Fei Roils Early Adopters As Stablecoin and Token Tumble After $1.3B Sale

Fei Protocol was one of the most anticipated project launches this year –– an algorithmic stablecoin backed by heavyweights like Andreessen Horowitz and Coinbase Ventures–– and it raised funds accordingly, attracting an eye-popping $1.3B in ether over the weekend. But it’s all spiraled down from there. The high of the sale was immediately tainted by…

By: Owen Fernau • Loading...

DeFi

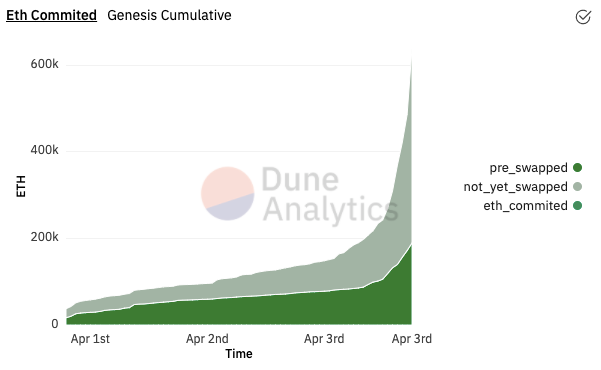

Fei Protocol was one of the most anticipated project launches this year –– an algorithmic stablecoin backed by heavyweights like Andreessen Horowitz and Coinbase Ventures–– and it raised funds accordingly, attracting an eye-popping $1.3B in ether over the weekend. But it’s all spiraled down from there.

The high of the sale was immediately tainted by angry traders, as the project’s governance token slumped and the stablecoin has failed to hold its $1 peg. But that’s not all, today, the team found a vulnerability in its code (which it quickly patched, according to its Twitter account.)

Fei was trading as low as $0.92 earlier today and Tribe has slid 20% to $1.61 since it launched on April 3. Participants in the genesis event received both FEI and TRIBE, though some whales immediately sold TRIBE for ETH.

“Pre-Swap”

The slump in both the governance token and the stablecoin can be partly explained by some of the launch and design mechanics. Fei provided a “pre-swap” option which allowed participants to automatically swap their FEI tokens for TRIBE at launch, likely adding selling pressure to the stablecoin and making it harder for it to keep the peg. As TRIBE is down, many TRIBE-holders are upset that they’ve been left holding the bag.

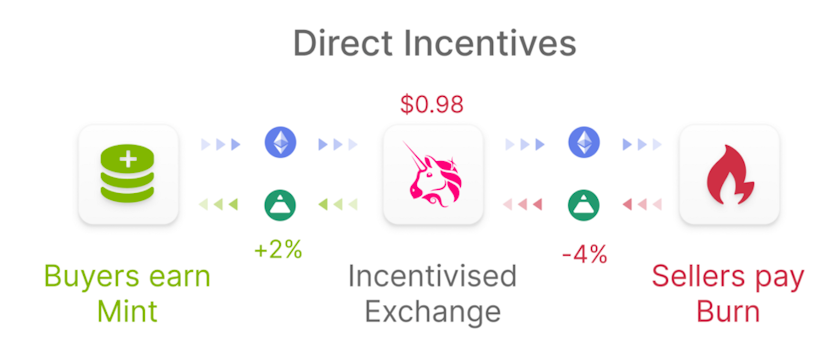

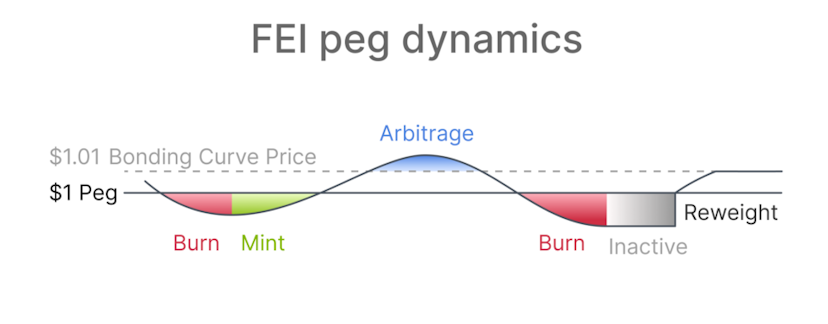

Adding to their frustration is that roughly 98% of the liquidity for TRIBE comes from the TRIBE-FEI pair. The Fei protocol has a mechanism which penalizes those who sell FEI (and rewards those who buy it) when it is below the peg. When Fei is below $1, trades to sell it will be penalized at a rate which squares the percentage difference against the peg. For example, at $0.95, FEI is 5% off its peg, meaning users selling FEI will incur a 25% token burning penalty.

