NFT-backed Lending Market Surges with $1M-Plus Loans and 20% Interest Rates

The NFT-secured lending market is exploding with loans exceeding $1M on 30-day terms.

By: Owen Fernau • Loading...

DeFi

The NFT-backed loan market is off the hook.

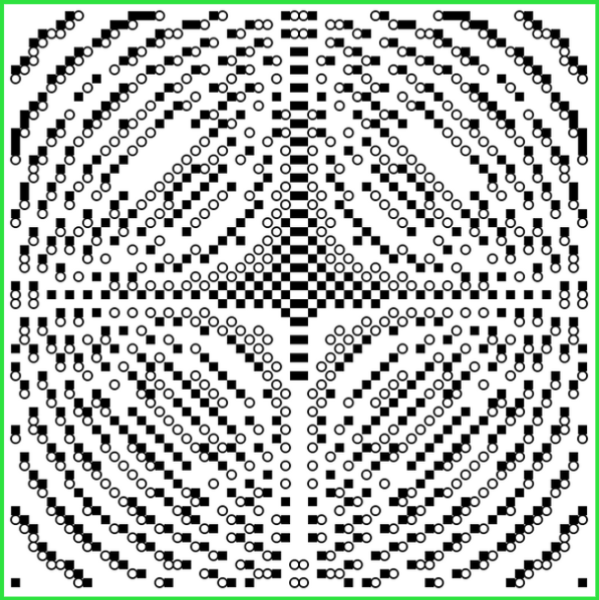

The latest sign? A $1.42M loan secured by Autoglyph #488, an NFT produced by CryptoPunks’ creators, Larva Labs, was approved on Oct. 28. It’s the largest NFT-backed loan ever, according to Stephen Young, the founder of NFTfi, the peer-to-peer lending protocol that facilitated the transaction.

The idea of using NFTs as collateral has been around since at least January 2020. That’s when Alex Masmej, a social token pioneer and member of Metacartel, the web3 community, proposed Rocket, a project which would facilitate loans backed by the tokens. That was followed by the fractionalization of NFTs — breaking the collectibles into more affordable pieces.

A raft of players are jockeying for position in the burgeoning market. Key platforms include Strip Finance, Banksea Finance, Drops DAO, Unbanked, which launched on Nov. 1, all of which provide some form of NFT-backed loan service as users look for liquidity while holding onto their assets.

“We’ve got 4-5 competitors launching soon, some with different models that aren’t peer-to-peer,” said Young.

Now the marketplace has entered a new phase by matching lenders and borrowers on peer-to-peer platforms. NFTfi specializes in this approach.

Autoglyph #488 secured the biggest NFT loan to date.

After launching in May of 2020, the platform struggled to get traction, recording its first $10M in loans over 14 months. Times have changed — in October alone, NFTfi arranged $8.6M, Young said.

Lenders are choosy when it comes to approving NFTs as collateral. “People come to us now wanting to pour liquidity in, but they want to lend on blue chip assets,” said Young. The leading collections: CryptoPunks, Autoglyphs, Art Blocks and Bored Apes Yacht Club.

As for annual lending rates, they’re 15% to 20% against Punks, said Young. That’s not bad for something non-believers often dismiss as valueless images that can be copied with a click.

Subject to Negotiation

NFTfi’s mechanics are straightforward. Just like P2P lending marketplaces, the platform matches borrowers and lenders and doesn’t underwrite the loans themselves. The platform makes money by charging a 5% rate on all interest earned by the lender. So if a lender earned 0.1 ETH in interest, NFTfi would make 0.005 ETH.

Borrowers list their NFTs on the site and lenders can then make offers to lend against the tokens. The principal, term, and annual interest rate are all subject to negotiation.

Unlike the years-long terms in the traditional lending market, loans in the NFT-backed space are hyper-accelerated. Terms are usually seven, 30, or 90 days. For example, the $1.4M loan secured by Autoglyph #488 had a 30 day duration at a 9.69% APR. If borrowers default, the NFTs will be sent to lenders to settle the loans.

A New Model

The metrics of NFTfi’s business model resemble that of pawnshops or subprime lending operations more than banks. Still, Young thinks NFTfi can use Web3 innovations to create a new model.

“We see ourselves less as a pawn shop (especially because our lenders are also users), but more like a tool to help collectors build their collections and leverage their NFTs.”

It would’ve sounded crazy a year ago, but we’re entering a world where $1M-plus loans secured by NFTs like Autoglyph #488 are commonplace.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.