Corporate—>DAO Finance

SponsoredEvolving DeFi by reinventing corporate finance for DAOs.

By: karpatkey • Loading...

DeFiDAO Governance Conundrum

The reason DeFi emerged as a potential candidate to become the world’s economic infrastructure was because of its unique technical properties, which allow for immutable, transparent, permissionless, and programmable ownership and settlement of financial assets.

For this matter, governance is just as important in accomplishing this value proposition. After all, code is (still) thought, written, deployed, and communicated by humans, so a protocol’s resiliency is eventually dependent on the organisation’s ability to transcend individual stakeholders and jurisdictions while being able to evolve according to market needs.

DAOs emerged as digital-native governance mechanisms designed to achieve just this: decentralised ownership promoting cooperation through intricate incentive schemes governed by capital ownership. However immensely useful to prevent the arbitrary decision-making of hierarchical structures, this approach has ultimately been taken to an extreme. The “decentralise everything” movement quickly evolved into an “everybody should decide on everything” mindset that has slowed progress and, in some extreme cases, even led to implosion.

As traditional finance embraces digital assets and onboards assets on-chain, it’s now time to start professionalising our industry. Not doing so may result in all this new capital flowing into centralised entities instead of DeFi protocols.

For that matter, it’s imperative that DeFi protocols start managing their financial resources in ways that maximise token holder value and ensure the capital necessary to maintain a sound, resilient, and innovative ecosystem.

Securing the tip of the iceberg

karpatkey was created to professionalise the management of any DAO’s biggest asset: its treasury. Most of today’s $42b+ DAO treasury assets remain underutilised. Opaque, manual, and non-scalable or absent processes have significant opportunity costs, not to mention the absolute risk associated with improper management.

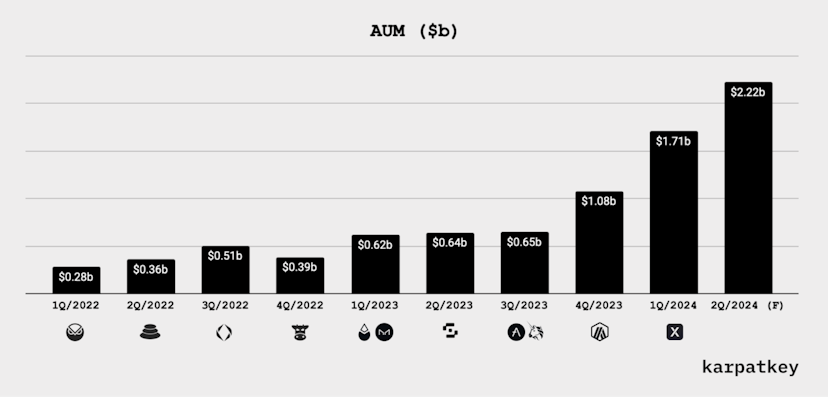

We’ve since grown to become the leader in active DAO treasury management and on-chain, non-custodial asset management, developing a strong network of DAO treasuries worth $1.7b+ with dedicated finance working groups for GnosisDAO, Balancer, ENS, COW, Lido, and Aave. We’ve also contributed to Uniswap, Spark/MakerDAO, Safe, and Arbitrum by establishing delegate platforms and conducting research.

Our past activity has ultimately generated objective knowledge across the Ethereum ecosystem and DeFi protocols, which we’ve used to contribute to the development of roadmaps and building and maintaining structural tooling for non-custodial on-chain treasury and asset management, and risk management infrastructure to secure institutional investment-grade funds.

Throughout this process, we’ve acknowledged that this challenge is bigger than treasury management.

Seizing the Opportunity

There’s ironically a lack of finance-focused working groups in DeFi DAOs, which translates into the absence of very basic finance primitives that are rooted in the foundation of modern capitalism.

Capital Budget/Structure/Raise, Working Capital Management, Risk Management, Financial Analysis and Planning, and M&A: these are all disciplines designed to improve resource allocation and ultimately optimise capital efficiency.

Traditional financial institutions would find it impossible to adapt these practices to our ecosystem today. Navigating the layers of complexity of DAO governance and gaining the community’s trust requires a huge investment in labour, delivering solutions in advance and forging long-lasting relationships at the level of founders, delegates, communities, and ultimately token holders.

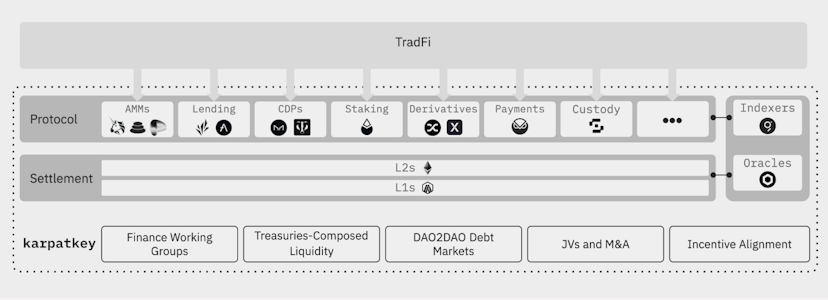

DAO Finance Services

At karpatkey, we built independent cells of asset managers and developers to become a permanent and intrinsic part of the leading DeFi protocols. These working groups deploy infrastructure and execute DeFi strategies and other Finance functions:

- Asset Management:

- Deployment of non-custodial and risk management infrastructure;

- Trading desk: buybacks programs and MEV-protected infra;

- Weekly optimisation of low-risk DeFi strategies e.g. AMM; lending; self-asset leveraged money markets; carry trade; etc.;

- Utilisation of the DAO native token for asset-backed debt, integrations, and market-making; and

- Deployment of alerts and protection against high volatility events and hacks.

- Incentives design and implementation;

- Technical integrations into leading Defi protocols;

- DAO to DAO deals, execution of trades, partnerships;

- Capital budgeting and allocation;

- Valuation analysis, the prospect of acquisitions or mergers;

- Risk frameworks and emergency plans;

- Reporting and analytics;

- Source financing needs and execute OTC deals;

Protocol Governance

Our governance team acts as local contributors, understanding and participating in the most pressing community subjects of the DAO. They defend the values we believe in and promote positive-sum games between our DeFi protocols.

Some examples of our solutions:

- Deploying governance platforms: Research, make proposals, and vote in the best interest of token holders;

- Technical partnerships sealed through token swaps;

- Debt markets: Gauge debt funding demand between our DAOs and issue private debt;

- Optimisation of composable liquidity between our protocols and accumulated tokens; and

- Coordination of incentives through voting power incentives

Ultimately, it’s up to crypto-native contributors to raise the bar and enable our industry to fulfil its full potential by reinventing corporate finance for DAOs. The focus should be on creating a sound, resilient, and innovative DeFi ecosystem—one that is able to finally start onboarding traditional finance at scale.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.