DeFi Insurance and how Nexus Mutual Works

As more apps and protocols launch, and more money pours into DeFi, it’s important that DeFi investors can mitigate the risk of losing their funds. With great power, comes great responsibility. Insurance protects us from the unexpected, and in DeFi, there’s nothing more expected than the unexpected. While DeFi is exploding in growth, it also…

By: The Defiant Team • Loading...

Explainers

As more apps and protocols launch, and more money pours into DeFi, it’s important that DeFi investors can mitigate the risk of losing their funds. With great power, comes great responsibility.

Insurance protects us from the unexpected, and in DeFi, there’s nothing more expected than the unexpected.

While DeFi is exploding in growth, it also frequently implodes from rug pulls, flash loan exploits, and smart contract bugs.

Humans code smart contracts which power DeFi applications and humans audit this code for bugs. We still rely upon humans to avoid failures in the code, which could lose millions in funds. So unless humans can attain perfection, which few of us can, we can assume we’ll continue to run into smart contract bugs and loopholes.

With billions of dollars in funds at risk in DeFi and lots more money coming, Nexus Mutual has been leading the quest to provide “DeFi insurance.” Nexus is a people-powered alternative to insurance built with smart contracts on Ethereum.

If Nexus had existed during the DAO Hack of 2016, perhaps 3.6M ETH wouldn’t have been lost.

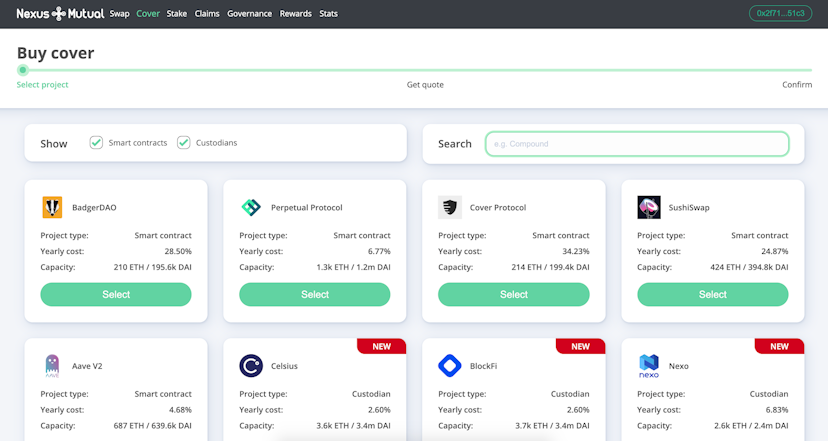

We’ve come a long way since then and now Nexus Mutual offers a product called Smart Contract cover, which allows you to pay as little as 2.6% annually for protection against a smart contract bug, and guarantees a payout in ETH or DAI if a smart contract bug is ever discovered in the DeFi app.

https://app.nexusmutual.io/cover/buy/select-project

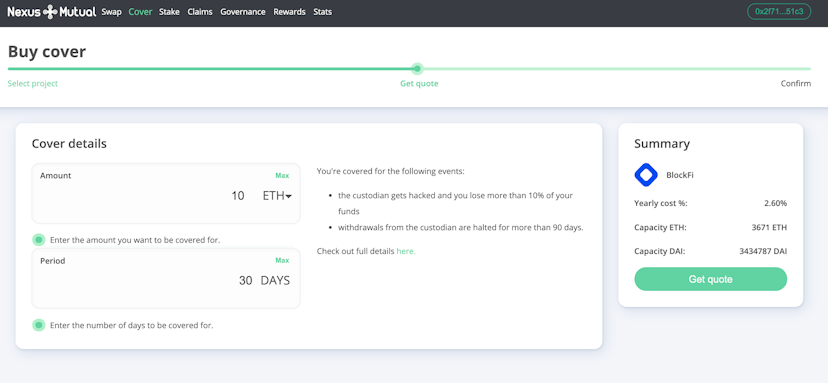

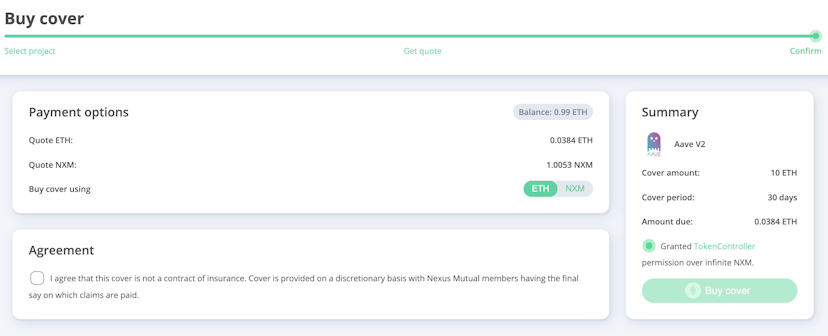

You can buy insurance policies for payouts in ETH or DAI.

You can buy this Nexus protection for 30 days minimum or up to one year or more in length by paying the premium in ETH or NXM.