So users who want to exit their TRIBE positions for ETH need to either trade for FEI, then ETH, incurring a 49% loss at the time of writing in addition to the already depreciated TRIBE, or trade directly for ETH and take massive slippage losses due to the low liquidity.

Bug in the Code

The vulnerability the team found in their code today was in the incentive calculation of Fei. They have shut down all minting rewards on FEI, and “are working on a fix to turn rewards back on,” according to a tweet.

Watch our video breaking it all down:

Salt in the FEI Wound

In addition to TRIBE holders’ woes, the distribution event was designed so that, as long as participants contribued less than $250M in ETH, they would get a discount on FEI, starting at $0.50. If more users contributed more than $250M in ETH, then that bootstrapping incentive would be gone. As the launch garnered $1.3B in ETH, irreversibly given to the project to help maintain the peg, the protocol distributed the FEI at no discount.

Worth noting is that Fei’s post on the genesis emphasized that the protocols’ “economic mechanisms implemented are entirely new,” and that “participants in Fei Protocol Genesis should understand and believe in the long-term vision.”

FEI’s Initial Goals

The Fei protocol differs from other DeFi protocols in that it employs what the project calls a Protocol Controlled Value (PCV) model which, unlike total value locked (TVL), entails a one-way transfer of assets into the protocol, meaning users cannot withdraw their deposited ETH. According to the project’s initial Medium post “PCV gives the protocol more flexibility to engage in activities that are not profit-oriented.” The primary activity of Fei’s PCV controller is to maintain FEI’s peg to $1.

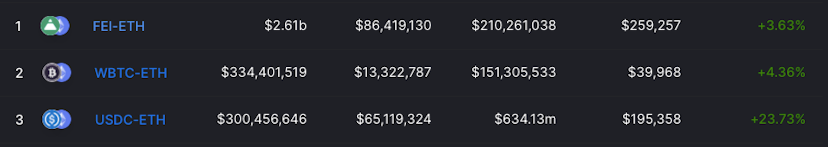

Initially the project used all its PCV, in the form of ETH raised from the initial sale, to become Uniswap’s largest liquidity provider, as the FEI-ETH pair is now the deepest trading pair. This is novel and means the protocol directly controls its own stablecoins’ liquidity (while collecting LP fees).

Fei’s PCV can also be used in a “reweight” in which the protocol will withdraw all its liquidity from the FEI-ETH pair, buy FEI with the withdraw ETH to bring the former up to its peg, redeploy the PCV into the LP position, and then burn the excess FEI. There have been two reweights so far, but the stablecoin’s price has quickly dropped after the Fei protocol briefly bought the price back up to $1.

Other stablecoin projects like OlympusDAO, Float Protocol, and Frax Finance are also using PCV models in various ways and Fei’s initial post also alludes to potentially “more creative” uses of its capital.

Growing Pains or Constant Pain

DeFi protocols have yet to integrate FEI into their platforms to generate yield for their depositors. This has thus far depressed FEIs price. Yesterday the protocol enabled TRIBE staking rewards for those who deposit FEI-TRIBE LP tokens.

“More integrations to drive the utility of FEI are underway,” Brianna Montgomery, Business Lead at Fei, told The Defiant. “Successful Genesis resulted in more PCV than net FEI in circulation, making the protocol overcollateralized,” she said.

Overcollateralization should give the protocol more flexibility to support FEI’s price, Montgomery said.

“FEI is weathering extraordinary amounts of sell pressure created by Genesis while retaining and growing PCV by $10M,” she said, adding that she believes the PCV can be leveraged to support FEI.

Sébastian Derivaux, head of real-world finance at MakerDAO, believes Fei is in for longer-term problems. He thinks that, as a FEI holder, if the value of the PCV, currently ETH, goes up, holders of the stablecoin are excluded from that upside. On the other hand, Derivaux believes that if ETH’s value goes down, TRIBE holders, in charge of the protocol, are unlikely to add ETH to cover the loss of value. He believes the protocol’s mechanism acts somewhat like a free call option on ETH from the protocol’s perspective.

“Most stablecoin teams think on how to reward the governance token holders (which makes sense as the team has a lot of it), but not how to make a good stablecoin that makes sense to hold,” Derivaux told The Defiant.

Regardless of how the FEI protocol turns out in the end, the project has certainly made a splash as the stablecoin has vaulted itself overnight to the fifth largest stablecoin with a total market capitalization of $2.3B according to CoinGecko. Whether it holds the spot depends both on FEI’s utility in the broader DeFi ecosystem, and also on the protocol’s core incentive mechanisms.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.