Yam Finance Votes to Remove Rebase Mechanism

YAM holders voted to remove the token’s rebase mechanisms, which expanded and contracted supply seeking to establish a stable price, after taking DeFi by storm this summer. Rebases issued and burned new tokens based on the price of YAM, targeting a $1 peg. After migrating to YAM V2 following a smart contract exploit that caused…

By: Cooper Turley • Loading...

DeFiYAM holders voted to remove the token’s rebase mechanisms, which expanded and contracted supply seeking to establish a stable price, after taking DeFi by storm this summer. Rebases issued and burned new tokens based on the price of YAM, targeting a $1 peg.

After migrating to YAM V2 following a smart contract exploit that caused unlimited token inflation, the project is now undergoing a third (and proclaimed final) migration to YAM V3. All YAM V2 tokens can be migrated at a 1:1 ratio for YAM V3 using the migration portal.

The rebase removal proposal also suggests implementing 3% annual inflation to continue growing the treasury. Still, there’s a separate vote against adding ongoing issuance to the protocol.

More Than a Meme

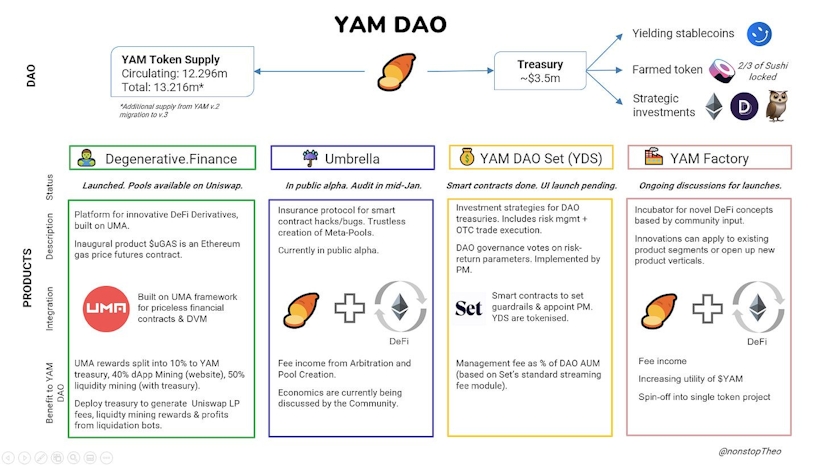

At its peak, over $800M was staked in Yam smart contracts, used to farm YAM governance tokens that seeded a community governed treasury. That treasury has since grown to ~$3.7M, giving the project a sizable runway to continue running DeFi experiments and product changes.

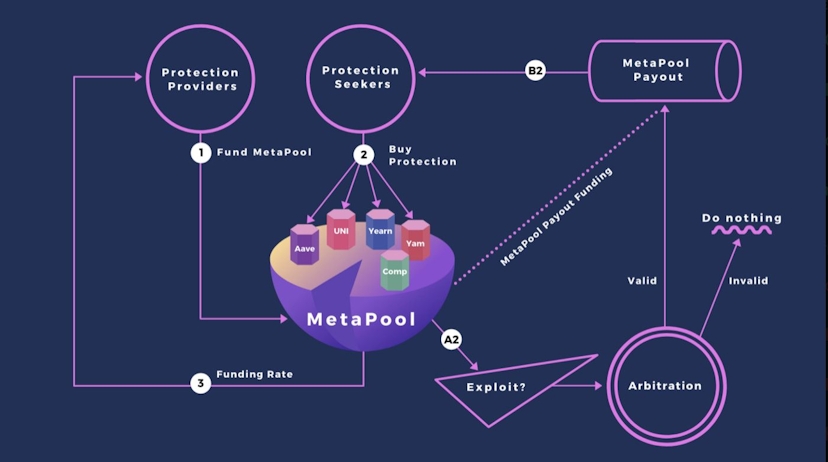

The Yam community now has its sight set on a suite of DeFi products, including an insurance product called Umbrella.

Combined with a synthetic asset to speculate on Ethereum gas prices called uGAS, treasury management from a top TokenSets social trader Krugman, and ambitions for a launchpad incubator, Yam seems progressing well beyond its original meme roots.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.