DeFi On-Chain Options

Options are yet another money lego growing like crazy on Ethereum, with growing liquidity on Hegic and Opyn. Options, like the name implies, give traders the option to buy or sell an asset at a pre-determined price on a future date. They are used to protect against price volatility and speculate on market moves. Options…

By: The Defiant Team • Loading...

Explainers

Options are yet another money lego growing like crazy on Ethereum, with growing liquidity on Hegic and Opyn. Options, like the name implies, give traders the option to buy or sell an asset at a pre-determined price on a future date. They are used to protect against price volatility and speculate on market moves.

Options are one of the most popular financial instruments in the world, with an estimated 15.23 billion options contracts traded in 2019. DeFi is about leveling the playing field and making the black box that is traditional finance into a transparent peer-to-peer model, accessible to anyone with an Ethereum wallet.

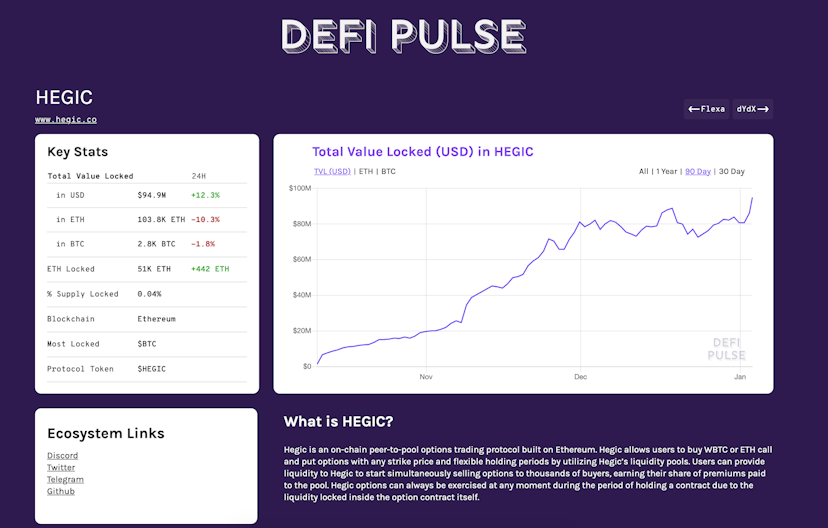

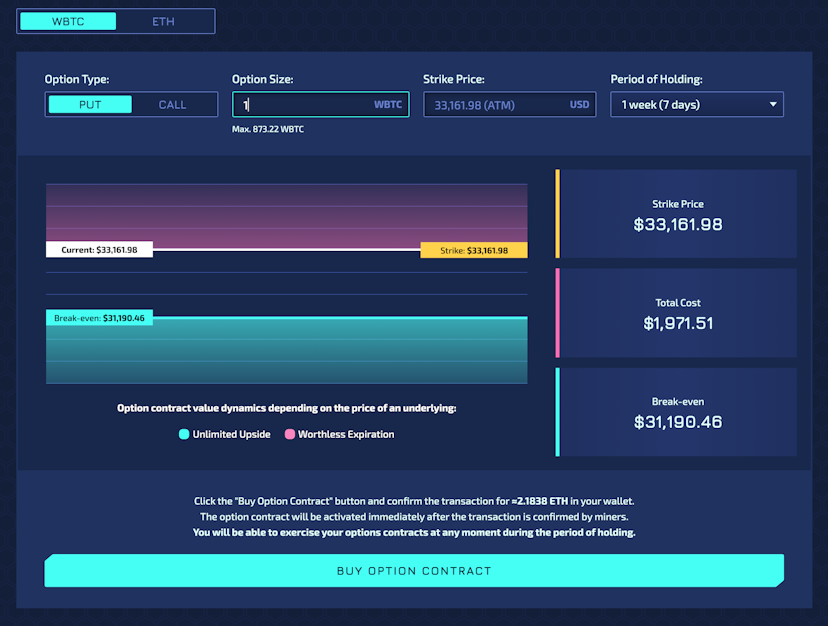

Hegic is an on-chain options trading protocol on Ethereum, where you can buy WBTC and ETH call or put options. You can also sell calls or puts as a liquidity provider (LP) on Hegic.

