Red Flag Alert: A Framework for Vetting Crypto Projects

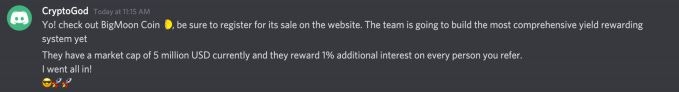

Let’s start with a story, Jean was just chilling on a Sunday afternoon and her phone buzzes, she picks up his phone and sees a bunch of messages by her friend who’s a so-called crypto expert. After some more back and forth with her friend, she finds out that they offer 1% daily compound interest.…

By: Eugenio Croitoru • Loading...

Research & Opinion

Let’s start with a story, Jean was just chilling on a Sunday afternoon and her phone buzzes, she picks up his phone and sees a bunch of messages by her friend who’s a so-called crypto expert.

After some more back and forth with her friend, she finds out that they offer 1% daily compound interest. Jean does some quick math and realizes that if she puts in $20000, she gets back about $750,000! Enough for her to keep sipping cocktails on a beach for a long time. She doesn’t know much about BigMoon Coin but manages to buy the coin from the website and gets the referral link, sharing it with her friends and family.

Photo by Kamil Kalbarczyk on Unsplash

The next day, she wakes up and opens the website to check the returns and sees the website down, she starts panicking and checks the social accounts. People on all social media accounts posting that the founders closed the program and vanished.

Now the moral of the story is not that Jean is not the sharpest tool in the shed. This could honestly be any one of us making a decision without researching the project. FOMOing into tokens and meme tokens (for pump and dump) is okay if you are using money that you can afford to lose. But chances are most of us don’t have $20,000 lying around which we’re okay letting go of.

If so, what should one do when there are thousands of projects releasing every day and each project claims to be the next big thing, supported by the ardent followers on Twitter willing to swear by it.

Buckle up, cause we’re going to learn a framework to analyse crypto projects which will at least help you avoid scam tokens, if not help find gems. There are three parts to this framework:

- Tokenomics (Categorising the market cap, total vs circulating supply, supply allocation, vesting, cliff, usage of the token in the ecosystem)

- Analysing the team, social media and backers (Vetting the founding team, partners, backers & investors, plagiarised material, analysing the white paper, find out the competition and what they’re doing differently, messaging the team on discord, telegram for announcements, bot analysis of Twitter followers)

- Markets, News, Buzz, recognition from famous people, some mental models to avoid stupidity.

This will be a three-part series in which we’ll cover everything required to separate the signal from the noise. In the first part, we’ll be covering the Tokenomics:

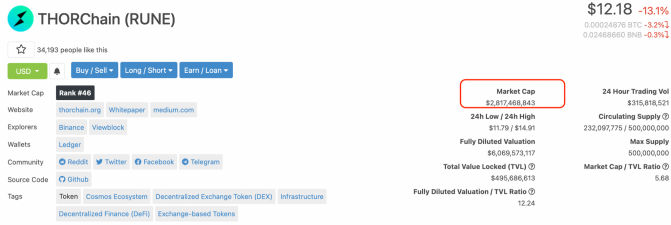

Borrowing the terms from traditional finance, we’ll first classify the token we’re interested in according to the market cap. For this, we’ll be using coingecko. You can find the market cap highlighted in red in the image below.

1. Classifying by market cap

For the purpose of our evaluation, we can classify the tokens as follows:

Usually, the risk associated with a smaller cap token is higher but so is the reward. It depends on how much volatility and risk you can stomach but as a rule of the thumb, the lower the market cap, the risk increases exponentially. That’s to say if you invest in a small-cap token in place of a medium-cap token, the risk is likely 10x more.

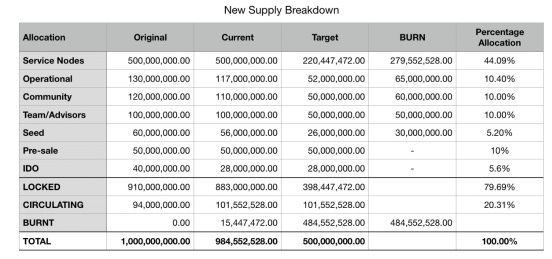

2. Figure out the current and total supply

The next thing to do is to find the whitepaper or the blog of the project and find out the number of tokens in supply and the total number of tokens that will be minted. We’ll cover what to look for in a whitepaper in more detail in the second article but for now, it’s important to understand the supply and demand. If there are continuously new tokens being minted without there being enough demand, then the price of the token will eventually go down.

