Layer 1s Outperform as Bitcoin Takes a Breather

Solana, Aptos and Fantom are up more than 20% in the past week despite a broader market pullback.

By: yyctrader • Loading...

Markets

Bitcoin and Ether are down 10% and 15%, respectively, from last week’s highs, but some Layer 1 ecosystems continue to forge ahead.

FTM has rallied 17% in the past 24 hours to a new local high, trading above a dollar for the first time since April 2022. Tokens issued to Fantom-based decentralized exchanges SpookySwap, Equalizer and SpiritSwap have soared 50% or more in that span.

Meanwhile, Solana memecoin season continues to defy belief despite SOL retracing 10%. SLERF has doubled despite a huge fumble by the team, and DogWifHat has bounced 25% from its overnight low. SOL remains up 20% in the past 7 days despite paring its gains.

Not to be left behind, Avalanche has posted a weekly gain of 15%, breaching $60 for the first time since May 2022.

Aptos and Sui, Layer 1s that use the Move programming language originally developed by Facebook, have been resilient through the selloff, with APT soaring 10% today to a new local high. SUI is up 15% in the last week.

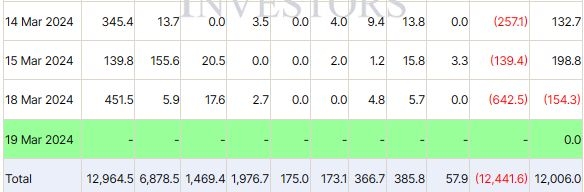

ETF Outflows

Crypto markets turned sharply lower yesterday after data showed Bitcoin ETF inflows receding. On March 18, the funds saw $154 million of net outflows, primarily due to over $640 million leaving GBTC – the largest single-day figure yet.

Inflation Jitters

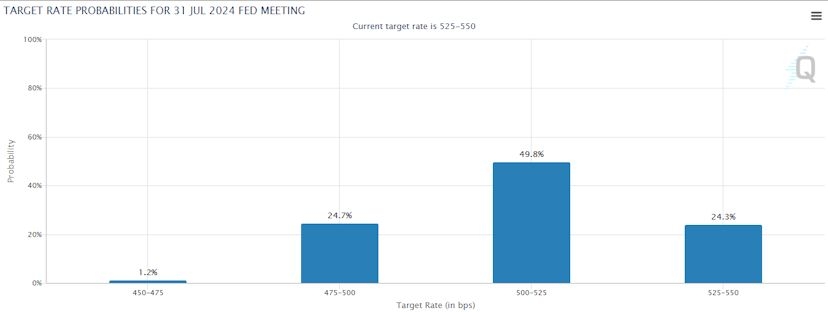

The latest U.S. inflation data came in hotter than expected, putting a damper on risk assets that had rallied in anticipation of imminent rate cuts. Market participants now expect the Fed to reduce rates in the summer at the earliest, according to CME FedWatch.

With the Fed set to leave rates unchanged tomorrow, it’s shaping up to be a volatile week. Investors will be looking for any hint of hawkishness from the central bank, which is likely to be a headwind for markets.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.