Hyperliquid: a new decentralized perpetuals exchange

SponsoredBuilt from the ground up to match the CEX experience

By: Jeremy Nation • Loading...

Explainers![Hyperliquid: a new decentralized perpetuals exchange [Sponsored]](/_next/image?url=https%3A%2F%2Fcdn.sanity.io%2Fimages%2F6oftkxoa%2Fproduction%2Fb81afae32e9b4a47f50a3d47f383ad385500cfe9-600x338.jpg&w=828&q=75)

The decentralized finance (DeFi) ecosystem has witnessed enormous growth, amassing an estimated $42B in total value locked across different protocols. A key part of that growth is owed to the development of decentralized exchanges (DEXs) that allow participants to transact without any central party to facilitate trades.

However, as may be expected in the intersection of new technologies and economic platforms, there remain rough edges within DeFi frustrating users that developers are working to smooth over.

DeFi users must navigate platforms with complex user interfaces, often featuring thin liquidity. At times of peak use, network congestion hinders the scalability of decentralized networks. This, in turn, impacts transaction times, impeding matching engine efficiency and can lead to costly price slippage for DeFi traders.

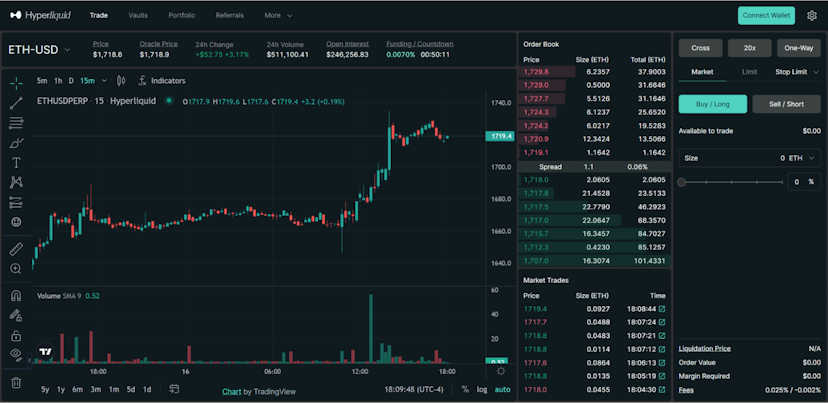

Hyperliquid is working to refine the DeFi user experience with an order book DEX for perpetual futures.

Developed with an emphasis on usability and functionality, Hyperliquid’s DeFi platform provides the ease of use of a centralized exchange (CEX), with a seamless UX, one-click trading and near-instant transactions. For more advanced traders, the platform offers partial take-profit (TP) and stop-loss (SL) orders and API support. Its native vaults open up market making and liquidation strategies to the community.

Currently, the Hyperliquid DEX is in a closed alpha phase and recently introduced trading fees to mainnet. It supported zero fee trading for an initial 3-month period. Takers pay a flat 2.5 bps fee, and makers receive a 0.2 bps rebate, while referrers receive 10% of their referees’ taker fees. The remaining fees go to the Hyperliquidity Provider (HLP), a market making vault open to the community.

Unlike other protocols where fees accrue to a company or tokens held largely by insiders, Hyperliquid’s fees ultimately go to the community – actual users.

Automated Market Makers vs Order Books

For many DEXs, such as Uniswap, prices are set by way of an algorithm that determines price by the ratio of the availability of a given token in a pool called an automated market maker (AMM). Liquidity providers (LPs) who deposit pairs of tokens to facilitate trading on DEX platforms, in turn, earn a proportion of trading fees.

Although LPs serve as the backbone of AMM-based DEXs, the platform’s default architecture of pairing together two tokens ultimately exposes LPs to impermanent loss as a result of price slippage. With an AMM, when the price of the tokens in a given pair fluctuates significantly, demand shocks can introduce opportunity costs to LPs as the proportion of tokens in their committed pairs adjusts with the market.

In contrast, order books aggregate demand among buyers and sellers, matching orders via pricing and sequential precedence to provide greater user autonomy over price execution. A robust order book supports advanced DeFi traders with the ability to set limit, stop limit, or post-only orders, and engage other market strategies.

