SocGen Wants To Borrow 20M Dai on MakerDAO Using Tokenized Bonds as Collateral

There’s a meme on crypto Twitter that calls DeFi the “future of France” as a play on the phrase the future of finance. Well, there may be more truth to the meme than many expected. Société Générale, the third-largest bank in France, has proposed to borrow Dai in MakerDAO using bonds it issued on the…

By: Owen Fernau • Loading...

DeFi

There’s a meme on crypto Twitter that calls DeFi the “future of France” as a play on the phrase the future of finance. Well, there may be more truth to the meme than many expected.

Société Générale, the third-largest bank in France, has proposed to borrow Dai in MakerDAO using bonds it issued on the Ethereum blockchain as collateral, according to a post on MakerDAO’s forum.

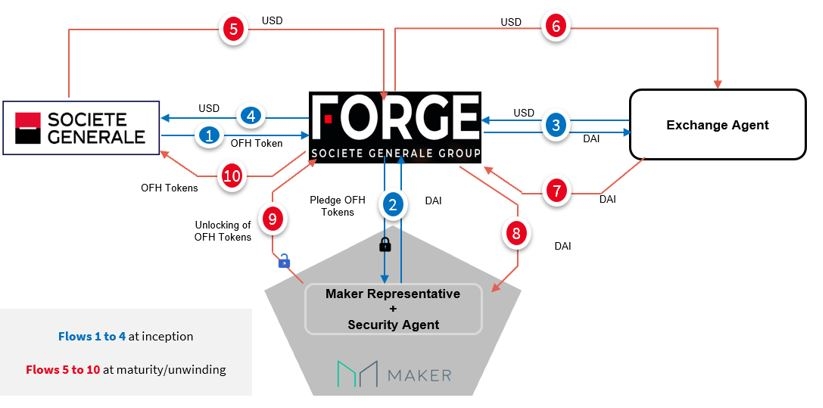

SG — Forge, which is an investment firm and subsidiary of SocGen, is proposing that MakerDAO accept its OFH Tokens as collateral in the protocol, in exchange for up to 20M Dai. OFH Tokens represent covered bonds backed by home loans, with a 0% rate, maturing in 2025, worth 40M EUR.

“Through this first pilot use case SG-Forge aims to refinance the OFH Tokens held by Societe Generale; Set-up the legal structure of the refinancing and apply the appropriate accounting and operational principles; Integrate with one of the largest DeFi protocols; Help to shape and promote an experiment under the French legal framework,” SocGen said in the post.

Diverisfy Collateral

The transaction will also allow MakerDAO to diversify its collateral assets away from cryptocurrencies.

“While the stability fees will be close to the interest rate paid under classical covered bonds, it provides access to a non-volatile type of collateral assets,” the post said.

The proposal would have SG — Forge granting a loan to SocGen. To do so, SocGen would transfer ownership of the OFH tokens to SG — Forge, which would then deposit the tokens in Maker and borrow DAI against them. SG — Forge would then exchange the DAI for USD, and loan those USD to SocGen.

Essentially, through the transaction, Société Générale is able to get leverage on its assets, by taking out a loan against them, through DeFi.

If the proposal passes, this would be the first time a major bank has deposited collateral in MakerDAO, DeFi’s first protocol. Now it’s time to wait and see which other banks hop on the train.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.