Tether Reports Record Surplus Reserves

USDT Supply Has Increased By Over $20B In 2023

By: Owen Fernau • Loading...

DeFi

Tether’s USDT has continued to build on its lead in the stablecoin sector in 2023.

Tether Holdings Limited, a company which provides operational support for the stablecoin, reported a record reserve surplus of $2.4B as of March 31.

The figure comes from a Q1 audit report from BDO Italia, a member of BDO Global, a top-five accounting network by revenue.

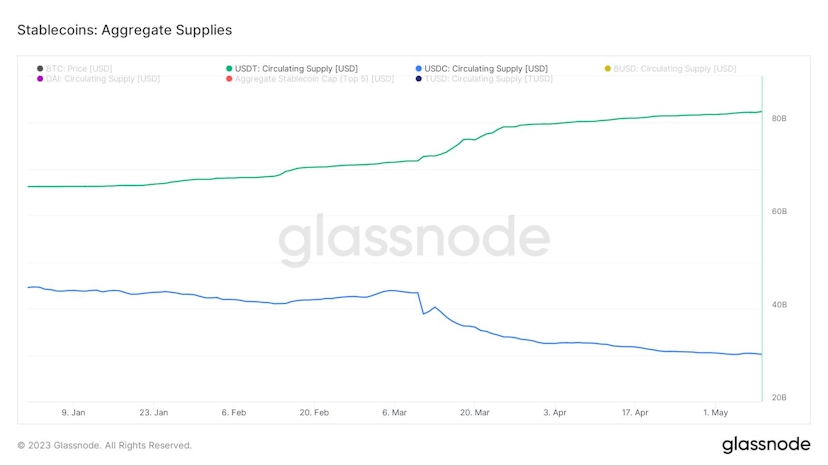

USDT has had a great start to the year. The stablecoin’s market capitalization has increased nearly 25% year-to-date from $66B to $87B, strengthening its lead over Circle’s USDC, its primary competitor.

USDC’s supply has dropped 32% to $30B since the start of the year. Almost all those losses came after the stablecoin briefly lost its dollar peg in March.

The widening gap between the top two stablecoins comes as deposits of all of the fiat-pegged assets on centralized exchanges have dropped to a two-year low, according to Glassnode.

Martin Lee, a data journalist at Nansen, gave The Defiant two possible reasons for the drop. The first is that large investors may be more wary of centralized exchanges after the collapse of FTX last year.

Lee added that USDT was taking market share from USDC.

The journalist also noted that the supply of Binance’s BUSD, still the third-largest stablecoin, will only decline over time, as a reason for exchanges experiencing outflows. This is because the New York Department of Finance Services ordered BUSD’s issuer, Paxos, to cease its issuance earlier this year.

Its increased supply isn’t the only space in crypto where USDT is showing its influence — Tether’s contract for USDT is regularly among the top three smart contracts in terms of gas consumption.

The combined upgrades of EIP-1559 and The Merge, which added a burning mechanism for ETH and transitioned the network to proof-of-stake consensus, have turned smart contracts on Ethereum into a furnace — the USDT contract has burned nearly 29,000 ETH in the past 30 days.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.