Algorithmic Stablecoins

Stablecoins on Ethereum boast an estimated $20B in liquidity (according to usdonethereum.com) and they show no signs of slowing down in growth. Stablecoins, examples of which include DAI, sUSD, USDC or USDT, come in all sorts of varieties: decentralized vs centralized, backed 1:1 by dollars vs overcollateralized vs reportedly undercollateralized (in the case of USDT).…

By: The Defiant Team • Loading...

Explainers

Stablecoins on Ethereum boast an estimated $20B in liquidity (according to usdonethereum.com) and they show no signs of slowing down in growth.

Stablecoins, examples of which include DAI, sUSD, USDC or USDT, come in all sorts of varieties: decentralized vs centralized, backed 1:1 by dollars vs overcollateralized vs reportedly undercollateralized (in the case of USDT).

There’s also been fierce competition to create the purist, most decentralized, most reliable dollar-pegged stablecoin in DeFi. Some argue it’s MakerDAO’s DAI. Others prefer the newer sUSD created by staking SNX on Synthetix.

In DeFi, it is always about what’s next, and in the case of stablecoins, what’s next appears to be algorithmic stablecoins.

The algorithmic stablecoin with the largest market cap as of Jan 2020 is Empty Set Dollar. Like other algorithmic stablecoins, such as AMPL, BAC (Basis Cash), FRAX (Frax Finance), and a recent fork of Empty Set called DSD (Dynamic Set Dollar), Empty Set Dollar aims to offer “a fully decentralized, algorithmically self-stabilizing digital dollar.”

Algorithmic stablecoins tend to attract 2 types of people:

- People interested in bootstrapping a censorship-resistant stablecoin

- People who are financially incentivized by holding a token that rewards you with compounding daily returns whenever it’s above the dollar peg. It’s worth noting algorithmic stablecoins like ESD or DSD have boasted returns of 2-3% interest compounding every 2-8 hrs, meaning as high as 3000% APY.

In the case of Empty Set, the protocol native token is an ERC-20 called ESD, which acts as both a stabilized dollar and as a governance token.

Empty Set Dollar protocol is defined by these 4 mechanics.

–Decentralized – from the start, it is only upgradable via on-chain governance, hence aiming to be censorship resistant

–Self-stabilizing – using an on-chain price oracle

–Single token – ESD is both a stablecoin and a governance token

–Opt-in Supply Adjustments – All supply expansions and contractions are incentivized and voluntary.

Algorithmic stablecoin protocols like Empty Set are designed to bring the native token back to $1 while market cap grows due to demand from those participating.

To maintain its stability, Empty Set Dollar establishes a voluntary supply expansion and contraction that helps bring ESD back to its dollar peg. This means if you hold ESD, you can do one of 3 things depending on the price of ESD and your risk tolerance is:

- Hold – One can simply hold ESD and not ever be affected by the changes in supply, but be aware most algorithmic stablecoins would fail if token holders didn’t participate in supply expansions and contractions.

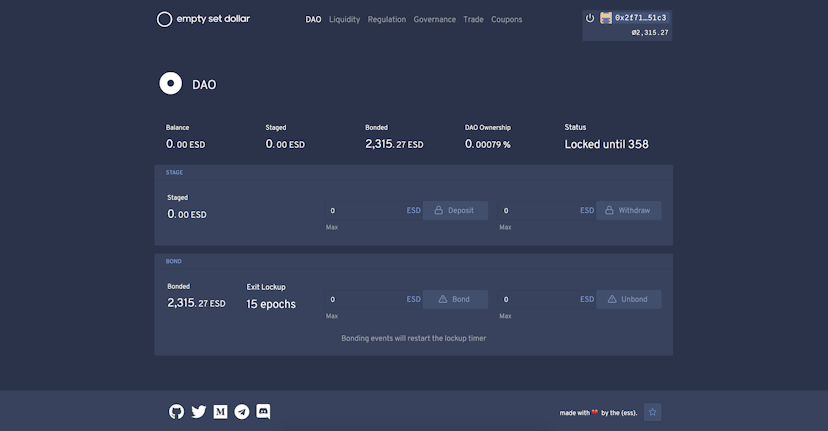

- Hold Bonded ESD and Earn More ESD – When ESD is above $1, it’s referred to as an expansionary period. So the idea is that if the supply of ESD can increase, the price of ESD should fall. Greater supply to outpace demand should lower the price of ESD. Those holding ESD who volunteered to stake ESD (or bond it to the DAO) will then earn more ESD proportional to how much of the ESD supply they own.

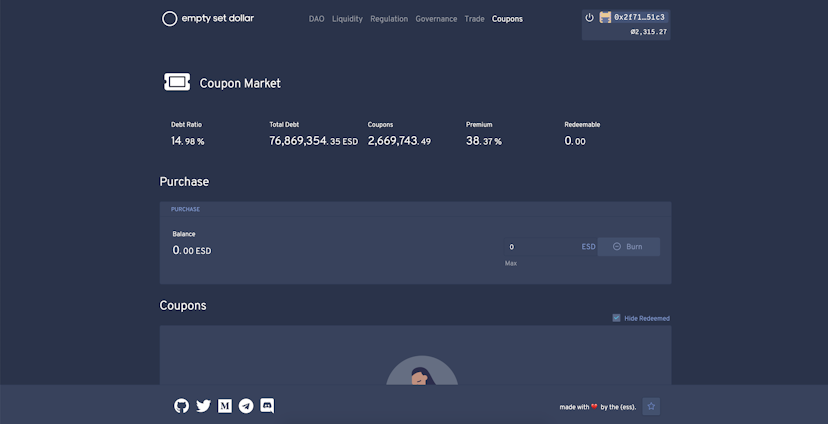

- Burn ESD for Coupons – Alternatively, if the price of ESD is below $1, it’s referred to as a contraction. The supply must shrink, but unlike Ampleforth, Empty Set uses a coupon system where anyone holding ESD can choose to burn their ESD for coupons redeemable for ESD + a premium whenever ESD returns back above $1. It’s a voluntary contraction because one volunteers to burn their ESD for a payoff later, which in turn helps reduce the supply of ESD, and hopefully raises the price of ESD.

If participants earn more rewards early on, then we have a larger market cap from newly minted stablecoins, and more liquidity means more participants can take part. More participants means more network effects growing attention around the stablecoin and hence more demand for the stablecoin, and more minting of stablecoins to bring the stablecoin back to peg, and so forth.

There’s a tremendous amount of game theory and high risk money games at stake with algorithmic stablecoins. That said, they’re growing in popularity. If just one can succeed as a censorship-resistant stablecoin, many believe all this experimentation will be worth it.

Please note, algorithmic stablecoins like ESD are high risk. You can lose 100% of your investment to multiple risks like a smart contract bug or simply failing to redeem coupons for ESD if the peg doesn’t return to $1 before your coupons expire in 30 days.

Algorithmic stablecoins demonstrate bleeding edge financial experimentation in DeFi. Whether it’s innovation or short sighted gambling is yet to be seen. In light of recent regulatory scares in the US about stablecoin regulation, the idea of a censorship-resistant stablecoin has huge demand in DeFi. But it’s impossible not to ignore the epic incentives these early adopters enjoy to help maintain the dollar peg of newly minted stablecoins with market caps anywhere from a few million to near $500M in the case of Empty Set.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.