Polygon Takes Lead in Layer 2 Race as MATIC Token and Assets Soar

Polygon’s token is rising the most among all cryptocurrencies in the past 24 hours, while assets in its networks spike. The activity is a sign an increasing number of users are betting the project will become a leading Ethereum scaling solution. Polygon’s MATIC token is up more than 30% just in the past day, the…

By: Owen Fernau • Loading...

DeFiPolygon’s token is rising the most among all cryptocurrencies in the past 24 hours, while assets in its networks spike. The activity is a sign an increasing number of users are betting the project will become a leading Ethereum scaling solution.

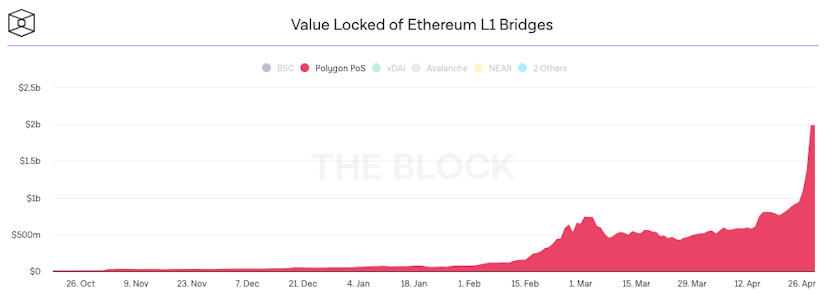

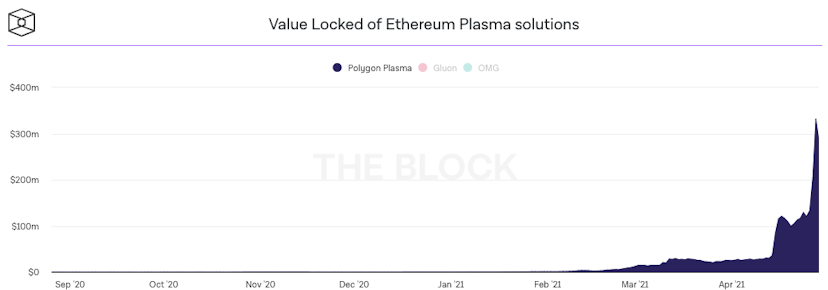

Polygon’s MATIC token is up more than 30% just in the past day, the most out of all cryptocurrencies listed in CoinGecko. The token is up 150% in the past seven days. Value locked in the project’s proof-of-stake bridge to Ethereum has spiked to $2B, doubling from $1B just three days ago, while assets in its Plasma solution crossed $300M yesterday, up from just over $100M last week, according to The Block’s data.

Needed Infrastructure

Scaling solutions are racing to provide the necessary infrastructure needed to continue growing decentralized finance after Ethereum gas fees skyrocketed in the past few months. Explosive growth on Polygon bodes well for the project, as network effects and the importance of composability for DeFi, make being the first mover even more important than usual.

The value is split across Polygon’s two live Layer 2 solutions, a proof-of-stake (PoS) chain, and a Plasma implementation. The PoS solution makes up 88% of the locked value.

On a Roll

Polygon has been on a roll lately, with Aave, Curve Finance, SushiSwap and other DeFi protocols, more than 100 in total, all deploying their applications on the project’s Layer 2 solutions.

The momentum has Crypto Twitter influencers like Hsaka calling for a $1 MATIC, and Quinten François calling for $2 before the current cycle is over. With announcements of new projects porting to the Layer 2 solution almost daily, plus the continued demand for lower fees on Ethereum, those calls seem less and less like hype every day.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.