Hyperliquid uses an order book because it lets liquidity providers precisely control their risks and leads to better spreads for users.

Hyperliquid’s Purpose-Built L1

The Hyperliquid L1 was designed so Hyperliquid’s order book could be fully on-chain. Hyperliquid’s on-chain order book allows for trustlessness and redundancy, removing reliance on centralized entities. Some other DEXs have offchain matching, which impacts their ability to be decentralized.

From network architecture to application code, this L1 is optimized to offer users the performant aspects of a CEX with the benefits of a decentralized stack. Written entirely in Rust, the Hyperliquid L1 uses Cosmos' Tendermint consensus engine.

The Hyperliquid L1 doesn’t support general-purpose smart contracts. Previously exhibited on Ethereum, general-purpose blockchains tend to have scalability issues, manifesting in expensive fees and intolerable transaction times.

With its custom architecture, the Hyperliquid L1 can achieve a throughput of 20,000 orders per second, including cancellations and liquidations, with median network latency of 0.2 seconds. This pegs the Hyperliquid L1 at 20 times higher throughput than Tendermint’s upper range of 1,000 transactions per second.

Trading on Hyperliquid

Hyperliquid offers traders a low fee experience at a flat 2.5 bps taker fee, which is comparable to higher volume tiers on CEXs. Makers receive a 0.2 bps rebate. Traders can also find API support for automated strategies, an uncommon feature among DEXs.

The trading experience is very similar to a centralized exchange. Users can trade without signing transactions for every order. Transactions take less than one second. Currently 25 different assets are available to trade, and new assets continue to be listed regularly.

In addition, traders can modify orders directly on the platform's TradingView chart integration by dragging or closing them on the UI. Users can set partial TP orders that automatically sell a portion of an asset when the price reaches a set level. Or, traders can opt to set a partial SL order that operates the same way, establishing a floor for an automated partial sale of an asset.

For example, if a trader buys 10 ETH at $1,800 and the price of ETH goes up to $2,000, applying partial TP/SL orders allows the trader to guarantee some profit and limit potential losses if the price takes a dive. The trader could set a partial SL to sell 5 ETH if the price drops to $1,900, which would secure $500 in profits while the rest of the trade stays open.

Hyperliquid Vaults

The concept of vaults is not new to DeFi, but Hyperliquid has their own spin on them. Hyperliquid’s vaults are a new approach to the concept of copy trading, which allows DEX traders to copy the trading strategies of others.

If you deposit into a Hyperliquid vault, you copy all of the vault’s trades and earn a share of the profits and losses. Any user can create a vault and trade on its behalf. Vaults are built natively into the Hyperliquid L1, meaning they enjoy the same performance benefits as the exchange. You can check any vault’s performance; all of the vaults’ historical trades, open positions, profits and losses, and more are on display for anyone to verify.

In addition to user vaults, Hyperliquid features two types of protocol vaults without any fees that perform core trading functions: liquidations and market making.

Hyperliquid stands apart from platforms where liquidation and market making flow primarily benefits the exchange operator or privileged market makers by virtue of its decentralized and democratized approach - the community can provide collateral for, participate in, and share in the P&L of these vaults.

The Liquidator protocol vault runs liquidation strategies, which only occur when a position is forcibly closed due to insufficient margin.

The Hyperliquidity Provider (HLP) protocol vault runs market making strategies.

Protocol vaults lock user deposits up for an interim and lack any tokenization as rewards are automatically compounded. The vaults help contribute to platform transparency by letting anyone track their performance and history.

Note: This explainer was sponsored by Chameleon Trading

Core Contributors

Contributing to Hyperliquid’s development are Chameleon Group and Chameleon Trading, led by Harvard classmates Jeff and iliensinc. Other members of the team hail from MIT, Caltech, and Waterloo, with previous experience at Citadel and Hudson River Trading. The Chameleon team is presently self-funded.

Series Disclaimer:

This series article is intended for general guidance and information purposes only for beginners participating in cryptocurrencies and DeFi. The contents of this article are not to be construed as legal, business, investment, or tax advice. You should consult with your advisors for all legal, business, investment, and tax implications and advice. The Defiant is not responsible for any lost funds. Please use your best judgment and practice due diligence before interacting with smart contracts.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.