Fixed-Rate Lending Protocol HiFi Launches

The field for fixed-rate lending protocols is becoming more dense as HiFi has joined the fray. Like Notional Finance and Yield Protocol, HiFi is able to offer fixed rates by locking in a specific duration by which the loan will mature. The debt will be represented with a “yToken,” which refers to tokenized debt backed…

By: Owen Fernau • Loading...

DeFiThe field for fixed-rate lending protocols is becoming more dense as HiFi has joined the fray.

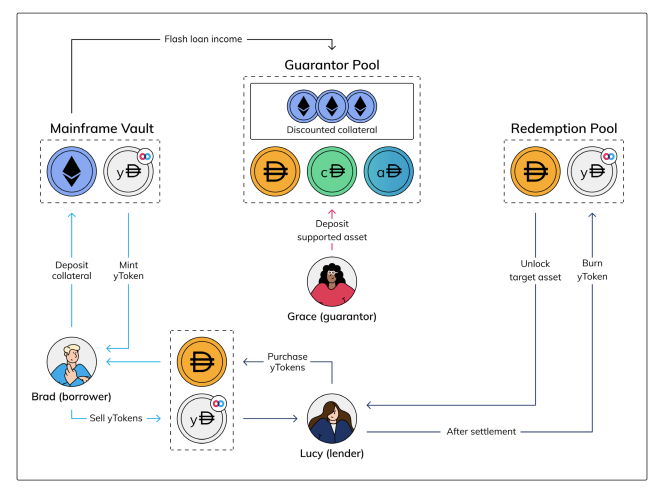

Like Notional Finance and Yield Protocol, HiFi is able to offer fixed rates by locking in a specific duration by which the loan will mature. The debt will be represented with a “yToken,” which refers to tokenized debt backed by collateral. yTokens will function like a zero-coupon bond. For example, in taking out a loan, a borrower will receive yDAI, which will trade as a discount relative to DAI, representing the interest rate if the yDAI were held to maturity.

The protocol currently offers loans in USDC with wrapped Bitcoin (WBTC) as collateral, though according to the press release the “team plans to rapidly add products and services to expand lending markets and collateral pairs.”

Fixed-rate lending promises to open up swathes of newfound demand for loans, a prime example of which is last month’s move by an engineer to buy the title of his house from the bank, preferring to pay off the loan through fixed rate protocols.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.