What Is Metronome Synth?

SponsoredMetronome Synth: Streamlining DeFi’s Cutting-Edge Innovation

By: Rahul Nambiampurath • Loading...

Explainers![What Is Metronome Synth? [Sponsored]](/_next/image?url=https%3A%2F%2Fcdn.sanity.io%2Fimages%2F6oftkxoa%2Fproduction%2F0e1a6c1dd6e47fa2daa44506ac8b527f60f65d9e-600x338.jpg&w=828&q=75)

As banks and exchanges suffer an erosion of trust, Decentralized Finance (DeFi) keeps pushing the innovation envelope. One of these DeFi vanguards is Metronome Synth, a multi-collateral and multi-synthetic protocol that expands users’ ability to trade and farm digital assets.

Before we delve deeper, it is important to understand the role of synthetic assets in the DeFi space.

Synthetic Landscape Explained

You have no doubt heard of liquid staking. The concept is simple. If you engage in Proof of Stake blockchain networks, you often find lock-up periods for your staked cryptos, which means that you cannot use them.

So, your assets become illiquid, locked up as they are. In comes liquid staking that unlocks that liquidity by issuing a token equal to the value of staked funds. For instance, Lido Finance issues stETH for an equal amount of staked ETH. Users can then deploy this stETH token in a variety of dApps just as if they would ETH itself, such as using it as a collateral for a loan.

From this, it is easy to assume that liquid staking tokens and synthetic tokens belong in the same category. After all, a synthetic token is created by a smart contract to track the price of its source collateral. Nonetheless, this is not true.

Synthetic tokens are specifically minted to mimic the price of an underlying asset, be it commodity, stock, or crypto, without holding it. In other words, synths provide exposure to that underlying asset’s price moves.

Case in point, a synthetic Bitcoin could be minted by using collateralized ETH, with the BTC synth price then pegged to the price of real Bitcoin. Such flexibility expands users’ convenience in both trading and hedging. For example, if a synth is pegged to the price of gold, traders could short gold (the physical commodity) without owning any gold if they believe its price will go down. The same could be done with a synth that mimics the price of the S&P 500 index.

What Metronome Brings to the Synth Table

In this early stage of synth development, the early bird gets the worm. Synthetix (SNX) platform was one of the first to enable users to mint synths using a wide range of underlying assets. As a result, Synthetic grew to a respectable $443.8M total value locked (TVL).

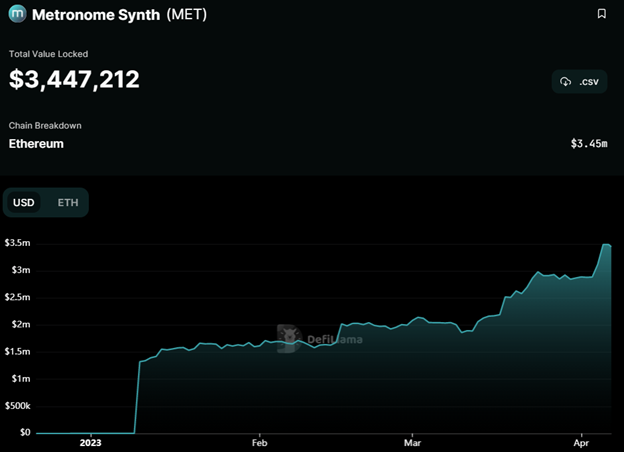

Launched relatively recently, in January 2023, Metronome Synth already accrued $4M TVL, while still in the beta stage. On April 18, the project is going full steam ahead, following the smart contracts’ successful audits and testing.

Created by the Bloq DeFi team, Metronome Synth originates from the earlier Metronome project, having raised $12.1M during the ICO fundraising in July 2018.

