Polygon’s Rise Comes with Increased Scrutiny of the Scaling Solution’s Security

Polygon, which in the past month soared to become the most popular Ethereum scaling solution, is coming under fire as critics say it is too centralized to be considered secure. Ethereum scaling solutions are crucial for decentralized finance to continue to grow, as using dapps directly on the network is becoming prohibitively expensive. Scaling solutions…

By: Owen Fernau • Loading...

DeFi

Polygon, which in the past month soared to become the most popular Ethereum scaling solution, is coming under fire as critics say it is too centralized to be considered secure.

Ethereum scaling solutions are crucial for decentralized finance to continue to grow, as using dapps directly on the network is becoming prohibitively expensive. Scaling solutions take processing and storage off the Ethereum main chain to allow for cheaper and faster transactions. Polygon is one such solution and for many, it seemed like Ethereum’s scaling woes were finally being solved. But that’s now being called into question by critics who say the network is not much better than using centralized solutions.

Polygon’s Proof-of-Stake bridge secures $4.74B and its Plasma scaling solution holds $1.4B, the most out of all Ethereum solutions, according to data compiled by The Block,

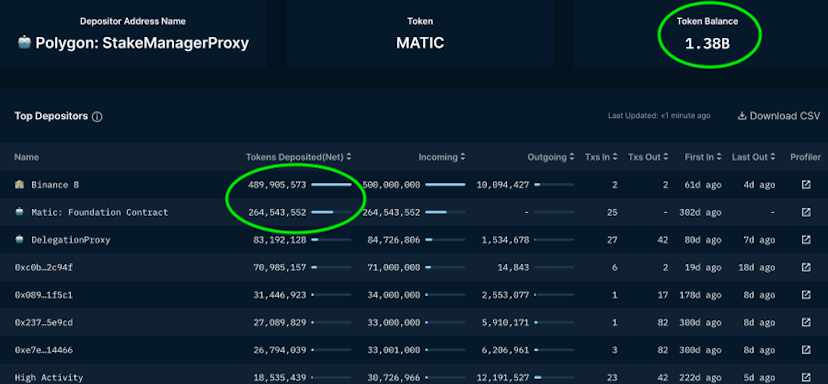

The crux of the issue is that about 55% of staked MATIC assets which secure the network appear to be controlled by only two parties, Binance and the Polygon team, according to analytics platform, Nansen AI.

Image source: Nansen

The risk for a network with concentrated validators is that it becomes easier for participants to collude and make arbitrary changes, which in the case of Polygon could in theory include blocking users from porting assets back to Ethereum.There are currently 100 validators securing Polygon’s chain.

Polygon forked geth, the Ethereum client, according to the project’s docs, with “custom changes done to the consensus algorithm.” Former Coinbase engineer, Andrei Anisimov, pointed out on Twitter that among the custom changes are “faster block times,” which, in his eyes, will lead to either Polygon becoming congested like Binance Smart Chain has recently, or the hardware running the validators being unable to keep up with the demands of running a faster chain.

Three of four Polygon co-founders didn’t reply to The Defiant’s request for comment. We were unable to reach out to the fourth one.

Sidechain or Layer 2?

The other issue Polygon is facing is whether it’s a true Layer 2, which derives its security directly from the main Ethereum chain, or a sidechain, which has its own security.

If it’s true that validators on Polygon can, in theory, prevent users from withdrawing from the scaling solution’s chain, then, according to a post by blockchain researcher Ali Atiia, the project is “not an L2 (Layer 2), but a sidechain.”

A sidechain, “is a separate blockchain which runs parallel to Ethereum mainnet and operates independently. It has its own consensus mechanism,” according to Ethereum.org. Sidechains have arbitrary levels of security, as opposed to Layer 2 which is a “category off-chain solutions which derives its security from mainnet Ethereum,” according to Ethereum.org.

Hamzah Khan of Polygon, defines Polygon’s PoS-Plasma chain as a “‘commit-chain’ and not a sidechain, pointing out that becoming a validator is permissionless. Khan also says that “we (Polygon) don’t have to rely on validator honesty, but inherit Ethereum security directly. Worst case if validators collude, community can always fork out and deploy the contracts back on ETH mainchain.”

Underlying the semantic debate lies the question of where Polygon’s level of security falls on the spectrum.

Despite the technical debates which continue to pop off on Twitter about whether Polygon is a true Layer 2 solution and what degree of security the chain offers, investors continue to pile in into the MATIC token, which is up almost 50% in the last 24 hours at the time of writing.

Image source: CoinGecko

A Mountain or a Mole Hill

While decentralization diehards may be railing against what they view as a sidechain masquerading as a more secure option like rollups, it bears noting that BSC has so far done very well as an Ethereum Virtual Machine (EVM) compatible chain, despite only having 21 validators compared to Ethereum, which has 4,148 according to Ethernodes.

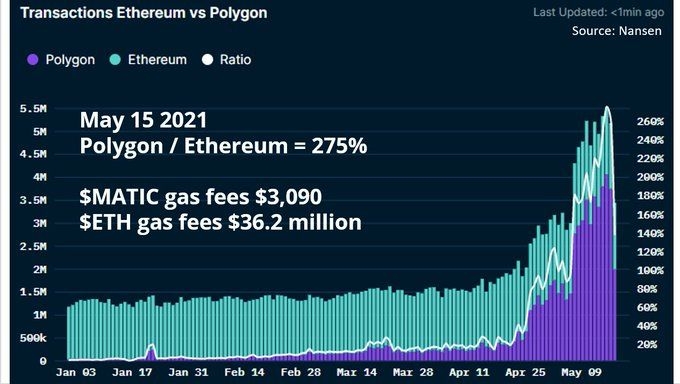

If Polygon’s security levels are really as low as some are saying, and with transactions still rising, it may be that users either don’t care about security, or can’t afford to care in a world where Uniswap trades on Ethereum cost about $30 and more complex DeFi transaction climb to the $100s, and thus are willing to move to Polygon.

Image source: Nansen via Twitter

The Polygon team has both zero-knowledge and Optimistic rollups on their roadmap, which means it may be close to offering more secure alternatives.

For now, despite the stormy technical debates accessible only to a few, Polygon’s MATIC token continues its climb, reaching an all time high of 16th in the crypto market cap rankings at the time of writing. More importantly for signs of adoption, assets locked aren’t slowing down.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.