ETH Futures Fears Fade As Tesla Adds $1.5B of BTC

It’s ETH futures time. Ether futures are now available on the Chicago Mercantile Exchange, the world’s largest derivatives exchange by volume, for the first time ever. Many thought the move would mark the top of the market, in the same way that CME futures marked the top for Bitcoin’s 2017 rally, but those fears have…

By: Owen Fernau • Loading...

DeFi

It’s ETH futures time.

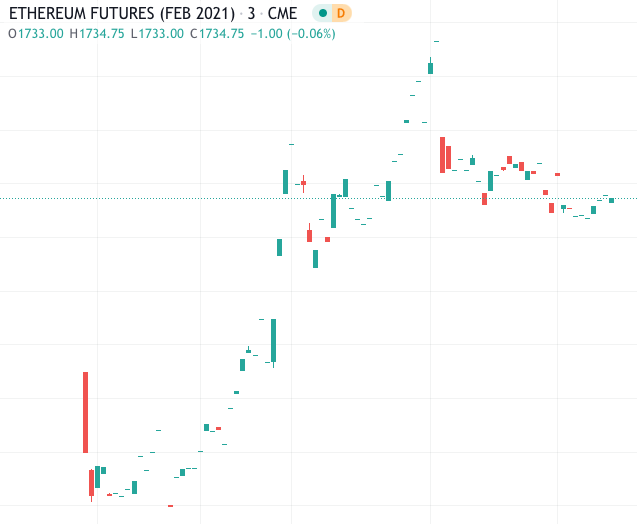

Ether futures are now available on the Chicago Mercantile Exchange, the world’s largest derivatives exchange by volume, for the first time ever.

Many thought the move would mark the top of the market, in the same way that CME futures marked the top for Bitcoin’s 2017 rally, but those fears have faded for now thanks to Tesla buying $1.5B of BTC, or about 8% of the company’s cash, further fueling the cryptocurrency rally.

ETH futures contracts expiring February 2021 are up almost 4% to $1,734 from the price at open. ETH is up almost 10% to $1,714, and BTC is soaring by 15% to as high as just over $44k.

Following CME’s announcement on Dec. 16, there was speculation that the contracts would help push down the price of the cryptocurrency. Futures allow for investors to go both long and short on the asset on which the derivative is based.

CME released its BTC futures contracts on Dec. 17, 2017, a day after the cryptocurrency hit its then all-time high of 19K according to CoinGecko. BTC crashed to 6.9K less than two months later.

This Time it’s Different

Aside from the push from Elon Musk advocating for Bitcoin, some argue that “this time it’s different.” Kadan Stadelmann CTO of blockchain solutions provider Komodo said that the cryptocurrency industry and Ethereum itself is more developed and mature than it was in 2017.

“When CME Group launched futures trading for Bitcoin in December 2017, the market was much different than it is today,” Stadelmann said. “The implementation of smart contracts technology was basically in its infancy, and much fewer people actually understood blockchain. Today we see how the Ethereum network has since become a global financial powerhouse with Ether at the center of it.”

Large Players

The futures contract opens up a trade where large players can buy Ether over-the-counter (OTC) without significantly moving the price, short the digital asset with a futures contract, dump the coins acquired through OTC on public exchanges, and then profit from the short positions.

The release signals a maturing market for Ether now that the world’s largest derivatives exchange has committed the resources to developing its market.

Money managers are now able to get exposure to Ethereum with less operational overhead, as they can simply use the same infrastructure they’re using to invest in traditional commodities and FX, without worrying about custody or regulation.

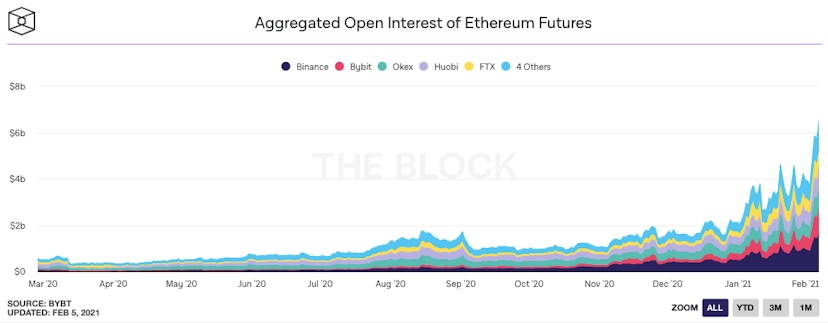

Rising Open Interest

Open interest in Ethereum futures has already been on the rise with exchanges like FTX and Bybit which are currently off-limit to American investors. The new futures contract is likely to continue the trend.

The listing will likely lead to a more sophisticated ETH market, said Martin Köppelmann, CEO at Gnosis, creators of the Gnosis Protocol DEX.

“Listing on CME opens Ethereum’s door to institutional money, creating even more value—and trust—for the ecosystem,” Köppelmann said. “Futures buying from such institutional platforms enables access to more sophisticated financial products for Ethereum traders and institutions alike, as there is no longer the need to have a specific crypto brokerage account to gain exposure to this asset.”

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.