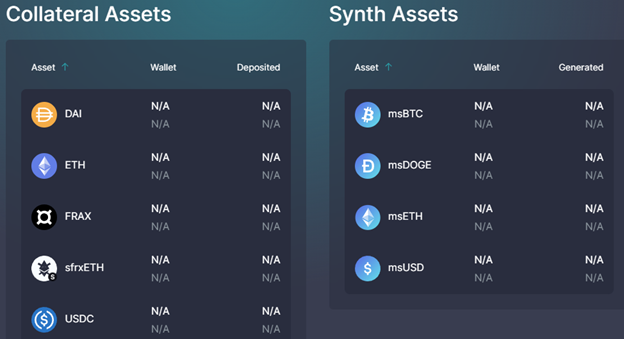

Under the banner of “unlocking limitless liquidity,” Metronome Synth allows DeFi users to deposit multiple types of cryptos as collateral to mint synths. This ranges from stablecoins (DAI, USDC) to leading cryptocurrencies (Bitcoin, Ethereum).

Moreover, even liquid staking tokens can serve this purpose. As of March 2023, the aforementioned stETH can be found as vastETH, with “va” relating to Vesper Finance protocol. Thanks to this integration, DeFi users can deposit Vesper Lido Staked ETH (vastETH) to Metronome in order to mint a variety of synths.

As one would expect, these Metronome Synths are minted with the “ms” prefix, such as msBTC, msETH, and msUSD. To mint any of them, users can deposit their preferred collateral, but each one has its own conditions.

Metronome Synths Exposure Examined

Let’s say you are a Bitcoin maximalist who only holds BTC. Yet, you still want to take advantage of various DeFi protocols. In that case, you would deposit your BTC in one of the BTC-to-WBTC protocols first, such as Bitgo or Kyber Network.

These protocols would then mint wrapped BTC (WBTC) equal to the value of your deposited BTC. With your wallet filled with WBTC, you would then connect it to the Metronome Synth app, where you would immediately get a clear overview of possible collaterals to mint synths.

Presently, the deposit limit for WBTC is 311 Bitcoins, with a collateralization ratio of 80% and liquidation penalty of 18%. This means that to mint 10 msBTC from Metronome Synth, you would have to deposit at least 12 WBTC to maintain the minimum collateralization ratio of 80%.

Likewise, if the value of your WBTC collateral falls under 80%, Metronome Synth would liquidate the collateral, plus incur an additional 18% as penalty. But wait, there is something very important to consider — slippage!

If you mint 10 msBTC using 12 WBTC as collateral, it is assumed that the price of both the collateral and the synth is maintained at a fixed exchange rate of one-to-one. After all, they are both pegged to the real price of Bitcoin. In practice, the market liquidity moves the price of synthetic tokens to deviate from the expected price.

In other dApps, this could result in getting 9.5 WBTC per msBTC, but not on Metronome Synth. When it comes to swapping synths, you can do so with zero slippage.

Metronome’s Smart Farming

If anything is the staple of DeFi, it is yield farming. Either for staking to secure a PoS chain or for borrowing, users can turn themselves into virtual banks as they gain interest in exchange for their liquidity service.

Standalone, yield farming is a simple concept. DeFi’s smart contracts and self-custodial wallets enable people to become their own virtual banks. But what if you want to amplify your farming position to receive higher yields? This is where Smart Farming comes into play, as a way to boost your position with synths.

When users provide liquidity to a lending/DEX protocol, such as Curve or Uniswap, they gain interest for their liquidity service. Just like a traditional bank would. But to boost those yield gains, liquidity providers (LPs) could augment their liquidity footprint by borrowing the funds.

This is looped yield farming. With the use of synthetic tokens, traders can maximize their returns, creating evolved Smart Farming. Metronome Synths works in conjunction with Vesper Finance, as the yield aggregator of choice.

