Aave V3 is About to Pass in Governance Vote

All signs point towards lending giant Aave getting a V3 soon. Voting is now live on Snapshot, with well over 99.9% of the votes supporting the protocol releasing its next iteration.

By: Owen Fernau • Loading...

DeFi

All signs point towards lending giant Aave getting a V3 soon. Voting is now live on Snapshot, with well over 99.9% of the votes supporting the protocol releasing its next iteration.

V3’s proposed features highlight how DeFi is becoming increasingly cross-chain and oriented towards Ethereum Layer 2s. Increased capital efficiency and user safety are also important themes.

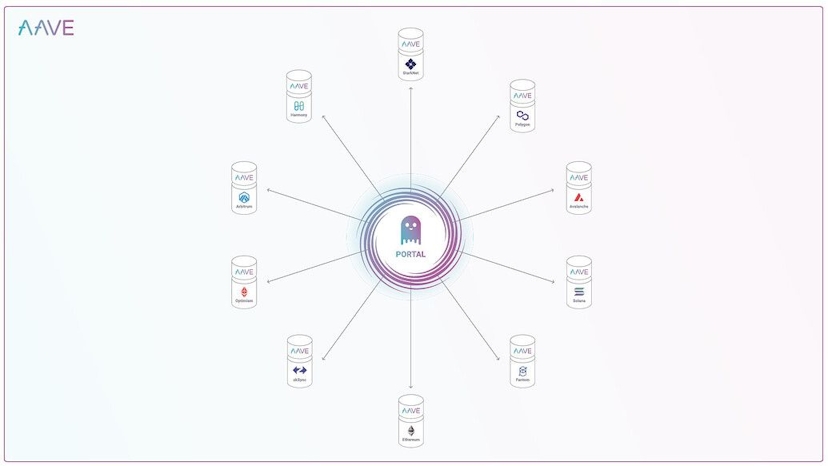

Perhaps the most significant update in Aave’s V3 is a feature called “Portal,” which allows users of the lending protocol to move their supplied liquidity across blockchains.

In practice this will mean users will burn aTokens on one blockchain and mint them on another. aTokens represent deposited liquidity. The underlying assets will be moved with cross-chain products like Hop Protocol, Connext, and others.

This should increase capital efficiency as users are easily able to move assets to where demand, and yields are highest.

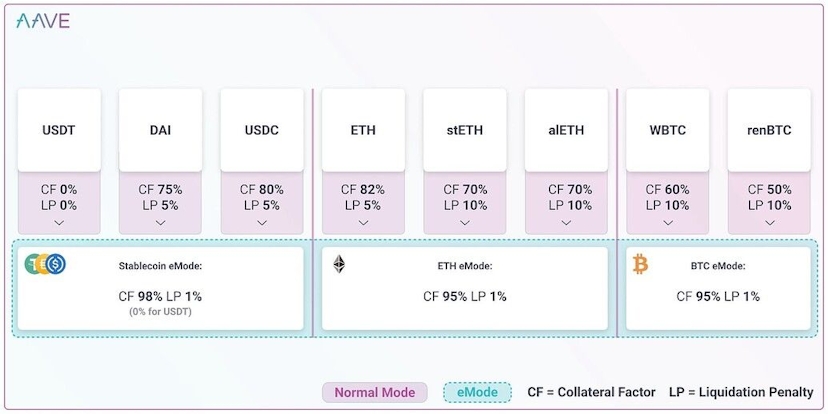

V3’s second feature is something called High Efficiency Mode, or eMode, which will categorize assets based on four parameters: loan-to-value, liquidation threshold, liquidation bonus, and an optional custom price oracle. An example of a category would be ETH, stETH (staked ETH), and alETH (ETH borrowed against collateral on self-repaying loan protocol Alchemix).

When turned on, eMode will allow users who supply assets in a given category to be able to borrow assets in the same category with a higher collateral factor (meaning they can borrow more), and a lower liquidation penalty.

The protocol is able to increase borrowing power within a given category because if the collateralized asset drops in value, so will the borrowed asset, maintaining a much more predictable ratio between the two. This will allow for more capital efficiency.

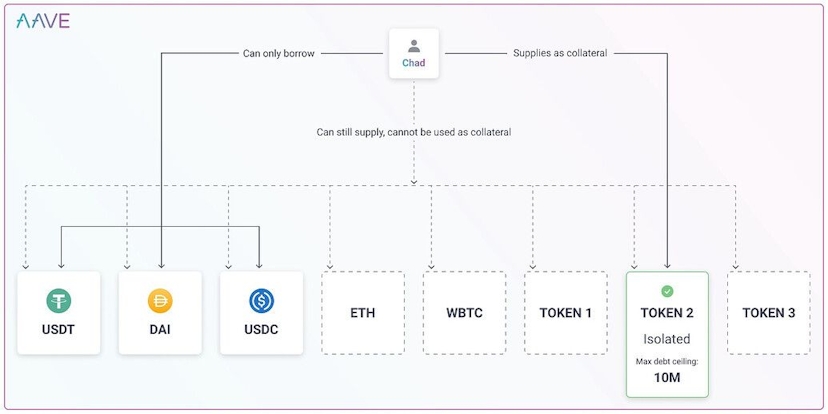

The third main feature of Aave’s V3 entails new risk parameters, primarily one called isolation mode which can be initiated when a token is first approved to be listed as collateral.

Isolation mode for a token means that only governance-approved stablecoins up to a given debt ceiling would be able to be borrowed against the asset.

Additionally, users who deposit “isolated assets” won’t be able to borrow against any of their other assets deposited as collateral (although those assets can still earn yield).

Isolation mode “limits exposure and risks to the protocol from newly listed assets by only permitting borrowing up to a specific debt ceiling,” according to the Aave forum post detailing the V3.

There are other risk management mechanisms in the upgrade too including the addition of governance control over supply and borrow caps of each asset.

Aave V3’s primary features reflect the changing DeFi landscape. For one, Portal shows Aave is embracing the multi-chain and Layer 2, neither of which were in the spotlight during 2020’s legendary DeFi summer. eMode shows a continued gravitation towards capital efficiency as Uniswap did with its V3.

Finally isolation mode will allow Aave to tentatively add more experimental assets. Lending protocol Rari Capital, recently introduced permissionless lending pools which allow virtually any asset to be borrowing against — Aave may need to start addressing the long tail of assets as well.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.