Bitcoin Forks Rally As Fees Spike On World’s Most Valuable Blockchain

Ordinals and BRC-20 Tokens Push Unconfirmed Transactions To All-time High

By: Owen Fernau • Loading...

DeFi

Digital assets that stayed out of the limelight during crypto’s last bull cycle are waking up.

Bitcoin SV (BSV), the product of a 2018 hard fork of the Bitcoin Cash blockchain, is up nearly 40% in the past 24 hours. The rally has pushed BSV’s market capitalization ahead of well-known DeFi tokens like Curve Finance’s CRV and the recently launched SUI.

Bitcoin Cash, itself a 2017 fork of Bitcoin, is also up over 10%. The price action contrasts with low volatility in the overall crypto market — the two largest digital assets, BTC and ETH, have moved only 10 basis points on the day.

Alex Miller, CEO of Hiro, which develops tools for Bitcoin, doesn’t think there is much beyond speculation behind the price surges. “No one's really using Bitcoin Cash or BSV for anything,” he told The Defiant. “Something good is happening adjacent.”

Miller is referring to Ordinals, a protocol for “inscribing” arbitrary data like text and audio onto the Bitcoin blockchain, as the “good” development. First used to create ‘Bitcoin NFTs’, the protocol got an extra boost with the advent of BRC-20 fungible tokens two months ago.

Hot Money

In a crypto market full of traders thirsty for breakout price action similar to 2021, which saw tokens like Solana’s SOL and Avalanche’s AVAX rise a hundred-fold in price — any form of success will attract imitation, both by developers looking to launch similar projects and investors looking to ride the wave.

BTC is up 66% on the year, ahead of ETH, which is up 52%, and the S&P 500, which is up 8%.

BSV, in contrast, has barely surpassed the $41 mark it started the year at.

If Miller is correct, speculators are betting that Bitcoin-adjacent projects like Bitcoin Cash and Bitcoin SV will receive some spillover of the newfound attention on the world’s most valuable blockchain.

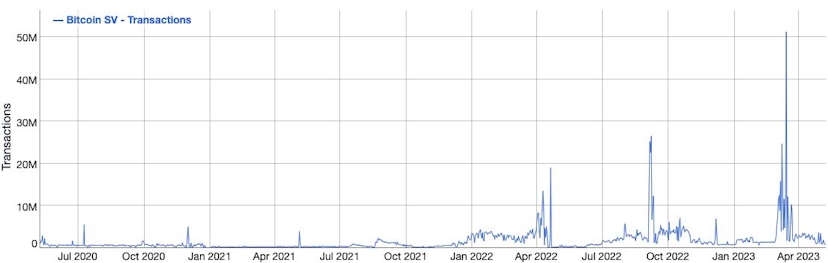

It’s not entirely true that people aren’t using Bitcoin Cash and Bitcoin SV more than usual — BitInfoCharts shows uncharacteristic transaction spikes for both blockchains this year. Bitcoin SV actually reached an all-time high of over 50M transactions in March.

Coming alongside the price action of Bitcoin Cash and Bitcoin SV, are rising prices of other tokens which were hot during the mania of 2017. Ethereum Classic, which forked from Ethereum in 2016, is up nearly 3% in the past 24 hours, and Litecoin, which has a similar design to Bitcoin, is up over 3.5%.

Unconfirmed Transactions at ATH

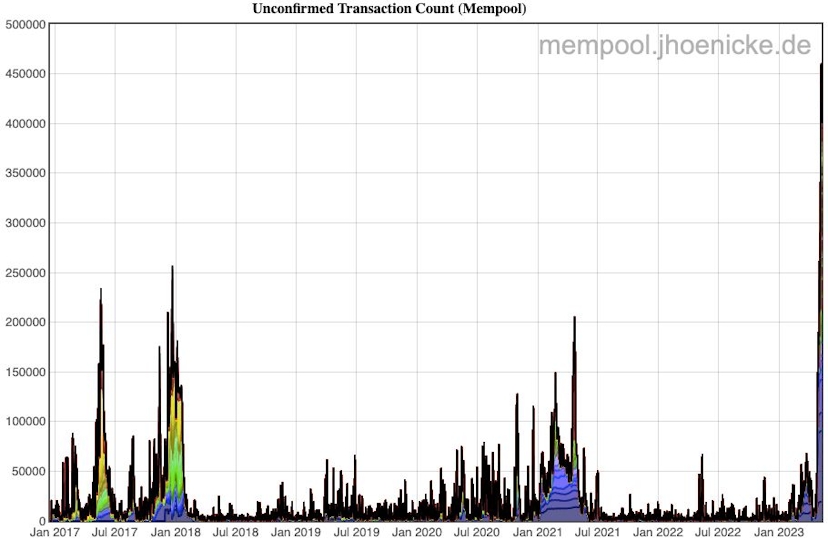

It’s unclear why some of the old guard are having their day in the sun, but it is clear that the Bitcoin blockchain is seeing demand only ever seen at the height of bull markets — the number of unconfirmed transactions is at an all-time high as of May 8, thanks to the increased demand from Ordinals and BRC-20s.

“A lot of people are competing for blockspace,” Miller said. He thinks the demand to transact on Bitcoin will lead to short-term difficulties for users as transaction fees have spiked and others await processing.

“For people who are trying to use it for financial transactions today, it's not the greatest,” he said.

Longer-term, Miller thinks that the increased demand will lead to the conclusion that Bitcoin will need to develop scaling technologies like Layer 2s which have attracted significant investment and users to the Ethereum ecosystem.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.