ETH in Whales’ Wallets Is Barely Budging

ETH in whales’ wallets isn’t budging while smaller holders take their tokens to DeFi. The number of wallets with 100 to 10K Ether have dropped by 7.2% since the cryptocurrency hit an all-time high four weeks ago. In contrast, the amount of wallets with over 10K ETH, valued at more than $18.4M, dropped only 0.9%…

By: Owen Fernau • Loading...

Markets

ETH in whales’ wallets isn’t budging while smaller holders take their tokens to DeFi.

The number of wallets with 100 to 10K Ether have dropped by 7.2% since the cryptocurrency hit an all-time high four weeks ago. In contrast, the amount of wallets with over 10K ETH, valued at more than $18.4M, dropped only 0.9% in that time according to data provided by data analysis platform, Santiment.

One explanation for the divergence is that the mid to high-tier ETH addresses are depositing their assets into DeFi protocols, while the addresses with more than 10K are owned by entities like exchanges whose primary function requires them to have ETH on hand, preventing them from accessing DeFi.

Chris Cable, NFT purveyor at FlamingoDAO, pointed out how few addresses hold over 10K ETH. “There are only 1262 addresses with 10K+ ETH,” he told The Defiant. “I suspect many of those are either exchanges or protocol treasuries which is why they haven’t moved their coins into DeFi.”

Cable believes that “many/most of those 100-10,000 $ETH wallets are simply putting their ETH to work in #DeFi…” as he said on Twitter. As 100 ETH is worth $183K at the time of writing, it’s likely that wallets controlling that amount or more aren’t casual users and thus aware of DeFi and the increased capital efficiency it affords.

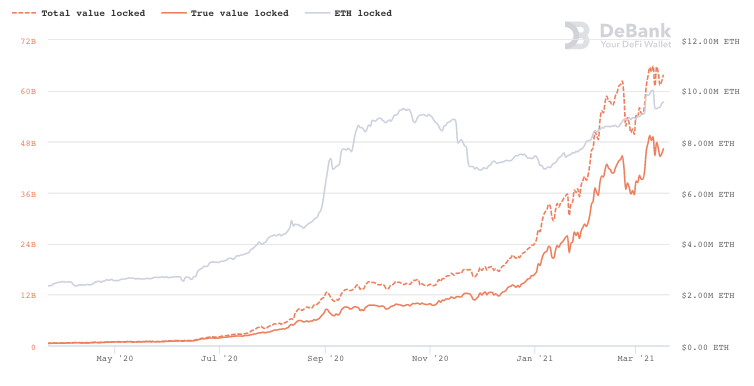

The amount of ETH locked in DeFi hitting an all time high of 10M Ether days ago on Mar. 10 according to DeBank corroborates Cables’ explanation.

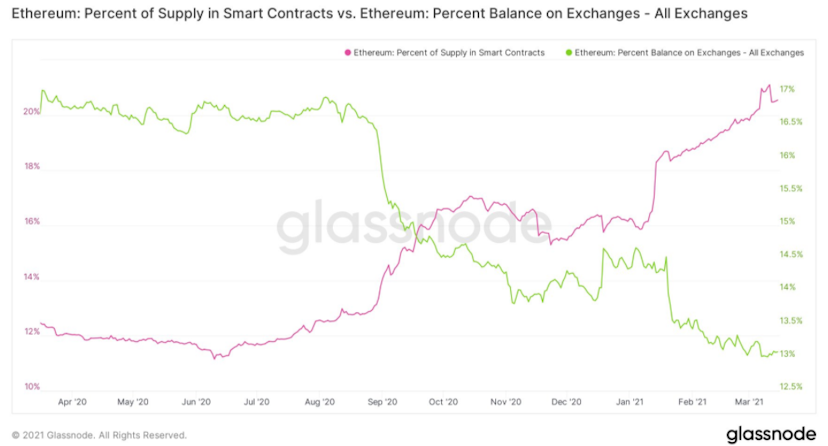

Further data puts a finer point on the explanation as users continue to take Ether off exchanges and into smart contracts. The similarity between Glassnode’s all-encompassing Ether in smart contract chart and DeBank’s locked in DeFi chart demonstrates that nearly all ETH is locked in DeFi smart contracts.

The amount of Ether locked in DeFi has grown steadily in the past three months, averaging 9.6% growth month-to-month, with the most recent growth period from Mar. 17th to Feb. 17th as slightly above that average at 11.2%.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.