Grayscale Says ETH is Money, Commodity, and Interest-Bearing Asset

Grayscale also thinks ETH is money. Digital currency asset manager Grayscale, breaks down three lenses through which to value Ethereum’s cryptocurrency Ether; money, commodity and interest bearing asset, in its first Ethereum-specific report. Grayscale offers institutional investors a vehicle to get exposure to ETH via its Ethereum Trust, which now has an AUM of $5.1B.…

By: Owen Fernau • Loading...

CeFiGrayscale also thinks ETH is money.

Digital currency asset manager Grayscale, breaks down three lenses through which to value Ethereum’s cryptocurrency Ether; money, commodity and interest bearing asset, in its first Ethereum-specific report.

Grayscale offers institutional investors a vehicle to get exposure to ETH via its Ethereum Trust, which now has an AUM of $5.1B.

Ether as Money

In the report titled “Valuing Ethereum” Grayscale cites the digital asset’s necessity as payment for transactions like smart contract deployment and trade execution as akin to money.

Ether (ETH) also exhibits money-like properties in its use as collateral with lending and borrowing protocols, and as a source of capital for the applications built on the network.

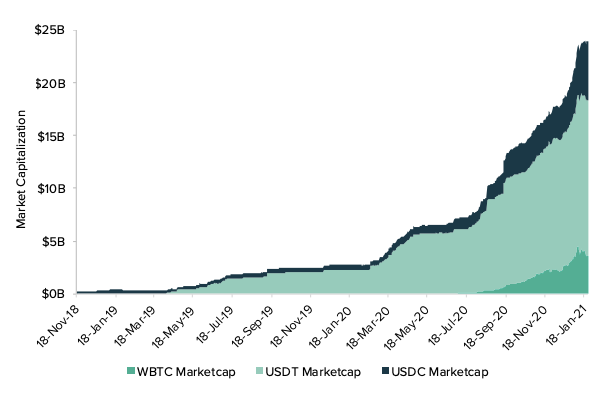

Grayscale points out that the market capitalizations of wrapped Bitcoin (WBTC), and stablecoins USDT and USDC, are all on the rise. As all three assets are used as collateral in DeFi, it’s possible Ethereum’s share of the collateral market may decrease.

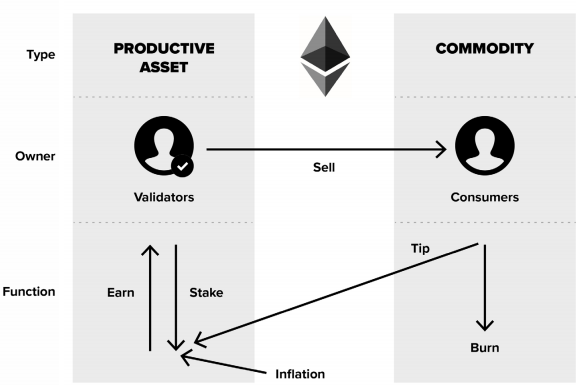

Ether as a Consumable Commodity

Grayscale also frames Ether as a consumable commodity. The necessity to use the cryptocurrency in order to change the blockchain’s state demonstrates the choice to use the word “gas” to denominate transaction fees was not a mistake. A person must pay to use the network.

Grayscale acknowledges concerns that Ether can be relegated to simply a means to pay transaction fees, with value accruing elsewhere. In the equation of exchange framework, this is equivalent to a high velocity of money driving its value down.

A key counterforce to this argument is the probable implementation of Ethereum Improvement Proposal 1559 (EIP-1559), which would burn the majority of transaction fees, à la real-world gas, instead of those fees going to miners.

Crucially, the burnable asset could only be ETH, locking in the currency’s status, as a “consumable commodity” as opposed to a medium of exchange, Grayscale writes.

Ether as an Interest Bearing Asset

Grayscale also views Ether as an interest bearing asset, pointing to the cryptocurrency’s use in the much-anticipated Ethereum 2.0 upgrade, which allows users to stake the digital asset to secure the network in exchange for an ETH-based reward.

This additional capability makes Ether a “productive commodity” as well as a consumable one. Users can generate interest by staking the token, with 2.9M ETH, generating a 9.1% APR, already locked in Ethereum 2.0’s beacon chain today.

The three lenses serve to remind investors of the complexity in valuing a first-of-its-kind asset like Ether.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.