Total supply of RUNE in Thorchain ecosystem (Source: Thorchain medium)

There can be many different models for this, Bitcoin (BTC) has a hard cap of 21 million, Ethereum (ETH) doesn’t have a hard cap but for now and the number of ETH minted keeps changing with time, and tokens like Binance coin (BNB) have a burn mechanism which reduces the circulating supply of the token, likely increasing its demand.

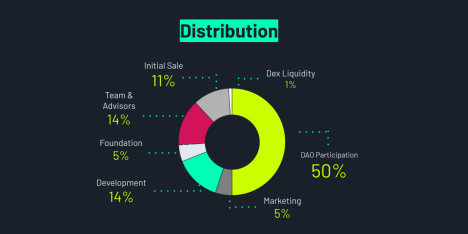

3. Allocation of tokens

Once, we’ve figured out the supply, we will now want to find out how those tokens are allocated in the ecosystem. In most cases, you should be able to find out a pie chart that shows how the tokens are distributed in either the whitepaper or blog.

Other than the obvious who the tokens are allocated to, what we want to look at is when are the tokens allocated. Usually, in a good project, the tokens allocated for the founding team, advisors etc. have a cliff and a vesting period to ensure that they don’t sell the tokens too quickly and have skin in the game to ensure the project succeeds. The best way to verify this is to check the code which should be there on GitHub or GitLab which requires a bit of coding knowledge. If you’re interested in looking into this, just googling “time-locked tokens” or “time-locked smart contracts” should get you plenty of resources. But if this is not your cup of tea, then don’t be afraid to contact the founders directly.

Allocation of ARCH token in Archer DAO(source: Medium)

Another thing to look for here is a single entity having an allocation of more than 50%. This is to ensure that you won’t have the rug pulled later on. This requires a bit of digging on our part.

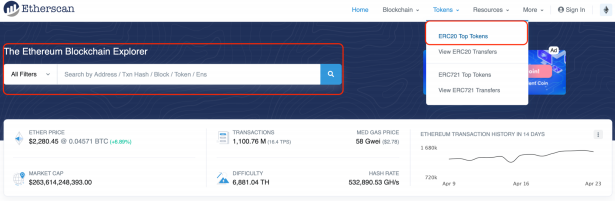

We’ll use etherscan for this purpose. When you open the etherscan page, you’ll see a page like this. Here, we can either select the ERC20 Top tokens on the right to see the list of popular tokens or put the name of the token in the search box.

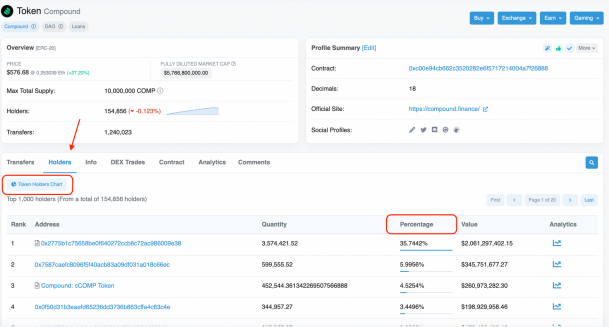

Once you’ve searched for your token, you’ll see a page like this. Here you want to click on the Holders button which the red arrow is pointing to. You’ll see the percentage of tokens held by each account. For visual analysis, you can click the token holders button to get a pie chart with the allocation.

Note that if an account is holding >50% of the allocation of tokens, it doesn’t necessitate that it’s a scam token. It means that further analysis is required on our end to see what’s the entity holding the majority of tokens. Similarly, if your token is on the Binance network then you’d want to use bscscan.

4. Usage of tokens in the ecosystem

The tokens that are released into the ecosystem should have a well-defined use-case. This is crucial because even if a project gets all the previous steps right, if the tokens don’t have a well-defined use then its value is just based on speculation. Good examples of tokens which have clear cut uses are the ones which are used for fees/transaction, acting as nodes in PoS system, governance etc.

There are a variety of tokens in the cryptocurrency landscape which serve a lot of purposes, and explaining them all is beyond the scope of this post. But if you want to learn more, then this post from MakerDAO’s blog is a good place to start.

If you followed these four steps, then you should have a clear understanding of what’s the market cap of your token, what’s the risk-reward ratio, how the tokens are allocated, whether they follow the basic economic principle of supply & demand, and that the tokens have a well-defined use-case which ensures that it’s not based on speculation. If you’re clear on these points then if the market dips then you’ll probably want to double down on your position rather than selling because you believe in the project.

In the next part, we’ll break down how to analyze the founding team, investors, things to look for in social media accounts and the all-important whitepaper

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.