Balancer - Recent articles

Loading...

Hackers Compromise Balancer Website In Ongoing Exploit

Decentralized Exchange Balancer Attacked Twice In Two Months

Loading...

Balancer Discloses Critical Vulnerability With $33M At Risk

Team Warns Users To Withdraw Assets From Affected Liquidity Pools

Loading...

Balancer Shakes Off Rivals' Shadow With Novel Strategy

Aura Finance Casts Spotlight on Exchange Amid LSD Rally

Loading...

Balancer Ends Long Governance Battle With Whale

DEX's Members Vote to Make Peace with Investor in Duel Over VE Tokenomics

Loading...

![Balancer Wars: Aura’s Path to Dominance in Ethereum DeFi [Sponsored]](/_next/image?url=https%3A%2F%2Fcdn.sanity.io%2Fimages%2F6oftkxoa%2Fproduction%2F1306b51cf66252c7ab64f957fee92b0a957fa381-1920x1080.png&w=828&q=75)

Balancer Wars: Aura’s Path to Dominance in Ethereum DeFi [Sponsored]

The Balancer Wars are getting more complicated. In the last few months, there has been a heavy focus in not only accumulating BAL tokens, but also veBAL, the recently announced vote-escrowed token of Balancer.

Loading...

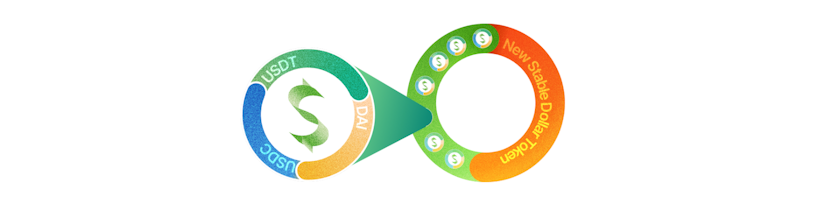

Balancer Launches Boosted Pools to Generate More Yield on Liquidity Deposits

Balancer is moving to generate more yield on Aave.

Loading...

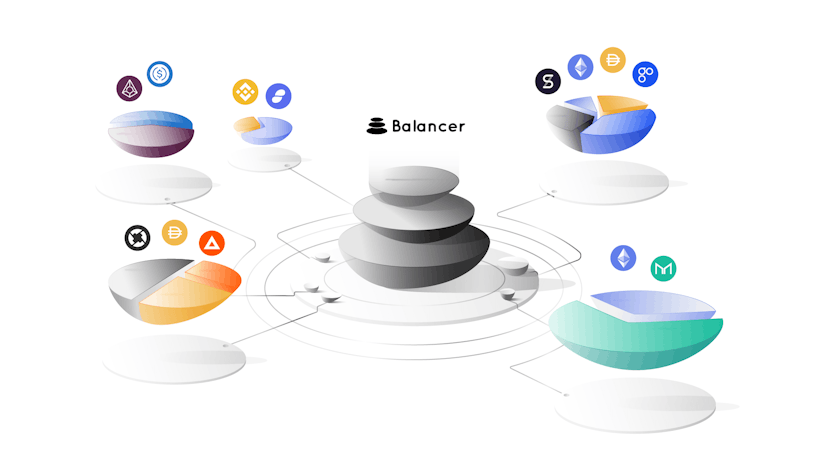

Balancer DAO’s Treasury Is Rapidly Diversifying Across DeFi

The Balancer community has begun integrating itself with other decentralized finance protocols by trading its governance tokens for those of other DAOs, also known as treasury swaps.

Loading...

Balancer’s New Kind of Pool Enters Battle for Crypto Liquidity

Automated portfolio manager Balancer introduced a new mechanism to improve capital efficiency for liquidity providers as it aims to take a larger bite of the interest-bearing token market. Balancer’s so-called metastable pools have a “nesting” feature, facilitating cheap swaps between one pool’s tokens and those of a nested group of tokens, as though all tokens…

Loading...

Defiant Degens: How to Farm Up to 152% APR in Balancer Polygon Pools

This is a weekly tutorial on the most compelling opportunities in yield farming, written by our friend DeFi Dad, an advisor to The Defiant and Head of Marketing and Portfolio Support at Fourth Revolution Capital. The goal is to expose more Defiant readers to new DeFi applications and their associated liquidity mining programs. Disclaimer: All…