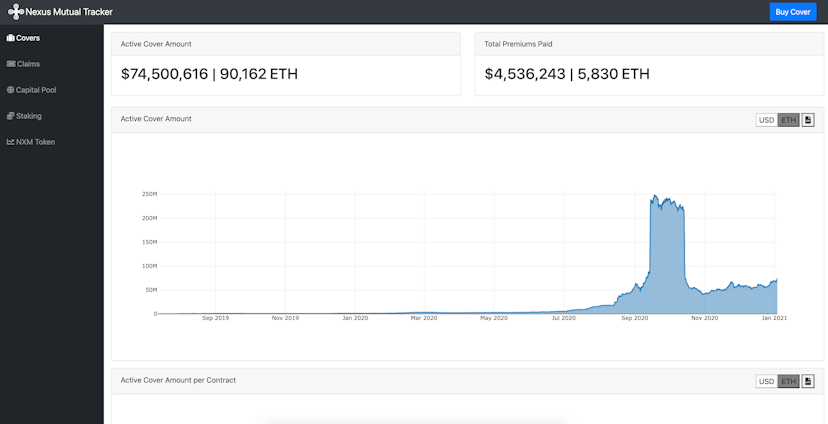

Since their launch in July 2019, Nexus has grown remarkably to over 162,000 ETH in the mutual capital pool (over 13X in just 2020), with under $75 million in active insurance coverage.

But this is only the start of DeFi insurance.

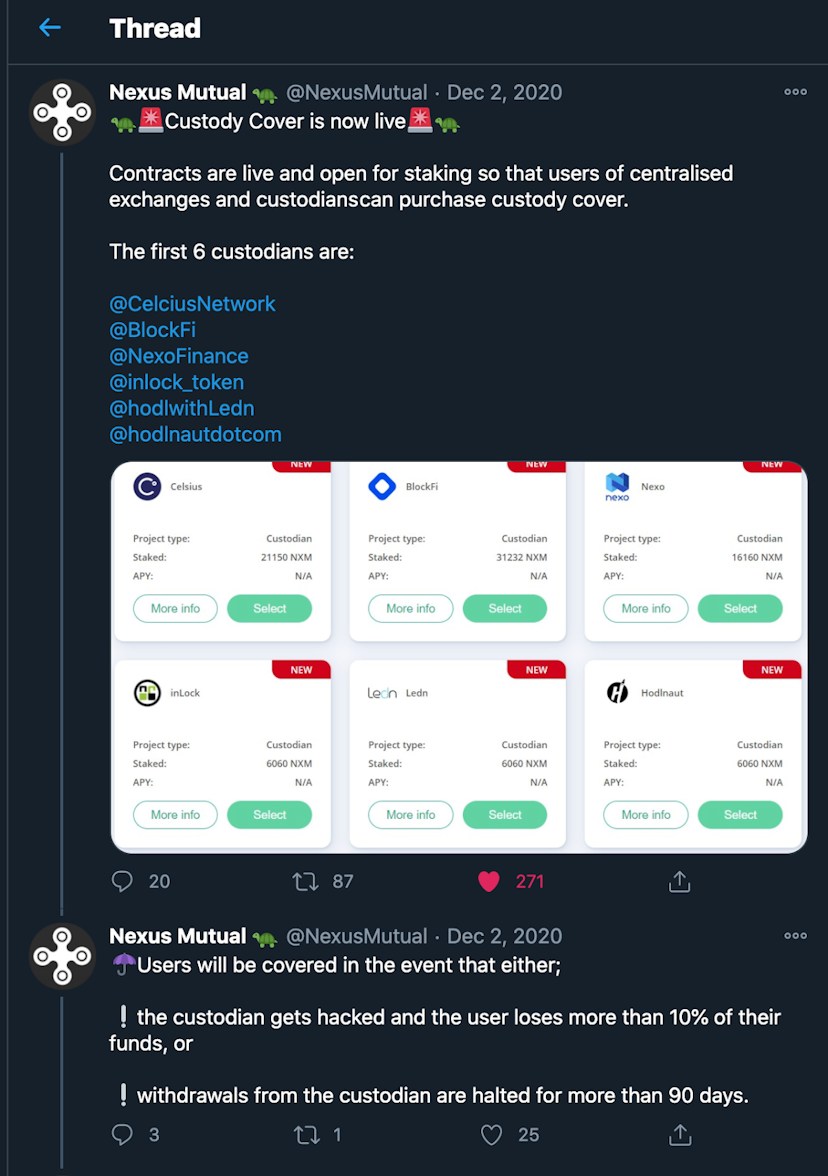

Recently, Nexus became the first Defi insurance team to offer protection for funds deposited in centralized finance (CeFi) services like custodial crypto lending at BlockFi and Celsius.

Find this tweet thread to show on screen here.

Nexus and other new players in DeFi insurance have begun extending smart contract insurance to each other, which resembles reinsurance, a practice in the legacy insurance world where insurers transfer portions of their risk portfolios to other parties.

Nexus has even laid out in its mission to extend coverage to legacy risk vectors like earthquake or flood insurance.

In the future, DeFi insurance will likely become just as standard as driving with car insurance.

As Nexus and other new players in this DeFi insurance vertical offer more comprehensive insurance to protect against any sort of exploit or loss of funds, it enables DeFi as a whole to grow.

If more people know they can depend on this kind of protection against the unexpected, it’s likely more will get started investing their money in smart-contract powered DeFi apps on Ethereum.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.