Yearn Restores yDAI Vault and Compensates Hack Victims

Yearn Finance, the yield aggregator protocol which suffered the first major hack of 2021 last week, is healing, making its Dai savings smart contract available to users again, and compensating victims of its recent hack. Yearn has restored its yDAI vault and returned $9.7M in DAI funds to users who had their stablecoins deposited in…

By: Owen Fernau • Loading...

DeFi

Yearn Finance, the yield aggregator protocol which suffered the first major hack of 2021 last week, is healing, making its Dai savings smart contract available to users again, and compensating victims of its recent hack.

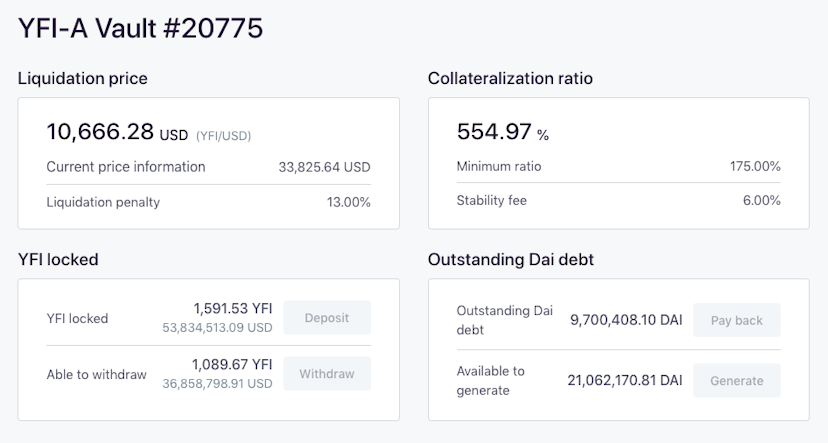

Yearn has restored its yDAI vault and returned $9.7M in DAI funds to users who had their stablecoins deposited in the vault at the time of the attack.

Yearn minted the DAI with a MakerDAO vault using Yearn’s native token, YFI, as collateral.

Yearn plans to pay off the debt through fees generated by the protocol.

Yearn emphasized that restoring the vault was “a one-off celebration of going through this DeFi rite of passage. Make sure to buy Cover next time,” the project tweeted, referring to Cover Protocol which serves as insurance for smart contract risk.

Insurance Claims Settling

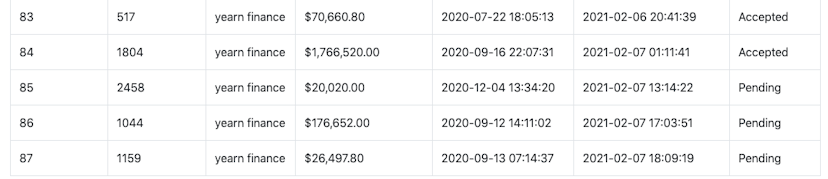

16 insurance claims, issued with insurance protocol Nexus Mutual and seeking payout for the Yearn hack, have been filed since the Feb. 4 attack.

Of the 16, 12 have been accepted for payouts worth ~$2.1M and 3 worth $223K remain pending, though it’s anticipated that they will be accepted.

Regarding the one denied claim, The Defiant contributor DeFi Dad believes that the claim’s owner did not lose at least 20% of the covered amount in the hack. This is a requirement for Nexus Mutual coverage to pay out.

Token and TVL

YFI has recovered losses of as much as 24% since the hack, and is now trading at $35k, near its pre-attack levels.

The token’s 7.2% spike yesterday may be due to the confidence inspired by the team’s voluntary restoration of user funds.

The $655M locked in Yearn has also been steady on the week, moving less than a percentage point according to DeBank.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.