on the Real-World Finance Unit.

The former two units will consist almost entirely of ex-Maker Foundation employees, while the first three Core Units Governance, Risk, and Real-World Finance team members have only ever worked for the DAO, according to Derivaux.

A First For Crypto

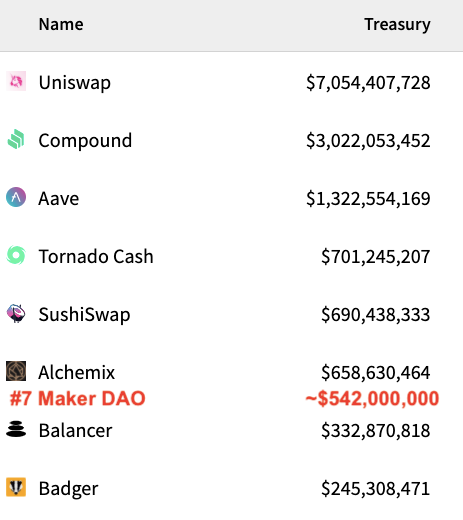

“The madmens, they actually did it,” State.eth, who identifies as a “governance ghost” at Aave, tweeted. “MakerDAO now has a huge treasury, half a billion dollars.”

The move is significant as it may be the first time that a legal entity dissolved itself in favor of a DAO, even giving its assets away, state.eth said in an interview.

Most DeFi projects hold decentralization as a north star, setting out a path to progressively get there. MakerDAO, one of the foundational DeFi projects, following through, will likely help set a standard to follow.

The Foundation’s dissolution also minimized regulatory risk, as the DAO isn’t a legal entity. On the flip side, Maker will now be more accountable to its community as all decisions will come under MKR holders’ jurisdiction.

Only to Burn It

There’s some question as to whether the DAO will decide to burn all 84K MKR tokens. As the DAO also controls the mint function, which ostensibly means that governance can mint tokens at will, some, like Maker forum user Spidomo think that, because “MakerDAO can always print and sell new MKR for funding anyway… there really are no new funds to spend.”

There is a “cooldown period” proposed on Maker’s forum, during which the DAO will agree to if not burn, at least not spend, its newfound windfall.

Maker’s DAO had previously received proposals to introduce staking rewards for MKR staked in the Governance Contract, and to compensate victims of Black Thursday,

“When someone wins the lottery, it helps to not change much for a while to let the new reality sink in,” AstronautThis wrote in the forum.

By adding the Foundation’s $512M with the $30M listed on Open-Orgs.info, which keeps track of DAOs’ balance sheets, Maker DAO currently has the seventh largest balance sheet in crypto, behind Alchemix by a little over $100M, and ahead of Balancer by over $200M.

Considering that the DAO just became more than 18 times richer, perhaps AstronautThis cautious approach may be best for the longevity of the organization upon which so much of DeFi is built.

[CORRECTION TO REFLECT THE RIGHT NAME OF THE MAKERDAO FORUM CONTRIBUTOR]

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.