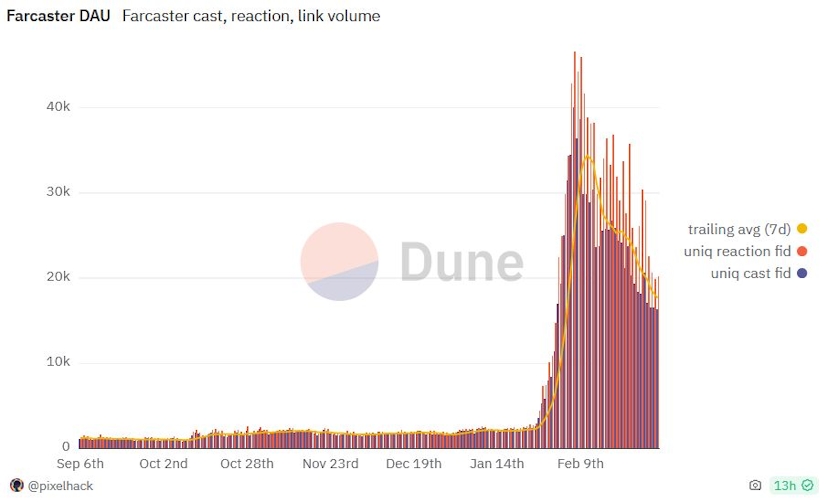

Farcaster Loses 60% of Users In One Month As Interest In SocialFi Wanes

At the beginning of February, it had over 40,000 daily active users. Now it only has 16,000.

By: Pedro Solimano • Loading...

DeFi

Activity on SocialFi app, Farcaster, has been on a consistent downtrend since its peak in early February.

Daily active users on Farcaster are down 60% to 16,000 from a peak of over 40,000 in early February, when users had spiked by 15 times in less than 30 days, according to data compiled on Dune Analytics.

The frenzy in activity last month followed the launch of Frames, which give creators the ability to launch applications and iframes within their posts – or casts as they’re referred to on Farcaster. But initial excitement around that feature has cooled.

Farcaster did not immediately reply to a request for comment from The Defiant.

The drop in activity on Farcaster is surprising, considering the crypto market rally. SocialFi, the category of applications which merges crypto and social media, has been widely touted as one of the growing trends in the industry.

Perhaps degens and traders are more interested in airdrops and memecoins, or the incumbent social media platforms still have a stronghold on where users go to interact.

Revenue and Engagement is Down

It’s not only daily active user count that’s down. Daily revenue, according to a Dune dashboard, barely exceeds the four digits, with the protocol making $288 dollars yesterday, after peaking at $49,735 on Feb. 5.

Reactions, another metric that signals activity, is also down. More than 63% of casts–the name for posts on the platform–are receiving zero reactions, meanwhile 30% are getting between 1-5 reactions. Anything above that and the number plummets to below 2%.

“I’m not surprised [by its downtrend]” said Mert Mumtaz, developer for the Solana-based developer platform, Helius Labs. For Mumtaz, “SocialFi is extremely hard,” due to the entrenched network effects that platforms like Twitter already command.

However, as he explained to The Defiant, he continues to use it despite the downspiralling trend, which means they’ve “definitely gained a non-trivial amount of sticky users.”

Friend.tech Activity Also Declines

Another SocialFi platform that gained notoriety last year but has since fallen off a cliff in terms of activity is Friend.tech.

Friend.tech is a Web3 social media application that facilitates interactions between creators and their audience through the selling and buying of "keys" linked to Twitter accounts, which give access to private chatrooms. It runs on Base, the Layer 2 network from Coinbase that launched this summer.

After witnessing inordinate success when it launched in August 2023, the protocol quickly rose the ranks in usage by the entire crypto industry. It reached $1 million in revenue in Sep., but has since fallen off a cliff.

Brief Points-Led Spike

The protocol had a brief surge in activity on Feb. 4, when the team announced their new points system would be 100% community owned. Transactions spiked from 2,400 on Mar. 03 to 8,800 on Mar. 04. Points were also being sold for $3 dollars on OTC sites such as WhalesMarket, highlighting the interest

But the community-owned points system hasn’t been enough to revive the once center stage Friend.tech. Yesterday and today has seen a significant decline in activity, with transactions hovering around the 3,500 mark on Mar. 05 and 1,000 mark on Mar. 06.

According to a Dune dashboard, it has flatlined in terms of use since the last two spikes in activity–one in October and the other in Dec. 2023.

Prices might be up, but SocialFi continues to lag behind–with enthusiasts hoping that changes soon.

Lens is Bright Spot

One SocialFi platform that is keeping the sector above water is Lens Protocol.

In fact, after it went permissionless on Feb. 27, Lens has seen an impressive uptick in usage. According to lenscan, user activity is up, nearly tripling the day after its launch. Posts jumped to 10,498 the day after from nearly 3,700, and has since preserved its uptrend.

Lens has also seen a fair amount of success in terms of protocol monetization, according to Aave’s founder, Stani Kulechov. On Mar. 04 he said on ‘X’ that Lens had raked in $500,000 in revenue in less than a week of going permissionless thanks to profile mints.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.