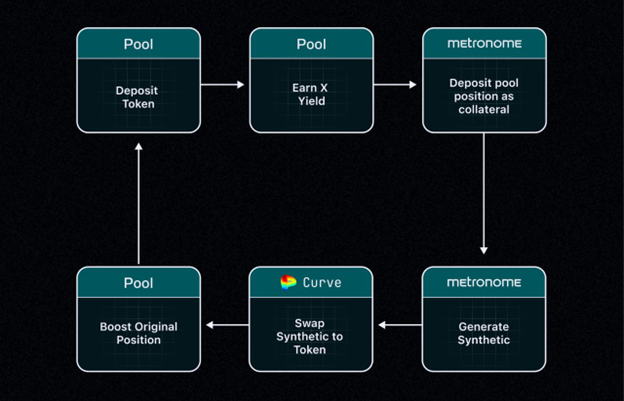

Combining Metronome with Vesper, a typical scenario involving synths would look like this:

- Deposit $1,000 worth of USDC stablecoin into Vesper Finance’s USDC pool.

- In turn, receive vaUSDC tokens as yield-bearing tokens.

- Deposit vaUSDC into Metronome Synth as collateral to generate a synthetic asset of choice.

Alternatively, one could deposit their vaUSDC position directly into Smart Farming to do the following:

- Customize the yield loop of your deposit based on your risk preference.

- Metronome Synth then mints msUSD, which is automatically swapped on a decentralized exchange (DEX) for USDC.

- Finally, Metronome deposits this freshly swapped USDC back into the Vesper Finance pool, returning vaUSDC and increasing your initial APY. Because vaUSDC is deposited as collateral to Metronome’s position, this means that your total position is safely overcollateralized.

As the yield farming period ends, the farmer withdraws their earnings and repays the borrowed USDC plus interest. From the gained profits, farmers can then pay off the synth debt as well. On Metronome Synth, users pay a 1% synth balance fee.

Outside of Smart Farming, Metronome’s ability to integrate more custom strategies with the support of vaAssets enables users to utilize yield-bearing collateral and support directional trading, aswell as zero-slippage swapping with both EVM and non-EVM assets.

Pushing the spirit of multi-dApp integration, Metronome users have access to Vesper and Curve pools as a way to increase their yield. Once users deposit their funds in Vesper, yield farming is automated, based on their collateral position in Metronome.

This is the essence of Metronome’s Smart Farming, as farmers only have to set the yield loop amount on their synth. Metronome’s Smart Farming protocol takes care of everything else, looping back into Vesper’s original position, as seen below.

So, Metronome removes the need to swap between multiple dApps for the specific purpose of maximizing yield farming, this not only improves the user experience but also saves an enormous amount in gas fees. Once the APY yield loop is customized, a users’ only job is to monitor the health of their Metronome collateral position.

Depending on the loop leverage Smart Farming position, users can view both their estimated APY potential and monitor their loop health.

With looped Smart Farming positions, you can optimize your yield and watch your profits grow. Keep track of your estimated APY potential and monitor your loop health in real-time, as you supercharge your earnings.

Who Created Metronome Synth?

The core team behind Metronome Synth are veteran developers, having contributed to major DeFi projects such as SpaceChain, Bloq, and VesperFi:

- Jeff Garzik

- Jordan Kruger

- Matthew Roszak

- Manoj Patidar

- Zane Huffman

Metronome Synth’s smart contracts have been fully audited by Halborn and Quantstamp firms. Thanks to Metronome’s clever combination of zero-slippage between synths and integration with the wider reach of Vesper Finance, DeFi has been made that much simpler to handle.

In turn, while synthetic assets may still be alien to even some crypto natives, the gateway to the synth landscape is lowered. At the end of the day, Metronome Synth shapes the future of the DeFi space. One that is more viable and sustainable than hopping on the next monkey jpeg train.

Note: This explainer was sponsored by Metronome Synth

Series Disclaimer:

This series article is intended for general guidance and information purposes only for beginners participating in cryptocurrencies and DeFi. The contents of this article are not to be construed as legal, business, investment, or tax advice. You should consult with your advisors for all legal, business, investment, and tax implications and advice. The Defiant is not responsible for any lost funds. Please use your best judgment and practice due diligence before interacting with smart contracts.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.