Move Over Options – This Is DeFi 3.0 Risk Management

SponsoredSay Goodbye To Options And Hello To 30% More Efficient Premiums With Bumpered Crypto Assets

By: Jeremy Nation • Loading...

Explainers

The traditional finance options trade represents a $13T global marketplace, and yet among the growing number of TradFi instruments iterated in Web3, today’s sophisticated digital asset traders have limited choices in terms of crypto options platforms.

As is often the case with crypto offerings, the existing class of DeFi options platforms struggle to offer users sufficient tooling. The space also generally suffers from a lack of liquidity– of the top 30 DeFi options protocols, only four have an amount of Total Value Locked (TVL) surpassing $10M, according to DeFiLlama.

For crypto traders, Bumper offers a decentralized alternative to options trading built around risk management, delivering sustainable yields, even in bear market conditions.

Now, Bumper is offering a $250,000 incentive to early adopters of the protocol.

Innovating for DeFi 3.0

DeFi has undergone a remarkable series of evolutions from inception: DeFi 1.0 marked the dawn of decentralized currency swapping, while DeFi 2.0 brought tradition finance's lending and yield services into the ecosystem. Now, DeFi 3.0 promises a series of groundbreaking tools to better leverage assets in this dynamic marketplace.

What differentiates DeFi 3.0 from previous sector innovation milestones is the fusion of advanced functionality alongside user-centric simplicity. Earlier DeFi platforms laid the groundwork, and DeFi 3.0 stands to evaluate the user experience by introducing more intuitive and potent solutions.

Bumper stands at the forefront of DeFi 3.0, representing cutting-edge innovation in the decentralized finance space. At the heart of Bumper ingenuity is the protocol's native BUMP token. When users engage with Bumper, they bond with BUMP, thereby enhancing the platform's security and economic robustness. This process not only fortifies the system but also fuels a strong demand for the token.

Contrast this with the intricate realm of traditional options trading, which often proves intimidating due to its inherent complexities, pushing many average users away. Bumper sidesteps these complications by presenting strategies that are both accessible and straightforward, allowing even novices to quickly comprehend its core mechanics.

The upsides of using Bumper for crypto protection don't just marginally surpass the contrasting market options; they significantly eclipse them.

Manage Risk, Not Options

Bumper offers put sellers a competitive average of 30% more efficient premium rates, consistently undercutting traditional with economic incentives that benefit traders. Bumper’s platform is streamlined, averting the complexity of many options trading interfaces, and requires no upfront capital commitments.

Meanwhile the platform delicately balances the affordability of premiums with lucrative yields for a fair price, while safeguarding the value of user assets.

Meanwhile, the platform intelligently manages the delicate balance between affordable premiums and attractive returns, safeguarding the value of users’ tokens and charging a fair price for protection.

Based on multi-year simulations using historical data, for put sellers, Bumper shows the potential to deliver yields that overshadow crypto options trading platforms. Moreover, the risk on Bumper’s platform is uniformly distributed across the protocol. Sellers can also count on immediate yields without incurring sell contract wait times, or engaging in market competition.

Liquidity providers may execute strategies that match various level of risk tolerance, relative to other ecosystem participants, thus ensuring a level of control via with long-term and renewable positions.

While traditional crypto options protocols require a user to lock up their crypto in order to take up a position, Bumper allows users to retain liquidity by providing a Bumpered asset, or a token representing the locked underlying asset, for instance Bumpered ETH.

An asset like Bumpered ETH may in turn be leveraged in the DeFi marketplace.

In the DeFi lending sector, assets protected by Bumper can potentially reduce the risk of forced liquidation within the confines of a specific policy. Should the token's underlying value decrease, a Bumpered asset would offer more stable collateral compared to an unprotected one.

Stop Losses, Go Yields

With Bumper, users need only select an asset, an amount of the asset to protect, and a term for the desired floor.

After determining the desired policy, users can authenticate their choice by staking Bumper's inherent BUMP token. This action solidifies the asset's position, granting users an agile bumpered variant of the cryptocurrency. This variant can then be traded, sold, or utilized for leveraging across various DeFi platforms.

Protection policies span durations of 30, 60, 90, 120, and 150 days. For a holistic market view, users can navigate to the Bumper dashboard, showcasing detailed policy stances and associated fee structures.

If markets rebound, and remain above the established policy threshold, traders capture the upside. For instance, a policy enveloping 100 ETH will yield a net 100 ETH, accounting for any deductions, upon policy maturity and redemption.

Should the tides turn and the markets experience downturns, fear not. Assets fortified by Bumper retain their shield against abrupt declines for the policy's entire duration. In such scenarios, should one wish to cash in, they can redeem the policy's full coverage, with platform fees appropriately subtracted.

$250,000 In Bumper Rewards

Bumper is introducing a $250,000 incentive program tailored for its early protocol participants.

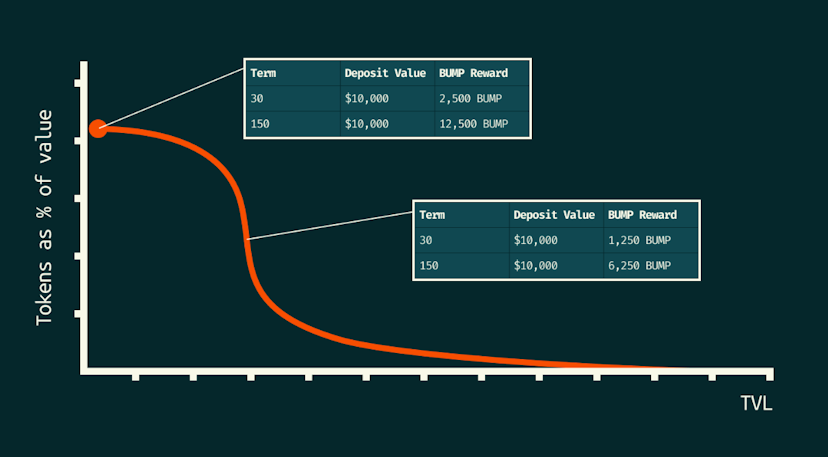

All early users of the Bumper protocol are eligible, whether they use the platform for crypto protection or yield generation. Incentive rewards are calculated via a gradually decreasing curve, based on the growth of platform TVL.

Earlier participants are set to receive greater rewards, with proportional correlation of token allotment to market positions of market makers and takers. In addition, longer policy term lengths will also influence incentive distributions; for instance doubling a policy length also doubles the applicable reward. Rewards are locked for the duration of a user’s selected term.

This chart displays the early adopter rewards emissions curve.

Get more out your DeFi yields with all of the Bump and none of the grind at Bumper, by protecting your crypto and earning today.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.