Goldfinch Says it Has Enabled $1M in Un-Collateralized Loans

Goldfinch, a newly launched DeFi lending protocol focusing on loans without collateral, today announced a $1M funding round and progress on its pilot lending program in emerging markets. Goldfinch, which launched in December, said it’s working with PayJoy in Mexico, Aspire in Southeast Asia, and QuickCheck in Nigeria, which have collectively drawn down $1M from…

By: Camila Russo • Loading...

DeFiGoldfinch, a newly launched DeFi lending protocol focusing on loans without collateral, today announced a $1M funding round and progress on its pilot lending program in emerging markets.

Goldfinch, which launched in December, said it’s working with PayJoy in Mexico, Aspire in Southeast Asia, and QuickCheck in Nigeria, which have collectively drawn down $1M from the Goldfinch protocol and deployed it to thousands of their end borrowers.

“And it’s having an immediate impact,” Goldfinch said in a blog post. “To list a few examples, the capital is being used to help people buy smartphones in Mexico, cover short-term expenses in Nigeria, and purchase equipment for business operations in Vietnam.”

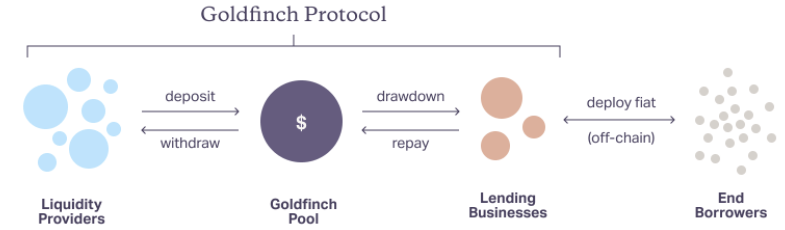

The protocol works by extending credit lines to lending businesses. These businesses draw down stablecoins from Goldfinch’s token pool, and then they exchange it for fiat and deploy it on the ground in their local markets. On the investor side, crypto holders can deposit into the pool to earn yield. Lending businesses’ interest payments to the protocol are immediately disbursed to all investors.

Goldfinch today also announced it has received $1M in funding from investors including Kindred Ventures, Coinbase Ventures, IDEO CoLab Ventures, Stratos Technologies, Variant Fund, Alex Pack, and Robert Leshner.

DeFi lending market’s growth to surpass $5B from less than $200M a year ago, while explosive, underestimates the true potential of DeFi, because all of that lending is overcollateralized, Goldfinch said in their post.

“These loans are only useful for a sliver of borrowers — primarily margin traders and crypto holders who don’t want to sell their positions,” the team wrote. “This is the crucial step that finally opens crypto lending to the majority of the world.”

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.