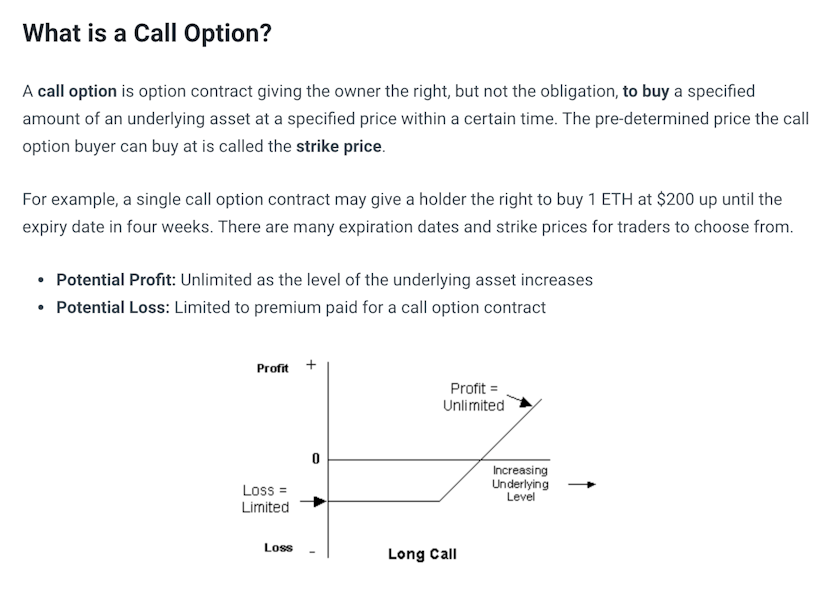

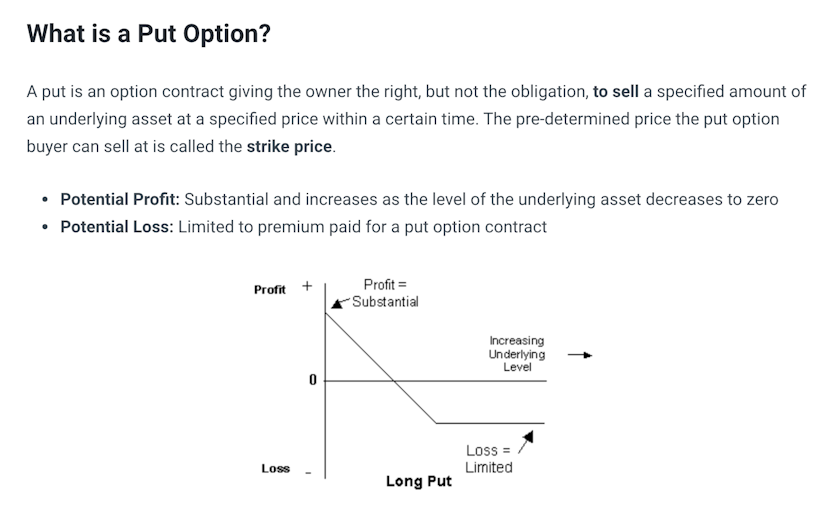

An option is a contract giving the buyer the right, but not the obligation, to buy (in the case of a call option contract) or sell (in the case of a put option contract) the underlying asset at a specific price on or before a certain date.

Options are also known as derivatives because they derive their value from an underlying asset.

Traders use on-chain options mainly for either speculation or to hedge their positions.

What separates on-chain options in DeFi on Ethereum from traditional finance, in the case of Hegic, are these decentralized on-chain options:

- Non-custodial–meaning no one takes custody of your assets per usual in DeFi

- 24/7 global trading, par for the course in DeFi and crypto but different from traditional finance

- Verified on-chain settlement of each option contract

- Choose any strike price for WBTC or ETH call or put options

- Exercise at any moment during the period of holding a contract

- Exercising is guaranteed by the liquidity locked on an option contract

- Censorship-resistant protocol without a KYC, email or registration required

- Earn yield on WBTC or ETH as an LP

- Liquidity auto diversification among all the contracts for the options writers

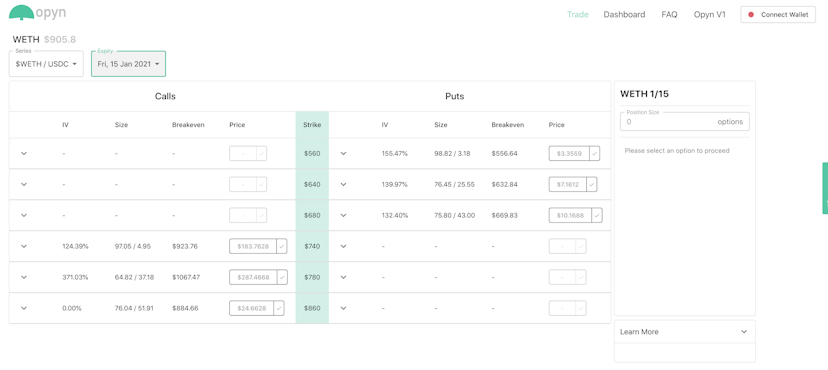

Opyn has a similar model with a few differences.

The key takeaway here is that aside from lending, borrowing, trading, derivatives, insurance, and perpetual futures, we now have yet another behemoth financial use case in DeFi, rebuilt to be more accessible, more transparent, and more capital efficient with non-custodial on-chain options on Ethereum. It’s part of an open source software revolution in DeFii to replace legacy finance–and best of all, it means powerful financial instruments are becoming accessible to all with an ethereum wallet vs a few on Wall St.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.